Осторожно! Много текста.

Uniswap – это набор компьютерных программ, которые работают на блокчейне Ethereum и позволяют децентрализовать обмен токенами. Uniswap работает с помощью единорогов (как и следует из логотипа).

На Uniswap трейдеры могут обменивать токены Ethereum, не доверяя никому свои средства. При этом любой может предоставить свою криптовалюту в пулы ликвидности, которые играют роль специальных резервов. За предоставление своих средств пулам трейдеры получают комиссию.

Как волшебные единороги конвертируют один токен в другой? Зачем вообще пользоваться Uniswap? Давайте разбираться.

Введение

Централизованные биржи оставались основой рынка криптовалют на протяжении многих лет. Их основные преимущества – быстрые расчеты, большой объем торгов и постоянный рост ликвидности. Но существует еще и «параллельный мир», построенный в виде протоколов, не требующих доверия. Для ведения торговли децентрализованным биржам (DEX) не требуются посредники или участники, ответственные за хранение средств.

Из-за ограничений технологии блокчейна создание децентрализованных бирж, способных конкурировать со своими централизованными аналогами, – задача не из легких. Большинство децентрализованных бирж не идеальны как с точки зрения производительности, так и с точки зрения пользовательского опыта.

Многие разработчики ломают голову над изобретением новых способов создания децентрализованной биржи. Среди них Uniswap – один из первопроходцев. Принцип работы Uniswap немного сложнее, чем у традиционной DEX. Однако вскоре мы убедимся, что у этой модели есть ряд существенных преимуществ.

В результате своих инноваций Uniswap стал одним из самых успешных проектов в сфере децентрализованных финансов (DeFi).

Итак, давайте подробнее узнаем о том, что представляет собой протокол Uniswap, как он работает и как вы можете обменивать токены с помощью кошелька Ethereum.

Что такое Uniswap?

Uniswap – это децентрализованный протокол для обмена, построенный на базе Ethereum, а если точнее – автоматизированный протокол ликвидности. Для совершения сделок здесь не требуется книга ордеров или какая-либо централизованная сторона. Uniswap позволяет пользователям торговать без посредников, сохраняя при этом высокую степень децентрализации и устойчивость к цензуре.

Uniswap – это программное обеспечение с открытым исходным кодом. Вы можете сами убедиться в этом на Uniswap GitHub.

Хорошо, но как можно торговать без книги ордеров? Uniswap работает по модели, в которой поставщики ликвидности создают пулы ликвидности. Такая система обеспечивает децентрализованный механизм ценообразования, который существенно сглаживает глубину книги ордеров. Далее мы расскажем об этом более подробно, а пока давайте просто запомним, что пользователи могут легко обмениваться токенами ERC-20 без книги ордеров.

Поскольку протокол Uniswap является децентрализованным, листинг отсутствует. По сути, если трейдерам доступен пул ликвидности, может быть выпущен любой токен ERC-20. В результате комиссий за листинг на Uniswap попросту нет. В некотором смысле протокол Uniswap существует как «общественное благо».

Протокол Uniswap был создан Хайденом Адамсом в 2018 году. Но технология, лежащая в основе его реализации, была впервые описана соучредителем Ethereum Виталиком Бутериным.

Как работает Uniswap?

В Uniswap нет книги ордеров, а значит, традиционная архитектура цифровой биржи невозможна. Здесь используется модель под названием Constant Product Market Maker (маркет-мейкер c постоянным продуктом), которая является вариантом модели Automated Market Maker (автоматический маркет-мейкер, или AMM).

АММ – это смарт-контракты с резервами ликвидности (или пулами ликвидности), которыми трейдеры могут торговать. Эти резервы финансируются поставщиками ликвидности. Поставщиком ликвидности может быть любой, кто вносит в пул эквивалентную стоимость двух токенов. Трейдеры в свою очередь платят пулу комиссию, которая затем распределяется между поставщиками ликвидности в соответствии с их долей в пуле. Давайте остановимся на этом подробнее.

Поставщики ликвидности создают рынок, делая взнос, эквивалентный стоимости двух токенов. Это может быть ETH, токен ERC-20 или два токена ERC-20. Пулы, как правило, состоят из стейблкоинов, таких как DAI, USDC или USDT, но это не является обязательным требованием. Взамен поставщики ликвидности получают «токены ликвидности», которые составляют их долю в общем пуле ликвидности. Токены ликвидности можно обменять на их долю в пуле.

