Осторожно! Много текста.

It’s 2021, and that means you can earn money by playing games and breeding virtual pets. An easy way to think of Axie Infinity is to imagine a blockchain game that combines Pokémon, CryptoKitties, and card game elements.

More specifically, Axie Infinity is an NFT game and ecosystem built on the Ethereum blockchain. Its native cryptocurrencies are the ERC-20 tokens Axie Infinity Shard (AXS) and Smooth Love Potion (SLP). AXS is a governance token, and SLP is used for breeding new Axies. AXS is also available as BEP-20 tokens on the Binance Smart Chain (BSC).

Each Axie creature has a different class and is made up of various body parts, stats, and other attributes. To play, you’ll need a team of Axies that can be either purchased or provided by another player. You can store your tokens and NFTs in either an Ethereum wallet or Ronin wallet. The Ronin sidechain allows for nearly instant transactions and allows players to transact tokens and Axies without using the Ethereum blockchain, which reduces transaction costs.

In the future, you’ll also be able to purchase Land NFTs. Both AXS and SLP are available to purchase on Binance and transferable to your Ronin wallet. You can also use the Ronin Bridge to send tokens from an Ethereum wallet to a Ronin Wallet.

Introduction

Following on the concept pioneered by CryptoKitties, Axie Infinity is an Ethereum-based collectible game that’s been growing since 2018. The game is the brainchild of Vietnam-based startup Sky Mavis, starting as a passion project before becoming a popular Ethereum game.

Axie Infinity Shard (AXS) is the token of the Axie Infinity ecosystem. AXS is an ERC-20 governance token launched in November 2020. AXS tokens can be purchased, traded, or earned through playing the game. AXS rewards are given out to the top-ranking players after each season.

Other Axie Infinity tokens include game assets (your Axies) in the form of ERC-721 tokens and Smooth Love Potion (SLP), an ERC-20 token. SLP has famously become part of the play-to-earn movement, letting gamers earn a fairly steady income simply by playing Axie Infinity.

What is Axie Infinity?

In the Axie Infinity ecosystem, the game characters are called Axies. They are non-fungible tokens (NFT) you own and control. You can store them in your crypto wallet, transfer them to other Ethereum addresses, or trade with other players using a blockchain-based marketplace. Apart from Axies, the game features virtual land and items, which are also ERC-721 tokens.

Within the ecosystem, players can use Axie teams in the Adventure mode (PvE – Player vs. Environment) to battle monsters in Lunacia – the Axie Infinity kingdom. They can also choose the Arena mode (PvP – Player vs. Player) to battle other real-life Axie trainers. When you win, you gain an asset called Smooth Love Potion (SLP), which is used for breeding Axies. SLP is also an ERC-20 token and can be traded on exchanges like Binance.

There can be an entry barrier for new players due to relatively high Axie prices and occasionally high Ethereum gas prices. The Ronin Ethereum sidechain helps reduce this problem.

What is Axie Infinity Shard (AXS)?

The AXS coin (Axie Infinity Shard) is not only a governance token, but it also lets holders stake and receive AXS rewards. These rewards come from the Community Treasury, which is filled by marketplace fees and in-game purchases. The total supply of AXS will be 270,000,000. Some tokens were allocated to the public sale, some for the play-to-earn features, and some to Sky Mavis and project advisors. The initial supply at the first public sale was just under 60,000,000. The number of tokens released is expected to grow yearly until 2026.

AXS use cases

Axie Infinity wants to be a mature game that gets players hooked with a strong community and thriving ecosystem. For fans of Pokémon or Final Fantasy, Axie Infinity offers a fun gaming experience to become immersed in.

In August 2021, Axie Infinity reached one million daily active players. Two months later, the number got close to the two million mark. If the game can garner an even larger player base, it will add more value to the ecosystem. As we’ve mentioned earlier, the Ronin sidechain has been implemented to encourage more growth. A future free-to-play version should also do the same.

By playing Axie Infinity, players can earn both AXS and SLP tokens. These tokens can then be exchanged for other cryptocurrencies.

How to store AXS

As AXS is an ERC-20 token, it can be stored in any ERC-20 compatible software wallet such as Trust Wallet, Binance Chain Wallet, Exodus, as well as hardware wallets such as Trezor One or Ledger Nano X. You can also store AXS in your Ronin wallet, a specialized wallet made for Axie Infinity.

What is Ronin wallet?

Ronin wallet is a crypto wallet that operates on the Ronin Ethereum sidechain. It’s a browser extension that allows you to interact with the Axie Infinity Decentralized Application (DApp). As Ethereum can experience high traffic and fees, the Ronin chain makes it much cheaper to play Axie Infinity and interact with its smart contracts. The Ronin wallet is also compatible with other games that use the Ronin blockchain.

What is the Ronin Bridge?

The Ronin Bridge lets you transfer tokens from the Ethereum blockchain to the Ronin side chain. ETH sent to the blockchain becomes wrapped ETH and can be used to buy Axie creatures, SLP, and other items. You can also transfer tokens from the Ronin blockchain to Ethereum to sell on markets like Binance.

What is Smooth Love Potion (SLP)?

Smooth Love Potion (SLP) is an ERC-20 token on the Ethereum network. SLP tokens are the main source of income for players. They can be sold or used for breeding new Axies. The token has an unlimited supply and can be gained by completing daily quests and battling other players. The SLP tokens are burned once used for breeding, and there is a limited amount you can farm per day.

SLP use cases

SLP has three main applications that drive its demand:

-

It gives users the ability to breed new Axies from two pre-existing Axies. A certain amount of Smooth Love Potions is required, which depends on the breed counts of the two-parent Axies.

-

Users can receive the token as a reward for reaching new levels with their Axies, completing quests, and winning fights.

-

SLP holders can speculate on the price and trade it on crypto exchanges like Binance.

These use cases are exactly what has helped to create the play-to-earn model that we see with Axie Infinity. Users are willing to pay for the token, and farmers are willing to earn it. By creating relatively simple methods to farm SLP, anyone with an Axie starter team can start to earn an income.

How to get started with Axie Infinity using the Ronin bridge

If you want to purchase your first team of Axies, you’ll need to get some ETH into your Ronin wallet. As Ronin is a side chain, you’ll also need to wrap your ETH (WETH) with the Ronin bridge. The process requires three main steps:

-

Purchasing ETH from an exchange like Binance.

-

Bridging your ETH with the Ronin bridge.

-

Accessing the Axie Marketplace with your WETH.