Рассмотрим пул ликвидности ETH/USDT. Назовем часть пула ETH – x, а часть пула USDT – y. Uniswap берет две эти величины и умножает их, чтобы вычислить суммарную ликвидность в пуле, назовем ее k. Основная идея Uniswap заключается в том, что величина k должна оставаться постоянной. Это означает, что общая ликвидность в пуле будет постоянной. Таким образом, мы получаем следующую формулу общей ликвидности в пуле:

x * y = kНо что произойдет, когда кто-то захочет совершить сделку?

Допустим, Маша покупает 1 ETH за 300 USDT, используя пул ликвидности ETH/USDT. Тем самым она увеличивает долю пула в USDT и уменьшает часть пула в ETH, а значит цена ETH растет. Почему? После выполнения транзакции в пуле остается меньше ETH, и мы знаем, что общая ликвидность (k) должна оставаться постоянной. Этот механизм определяет цену. В конечном счете цена, уплачиваемая за этот ETH, зависит от того, насколько данная сделка изменяет соотношение между x и y.

Следует отметить, что такая модель не масштабируется линейно. Чем больше ордер, тем больше смещается баланс между x и y. Таким образом, крупные ордера становятся экспоненциально дороже в сравнении с небольшими ордерами, что приводит к большему проскальзыванию. В свою очередь увеличение пула ликвидности упрощает обработку крупных ордеров, так как это позволяет сократить разницу между x и y.

Uniswap v3

Технология, лежащая в основе Uniswap, пережила несколько итераций. Скорее всего, если вы пользовались Uniswap, это была Uniswap v2. Но технологии совершенствуются и не стоят на месте. Давайте рассмотрим самые важные нововведения Uniswap v3.

Эффективность капитала

Одно из наиболее значительных изменений Uniswap v3 касается эффективности использования капитала. Большинство AMM крайне неэффективны с точки зрения капитала: большая часть средств, которые находятся в них на текущий момент, не используется. Это связано с особенностями модели x*y=k, о которой мы говорили выше. Простыми словами: чем больше ликвидности в пуле, тем более крупные ордера система может поддерживать в большем ценовом диапазоне.

Однако поставщики ликвидности (LP) в этих пулах обеспечивают ликвидность для ценовой кривой (диапазона) от 0 до бесконечности. Весь этот капитал зарезервирован для сценария, когда один из активов в пуле вырастает в 5, 10, 100 раз.

Если это произойдет, то неиспользуемые активы гарантируют, что в данной части кривой еще останется ликвидность. Это означает, что только небольшая часть ликвидности в пуле находится там, где происходит большая часть торговли.

Например, сейчас заблокированная ликвидность Uniswap составляет около 5 миллиардов долларов, в то время как в день используется только 1 миллиард от этого объема. Согласитесь, можно было придумать что-то более совершенное? Похоже, команда Uniswap тоже об этом задумалась и решила проблему с помощью Uniswap v3.

Поставщики ликвидности теперь могут устанавливать индивидуальные диапазоны цен, для которых хотят предоставлять ликвидность. Это должно увеличить концентрацию ликвидности в том ценовом диапазоне, в котором происходит большая часть сделок.

В некотором смысле Uniswap v3 – это элементарный способ создания ончейн-книги ордеров на Ethereum, где маркет-мейкеры могут принимать решения о предоставлении ликвидности в устанавливаемых ими ценовых диапазонах. Следует отметить, что от данного нововведения выигрывают в первую очередь профессиональные маркет-мейкеры, а не розничные участники. Ключевое преимущество AMM в том, что каждый может обеспечить ликвидность и заставить свои средства работать.

Однако из-за этого усложнения «ленивые» поставщики ликвидности будут зарабатывать на торговых комиссиях гораздо меньше, чем профессиональные игроки, которые постоянно совершенствуют свою стратегию. Нетрудно предсказать, что некоторые агрегаторы, например, yearn.finance, будут предлагать розничным поставщикам ликвидности возможность сохранить хоть какую-то конкурентоспособность в этой среде.