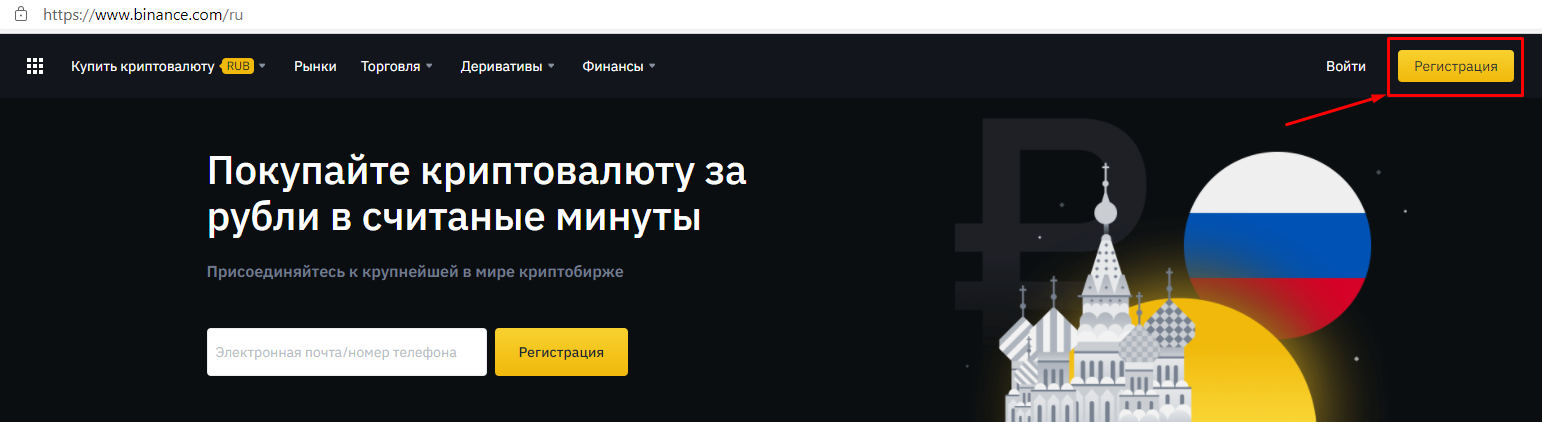

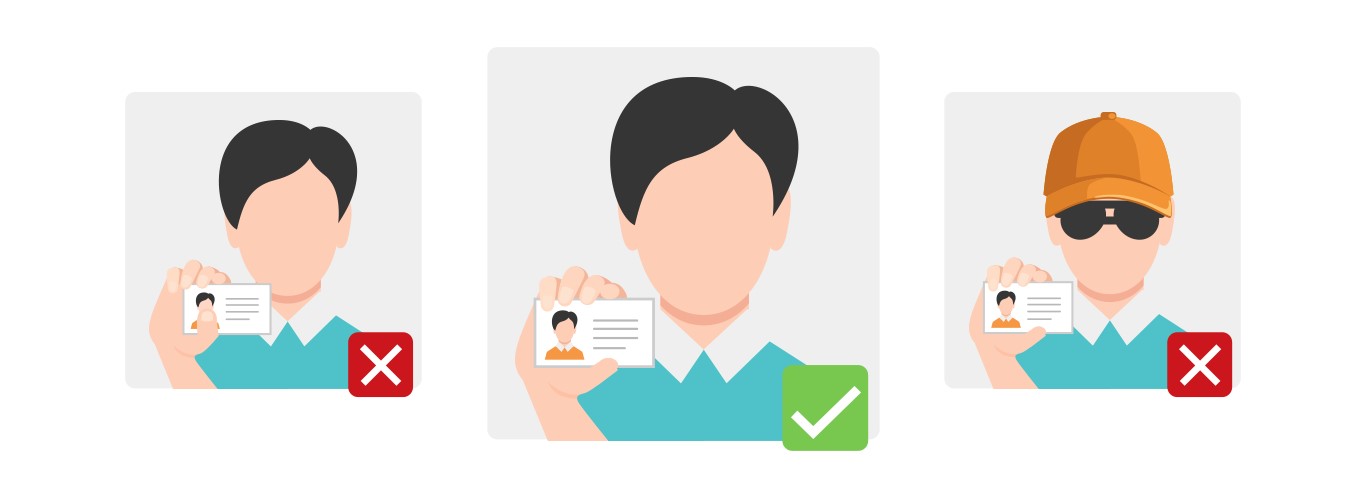

For the first step, make sure that you’ve already registered a Binance account and have completed both KYC and AML.

How to buy and transfer ETH to Ronin Wallet

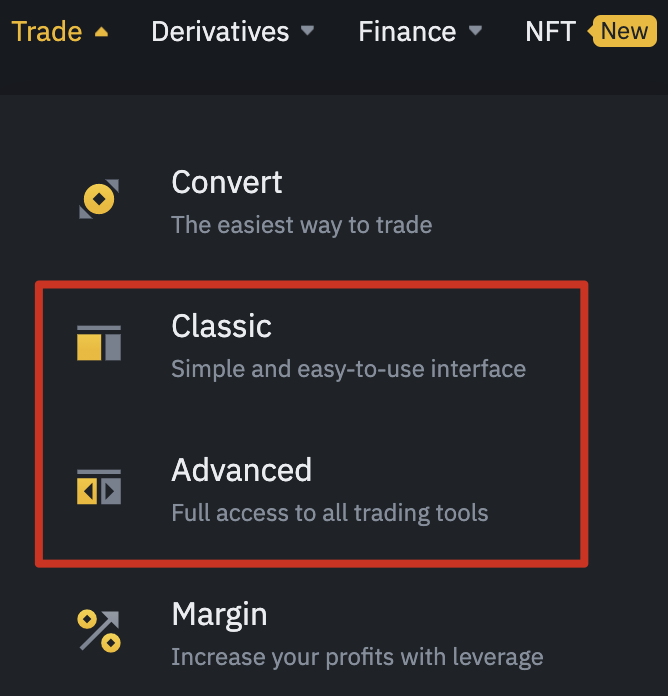

- Log in to your Binance account, mouse over the [Trade] tab, and choose the [Classic] or [Advanced] trading view.