LP-позиции на Uniswap в качестве NFT-токенов

Теперь мы знаем, что все LP-позиции в Uniswap уникальны, поскольку каждый может установить свой собственный ценовой диапазон. Это означает, что LP-позиции в Uniswap не взаимозаменяемы. В результате каждая LP-позиция представлена невзаимозаменяемым токеном (NFT).

Одним из преимуществ представления LP-позиции в Uniswap в качестве взаимозаменяемого токена была бы возможность ее использования в других частях DeFi. LP-токены в Uniswap v2 можно вносить в Aave или MakerDAO в качестве обеспечения. В Uniswap v3 так уже сделать нельзя, поскольку каждая позиция уникальна. Однако такой разрыв в модульности может компенсироваться новыми видами деривативов.

Uniswap на уровне 2

Комиссии за транзакции в Ethereum резко выросли за последний год. Это делает использование Uniswap экономически невыгодным для многих пользователей с небольшим объемом средств.

Uniswap v3 также будет развернут в решении 2-го уровня для масштабирования под названием Optimistic rollup (Оптимистический роллап). Это надежный способ масштабировать смарт-контракты в безопасной сети Ethereum. Такое развертывание должно привести к значительному увеличению пропускной способности транзакций и гораздо более низким комиссиям для пользователей.

Что такое непостоянные потери?

Как мы уже говорили, поставщики ликвидности получают комиссию за предоставление ликвидности трейдерам, у которых появляется возможность обмениваться токенами. Есть ли еще что-то, о чем следует знать поставщикам ликвидности? Да. Например, об эффекте под названием непостоянные потери.

Предположим, Маша вносит 1 ETH и 100 USDT в пул Uniswap. Поскольку пара должна иметь эквивалентную стоимость, это означает, что цена ETH составляет 100 USDT. В то же время в пуле всего 10 ETH и 1000 USDT – остальные финансируются другими поставщиками ликвидности, такими как Маша. Это означает, что Маше принадлежит 10% пула. Общая ликвидность (k) в данном случае равна 10 000.

Что произойдет, если цена ETH увеличится до 400 USDT? Помните: общая ликвидность пула должна оставаться постоянной. Если ETH сейчас стоит 400 долларов США, то соотношение между количеством ETH и USDT в пуле меняется. А значит, сейчас в пуле 5 ETH и 2000 USDT. Почему? Арбитражные трейдеры будут добавлять USDT в пул и удалять из него ETH до тех пор, пока соотношение не будет отражать точную цену. Именно поэтому важно запомнить, что k является постоянной величиной.

Маша решает вывести свои средства и получает 10% пула в соответствии со своей долей. В результате она получает 0,5 ETH и 200 USDT на общую сумму 400 USDT. Похоже, она получила неплохую прибыль. Но что, если бы она решила не вкладывать свои средства в пул? У нее в распоряжении был бы 1 ETH и 100 USDT на общую сумму 500 USDT.

В итоге Маше нужно было использовать HODLing, а не вкладывать средства в пул Uniswap. В данном случае непостоянная потеря – это упущенная выгода от внесения в пул токена, который дорожает. Таким образом, вкладывая средства в Uniswap в надежде заработать комиссию, Маша может упустить другие возможности.

Обратите внимание: данный эффект имеет место независимо от того, в каком направлении меняется цена с момента депозита. Что это значит? Если цена ETH снизится относительно цены во время внесения, убытки также могут увеличиться. Если вы хотите подробнее изучить этот вопрос, прочитайте статью Pintail.

Но почему потери непостоянны? Если цена токенов в пуле восстанавливается до уровня цены при их добавлении в пул, то эффект смягчается. А поскольку поставщики ликвидности зарабатывают комиссию, то убытки со временем могут компенсироваться. Тем не менее поставщики ликвидности должны учитывать это, прежде чем добавлять свои средства в пул.

Как Uniswap зарабатывает деньги?

Никак. Uniswap – это децентрализованный протокол, поддерживаемый Paradigm (хедж-фонд криптовалют). Все комиссии идут поставщикам ликвидности, и ни один из учредителей не получает процент от сделок, совершаемых через протокол.

В настоящее время комиссия за транзакцию для поставщиков ликвидности составляет 0,3% за сделку. По умолчанию заработанные комиссии добавляются в пул ликвидности, но поставщики ликвидности могут погасить их в любое время. Комиссии распределяются в соответствии с долей каждого поставщика ликвидности в пуле.