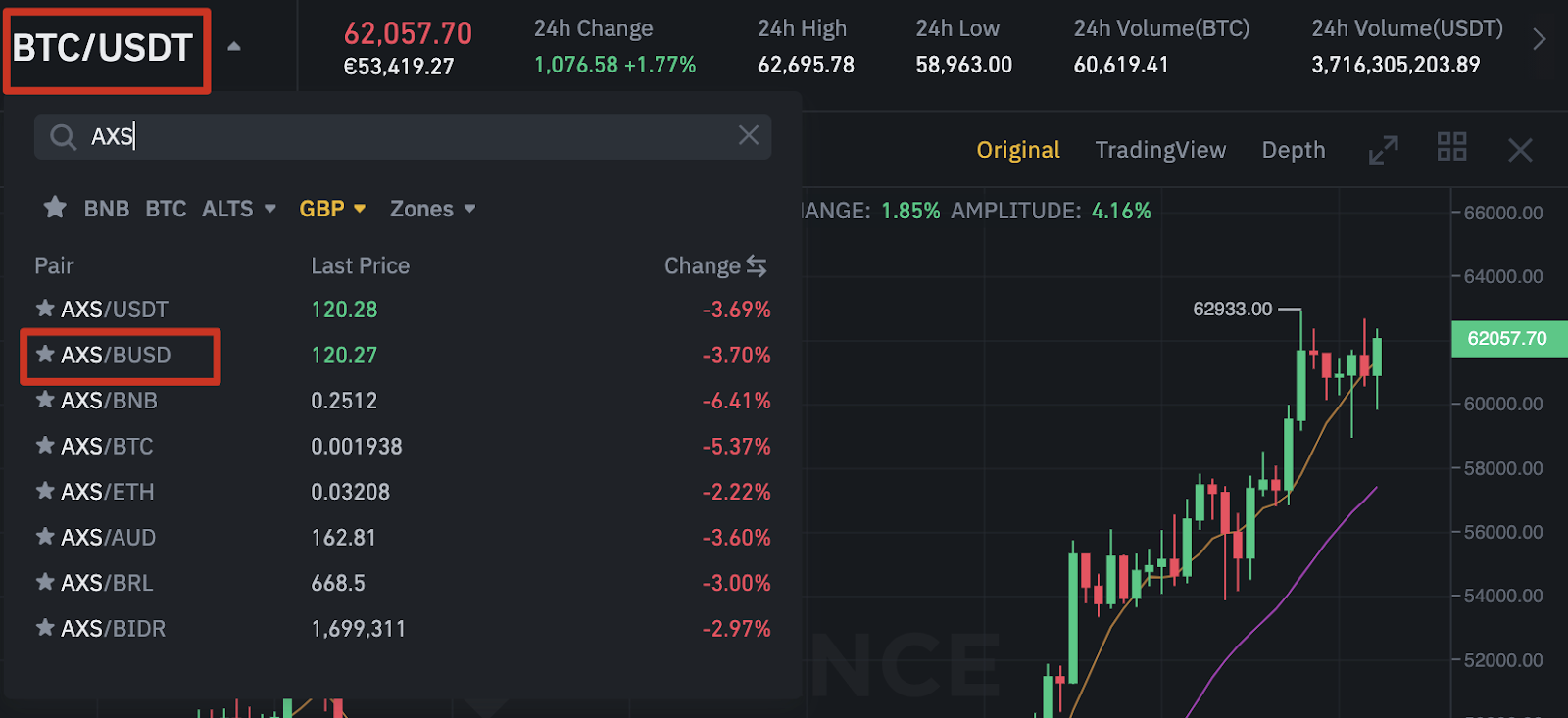

- Hover over the trading pair displayed on the left and type ETH in the search bar. Choose a suitable ETH pair, in our case [ETH/BUSD].

- Purchase your ETH with an order type of your choice. We’ve gone for the simplest method using a market order. Click [Buy ETH] to submit your order.

How to bridge ETH with the Ronin Bridge

-

First, you’ll need to create a crypto wallet if you don’t already have one. Specifically, you’ll need a wallet that can connect to DApps. MetaMask or Binance Chain Wallet are both good choices.

-

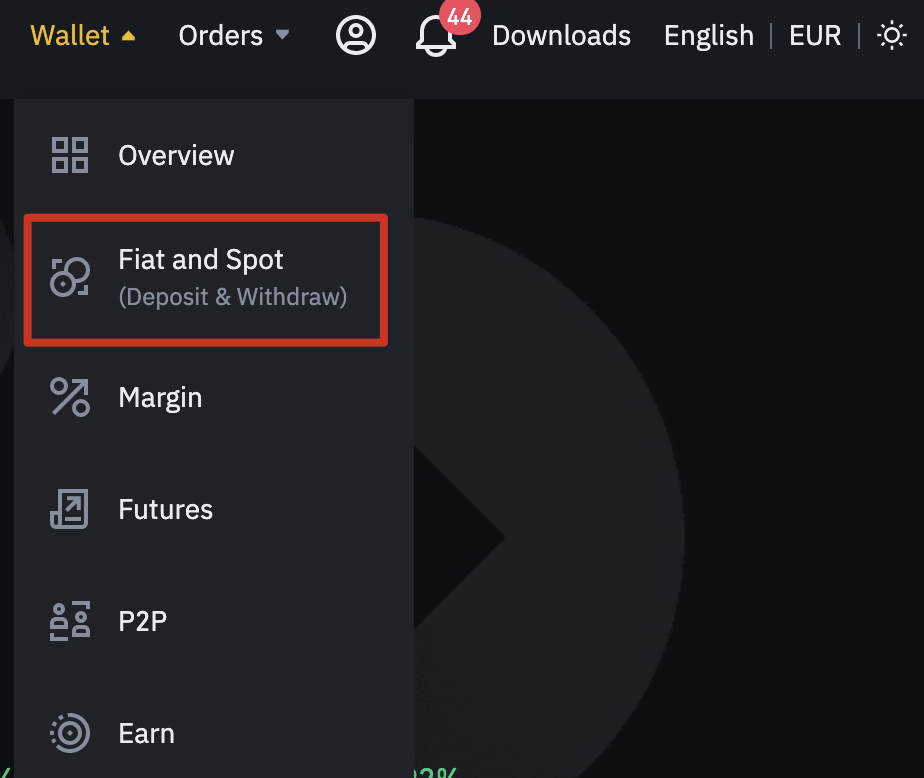

To begin bridging your ETH, hover over the [Wallet] menu tab and select [Fiat and Spot].

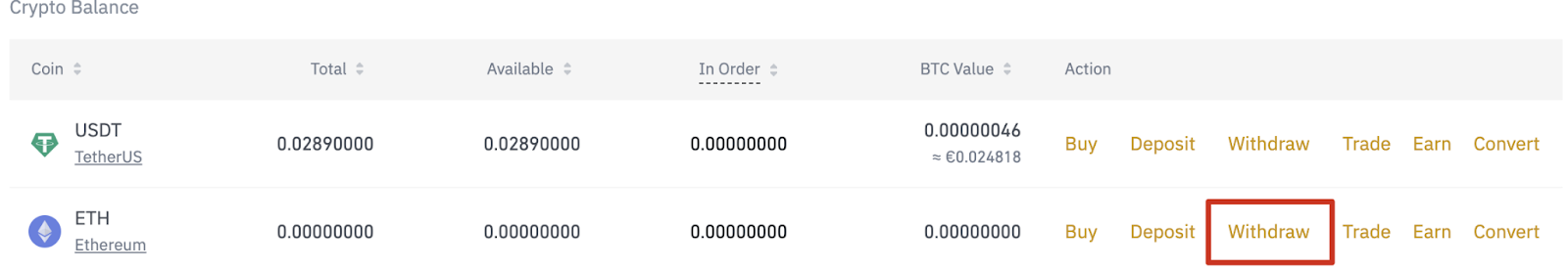

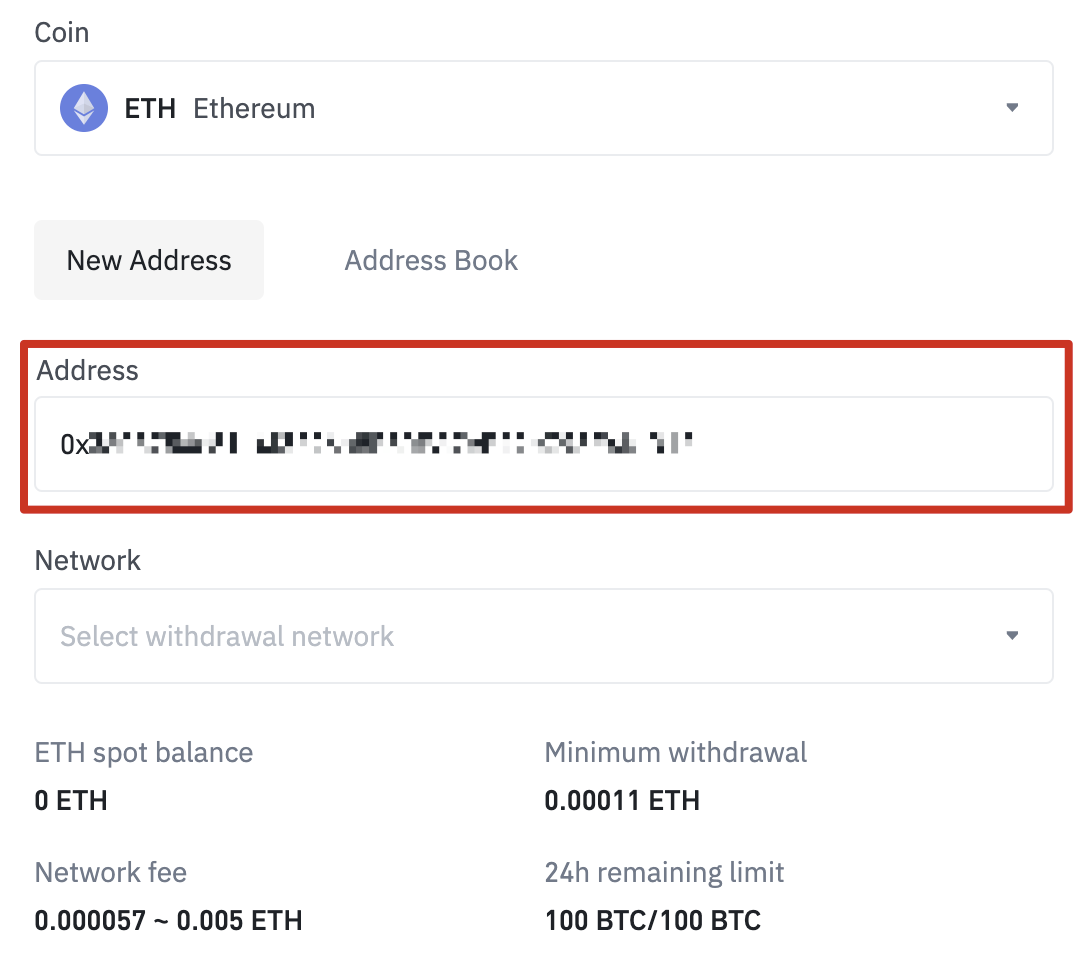

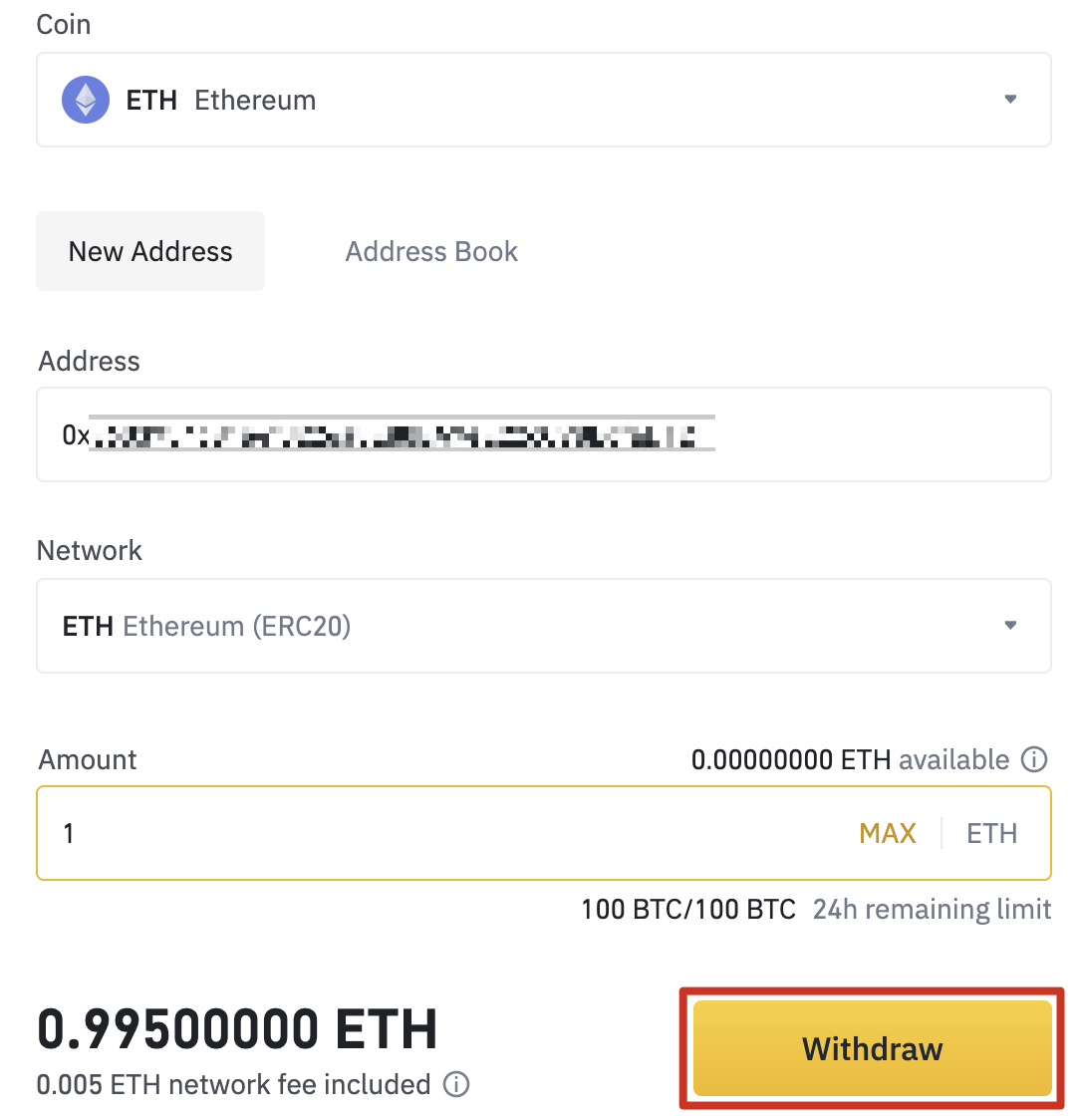

- Search for ETH and click [Withdraw].

- Copy in the Ethereum ERC-20 address you want to deposit to. This will be the depositing address from your external crypto wallet.

- Click the [Network] field and choose [Ethereum (ERC20)].

- Check the transaction’s details and click [Withdraw] to send your ETH.

-

Next, create a Ronin wallet. Note that it’s only available as a browser extension and not a desktop client. Beware of scams. Ronin is not available for mobile users yet.

-

Head to the Ronin Bridge website and click the [Deposit] button. Connect your MetaMask wallet with the pop-up that shows.

- Click [Next] and finish connecting your wallet.

- Copy your Ronin wallet’s address into the [Ronin Address] field.

- Select the asset you want to deposit by clicking the [Asset] field. In our example, we’re going to deposit ETH.