Часть комиссий может быть направлена на развитие Uniswap в будущем. Команда Uniswap уже запустила улучшенную версию протокола под названием Uniswap v2.

Как пользоваться Uniswap

Uniswap – это протокол с открытым исходным кодом, а значит, любой может создать для него собственное приложение. Однако большинство пользуется https://app.uniswap.org или https://uniswap.exchange. Откройте интерфейс Uniswap.

- Подключите свой кошелек. Вы можете использовать MetaMask, Trust Wallet или любой другой поддерживаемый кошелек Ethereum.

- Выберите токен, который хотите обменять.

- Выберите токен, который хотите получить.

- Нажмите Swap (Обменять).

- Проверьте сведения о транзакции в появившемся окне.

- Подтвердите выполнение транзакции в своем кошельке.

- Дождитесь подтверждения транзакции в блокчейне Ethereum. Статус транзакции можно отслеживать на сайте https://etherscan.io/.

Токен Uniswap (UNI)

UNI — это собственный токен протокола Uniswap, который дает своим держателям права на управление. Это означает, что владельцы UNI могут голосовать за изменения в протоколе. Ранее мы упоминали, что протокол существует как своего рода общественное благо. Токен UNI подтверждает эту идею.

При создании Uniswap был эмитирован 1 миллиард токенов UNI, 60% из которых распространяются среди существующих членов сообщества Uniswap. Остальные 40% станут доступны членам команды, инвесторам и консультантам в течение четырех лет.

Часть токенов распределяется сообществу за счет добычи ликвидности. Токены UNI будут распределены между теми, кто предоставляет ликвидность следующим пулам Uniswap:

-

ETH/USDT

-

ETH/USDC

-

ETH/DAI

-

ETH/WBTC

Кто входит в сообщество Uniswap? Любой адрес Ethereum, который взаимодействовал с контрактами Uniswap. Далее давайте рассмотрим, как можно получить токены UNI.

Как получить токены Uniswap (UNI)

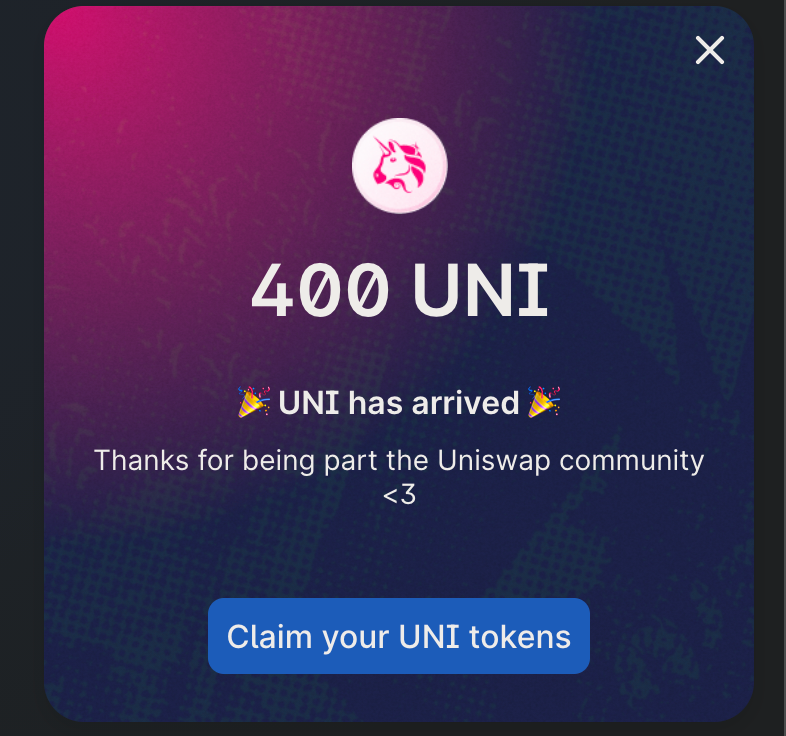

Если вы использовали Uniswap, то, скорее всего, сможете получить 400 токенов UNI на каждый адрес, с которым вы использовали Uniswap. Как получить свои токены:

-

Перейдите на https://app.uniswap.org/.

-

Подключите кошелек, с которым вы ранее использовали Uniswap.

-

Нажмите Claim your UNI tokens (Получить токены UNI).

-

Подтвердите транзакцию в своем кошельке (вы можете проверить текущие цены на газ на Ethscan Gas Tracker).

-

Поздравляем! Теперь вы владеете токенами UNI.

Хотите продать свои токены UNI? Используйте для этого Binance.

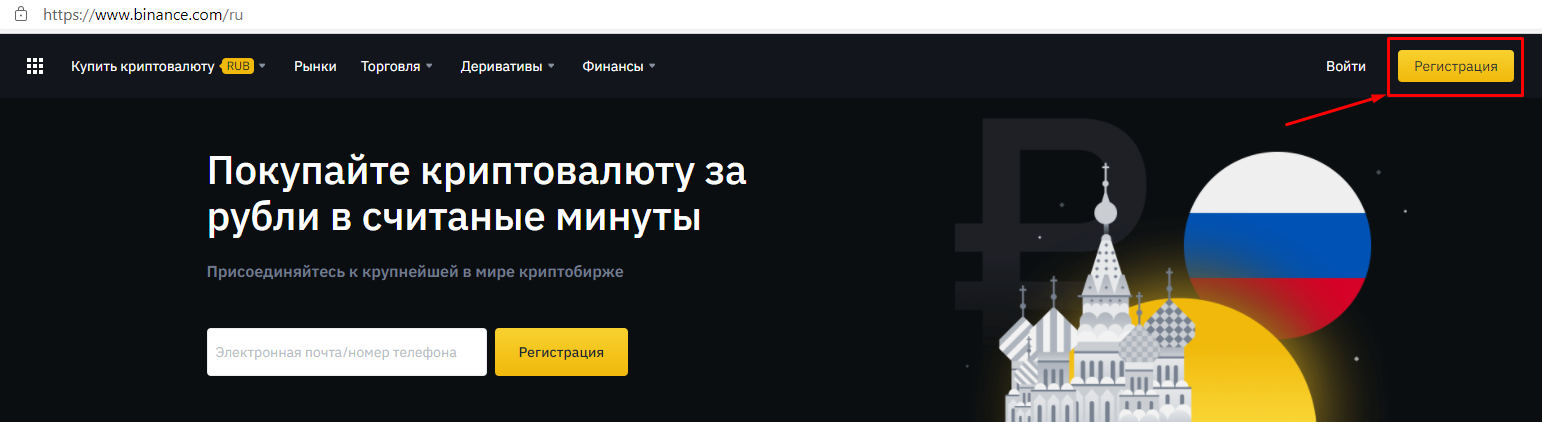

Как купить UNI на Binance

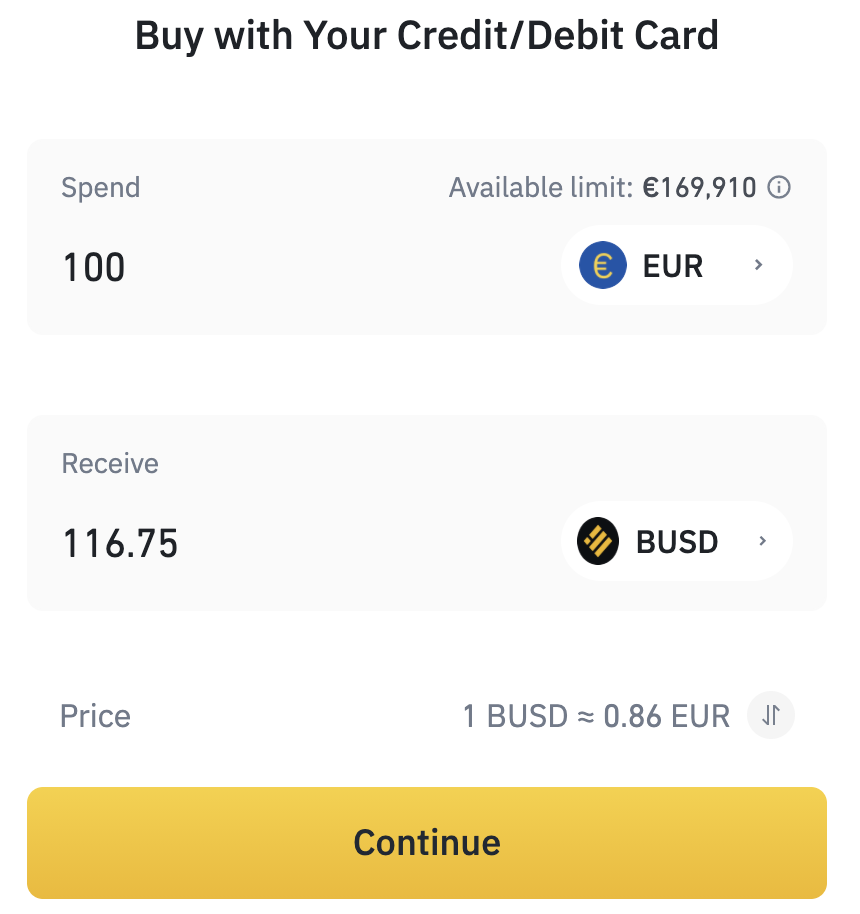

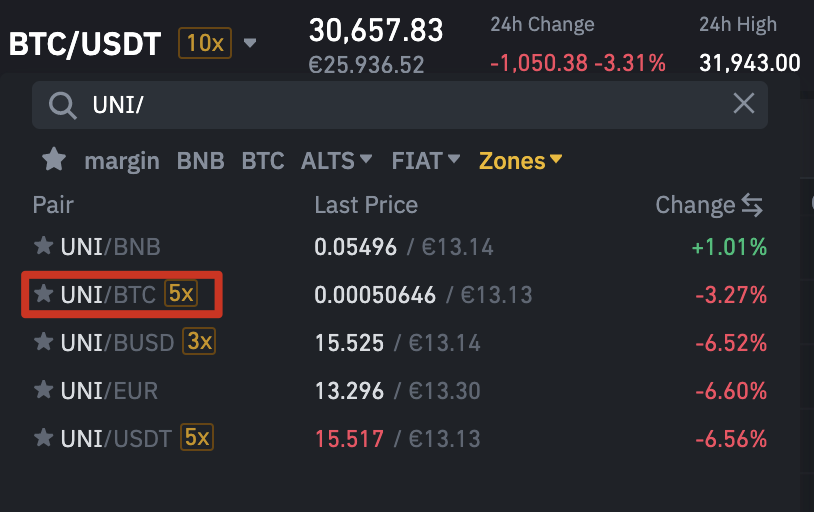

Чтобы купить UNI, необходимо обменять либо фиатную валюту, либо криптовалюту на бирже Binance. Использовать дебетовую/кредитную карту для прямой покупки UNI нельзя. Ниже приведены возможные пары с BNB, BTC, BUSD, USDT или евро.

Если вы хотите приобрести UNI за криптовалюту, переведите монеты в свой спотовый кошелек или купите их. Мы рекомендуем к покупке BUSD ввиду его стабильности. Покупку BUSD можно совершить с помощью кредитной/дебетовой карты на вкладке [Купить криптовалюту]. Введите желаемую сумму BUSD и нажмите [Продолжить], чтобы ввести данные своей карты.

Получив криптовалюту, перейдите на биржу и выберите пару UNI, которой хотите торговать. Выбрать другую пару можно, нажав кнопку с текущей рыночной парой в левом верхнем углу.