-

Finally, click [Next] at the bottom of the page to confirm your details and bridge your tokens to your Ronin wallet.

-

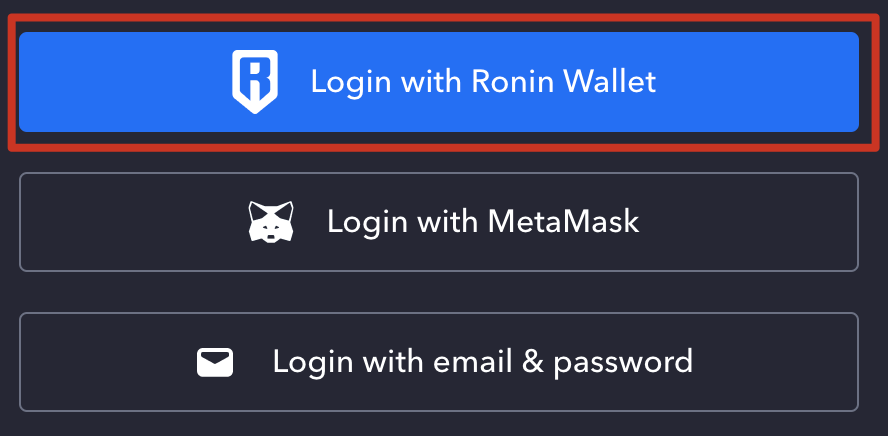

Before you can play, you’ll need to create your Axie team. Log in to the Axie marketplace and choose the Ronin wallet option. You’ll need to do this if you’ve never created an Axie account before. If it’s your first time logging in, you’ll find instructions on how to open one.

How to buy an Axie on the Axie Marketplace

- On the Marketplace, pick an Axie you’d like to purchase. Click on their avatar to find out their stats and other information. You can also use the filters on the left to help your search. If you are not familiar with the game mechanics, we recommend you do some research before buying your first Axies.

- On Axie's individual page, click the [Buy now] button to complete the purchase. You will need to confirm the transaction using your Ronin wallet extension.

Don’t forget that a full team requires three Axies. There are strategies and guides to building a team available in the Axie Infinity community, so make sure to do some research before spending your money.