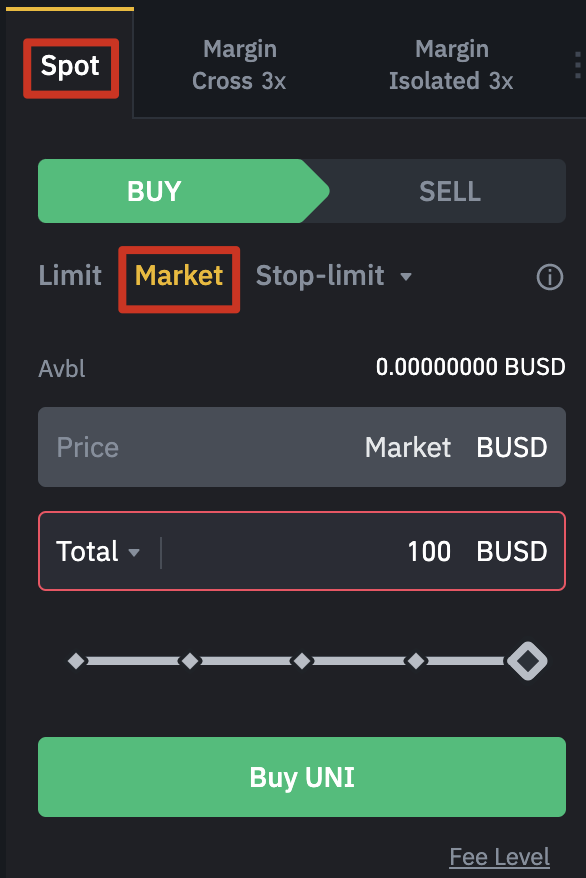

В строке поиска введите выбранную вами пару. В нашем примере используется UNI/BUSD.

Теперь можно создать ордер на покупку UNI. Самый быстрый способ — это создать рыночный ордер, в котором будет указана текущая спотовая цена. Также можно создать лимитный или стоп-лимит-ордер, если вы хотите совершить покупку по определенной цене или еще выгоднее.

Чтобы создать рыночный ордер, нажмите [Спот] в левой части экрана. На вкладке [Купить] обязательно выберите [Рынок] в качестве типа ордера и введите нужную сумму BUSD. После этого нажмите [Купить UNI], и ордер будет размещен.

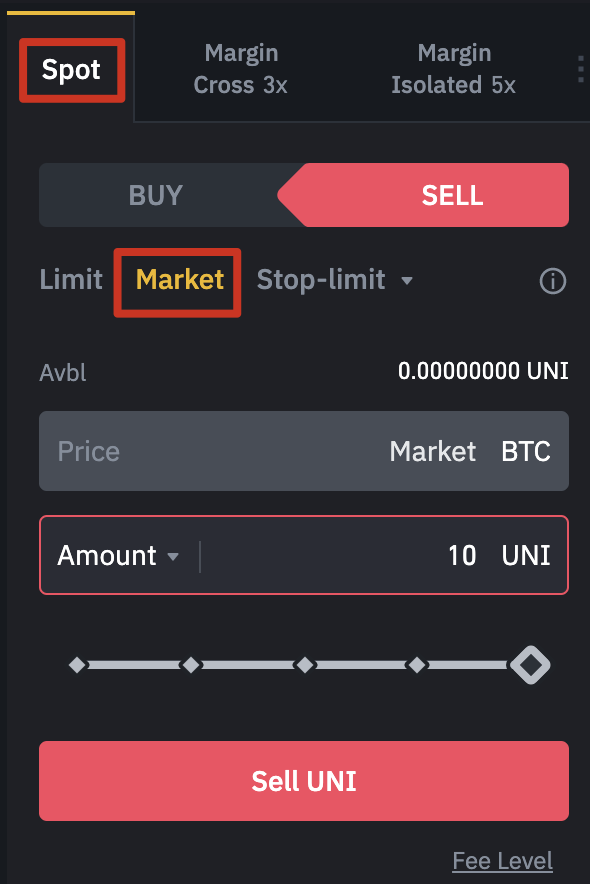

Как продать UNI на Binance

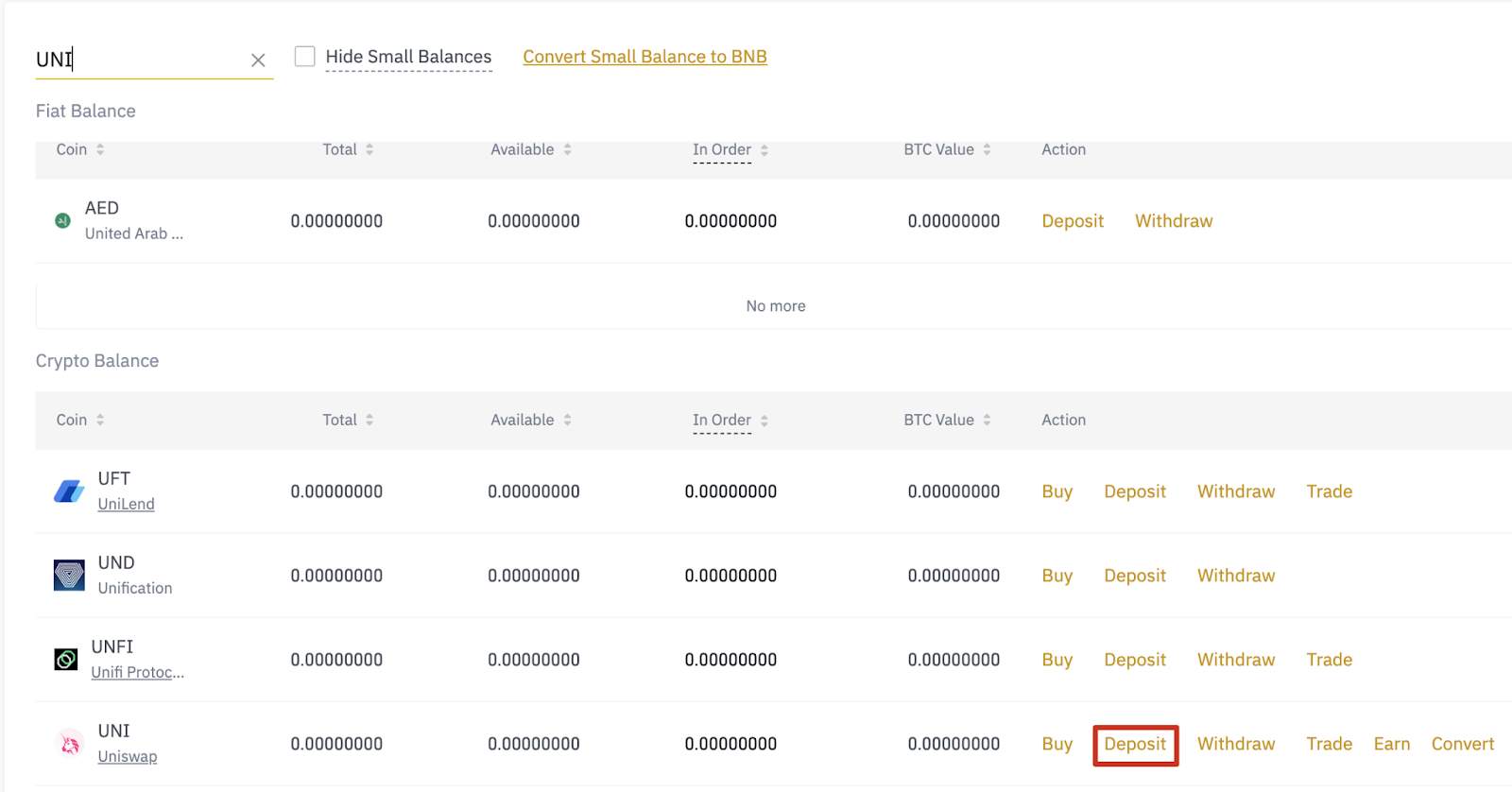

Процесс продажи UNI аналогичен покупке. Прежде всего, UNI должны находиться в вашем спотовом кошельке Binance. Если вы еще не ввели токены, перейдите на страницу [Фиат и спот] и найдите UNI. Узнать подробнее о переносе UNI можно на вкладке [Ввод].

После успешного введения UNI откройте вкладку биржи и выберите пару UNI, которую хотите обменять. Возьмем для примера UNI/BTC.

Найти необходимую пару можно через строку поиска. В нашем случае нажимаем на пару [UNI/BTC].

Чтобы продать свои UNI по текущей рыночной цене, перейдите в левую часть экрана. Нажмите [Спот] и выберите [Рынок] в качестве типа ордера на вкладке [Продать]. Введите нужную сумму UNI и нажмите [Продать UNI].

Резюме

Uniswap — это инновационный протокол обмена, построенный на базе Ethereum. Он позволяет всем, у кого есть кошелек Ethereum, обменивать токены без участия какой-либо централизованной стороны.

Несмотря на то, что у этой технологии есть свои ограничения, она может положительно повлиять на процесс обмена токенами, не требующий доверия. Когда решения по масштабированию Ethereum 2.0 будут реализованы, у Uniswap, вероятно, тоже появятся новые преимущества.