How to download Axie Infinity

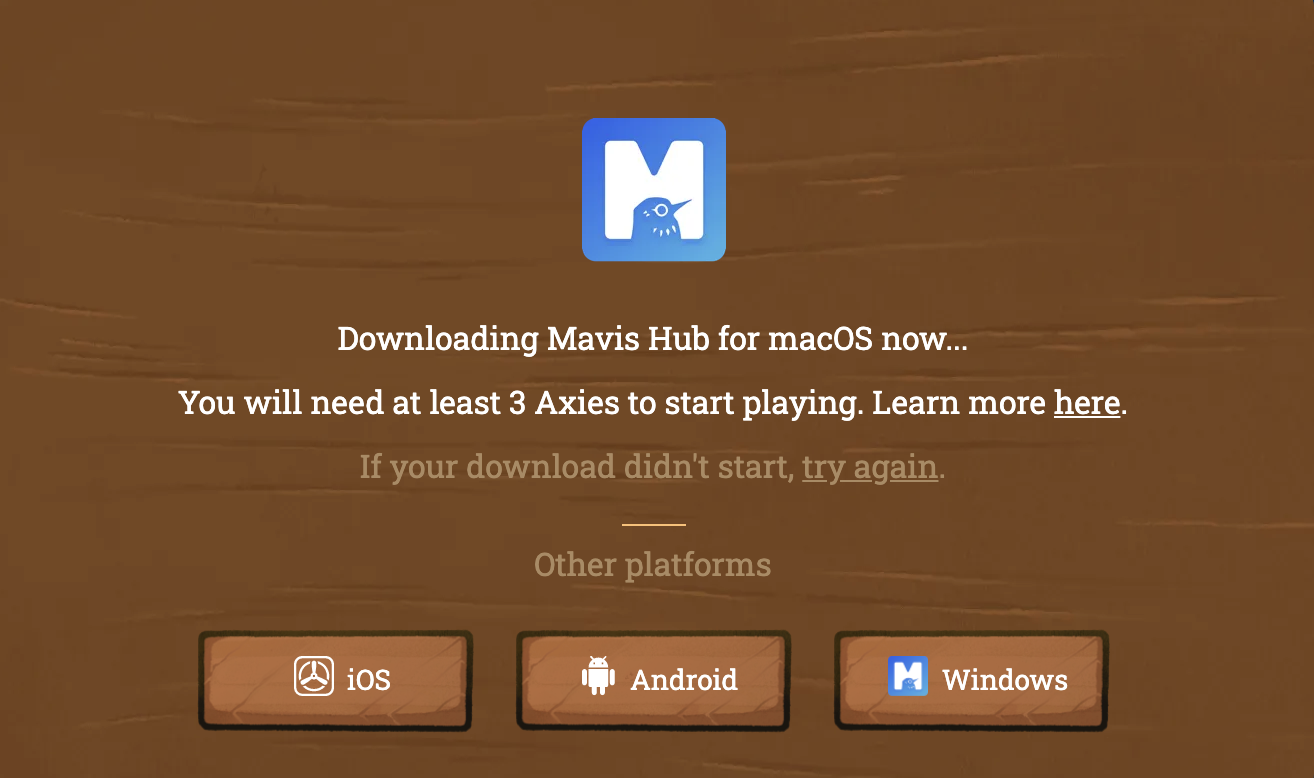

Axie Infinity is available for Windows, macOS, Android, and iOS. The best way to install the game is to head to the Axie Infinity homepage and click the [PLAY NOW] button in the top right corner.

This will automatically download a client for your desktop or laptop computer. Note that if you choose the iOS version for your iPhone, you’ll need to have TestFlight enabled on your device. This will allow you to install applications still in development. For Android, you will need to install the .apk file downloaded from the splash screen.

Overview of an Axie

Each Axie is a small fantasy creature made up of a combination of different attributes and characteristics. These are their class, stats, and body parts. As of October 2021, there are 9 different classes of Axies.

What are the Axie base classes?

Axie Infinity has nine classes, of which three are special classes (shown below in bold) without unique Body Parts or Class Cards.

Aquatic | Group 1 |

Bird | Group 1 |

Dawn | Group 1 |

Bug | Group 2 |

Beast | Group 2 |

Mech | Group 2 |

Plant | Group 3 |

Reptile | Group 3 |

Dusk | Group 3 |

An Axie’s class is an important part of how it fights. Each class has a weakness fighting another class type but is stronger against others. Cards are also associated with specific classes, giving them a 10% attack bonus when they use the card against weak types.

For example, Aquatic, Bird, or Dawn Axies will do extra damage against Bug, Beast, or Mech Axies, but they take extra damage from Plant, Reptile, and Dusk classes. In other words, Group 1 classes are strong against Group 2, but weak against Group 3. Group 2 Axies are strong against Group 3 but weak against Group 1. Finally, Group 3 Axies are strong against Group 1 but weak against group 2, closing up the cycle.

What are Axie Abilities/Cards?

There are 132 cards in Axie Infinity associated with six out of nine of the available classes. You can also divide the cards into related body parts, their range, and cost. While any Axie class can use a card, there is bonus damage if it’s associated with their specific class.

What are Axie stats?

Axies have a collection of stats that determine certain characteristics:

HP | Provides each Axie’s total health or hit points. Axies with more HP can take more damage. |

Skill | Adds bonus damage to combo attacks. |

Morale | Each Axie’s critical strike chance relies on its Morale, as well as the number of Last Stands they have. |

Speed | Axie’s with a higher speed attack first in battle. Speed also reduces the chance of getting a critical hit when defending. |

What are Axie body parts?

Every Axie has a combination of six body parts: ears, eye, horn, back, mouth, and tail. The last four determine the exact cards your Axie can use in battle, and each one also affects the creature’s stats.

How much does it cost to start playing Axie Infinity?

As of October 2021, the cheapest Axies cost around $130 US dollars (in WETH). Your Axie team will have three creatures, meaning that you can get started for about $390. The best way to see how much it costs to start playing is to go to the Axie Marketplace and sort by price.

How to get free Axies via scholarships

There are two possible ways to get free Axies. First, you can get Scholarships from other players who provide free teams. Each scholar will then give out a share of their Smooth Love Potion earned to the donor. This is a popular method as users are only allowed to have one Axie account. Therefore, it makes sense for people to put their Axie to use.

Scholarships are provided and managed by other players, not the Axie Infinity team. So you should be cautious when entering into one. CoinGecko is one place to track available scholarships. Once you have your team, you can use it to battle in the Arena or Adventure mode. Note that only the Axies owner (the scholarship manager) can claim the SLP tokens you farm, and it is up to them to send your part of the deal. In most cases, scholars and managers share 50% of the earnings.

An alternative method is to wait for the release of Battles Version 2.0. This update will unlock new game modes that will give users a free Axie to battle with. However, these creatures cannot earn tokens to sell. If you’re looking to use Axie Infinity as a play-to-earn game, you’ll still have to buy the team yourself or get a scholarship.

What affects Axie prices?

Axies can range in price from around $130 to even over $100,000. While their value mainly depends on their in-game power and utility, there’s also a lot of speculation involved. Origin Axies from the game’s early days are usually worth more. There are also Mythical Axies that look more colorful and are particularly rare. Typically, rarer attributes also provide the most utility in-game and demand higher prices. With the massive popularity of Axie Infinity, the market for creatures is now affected not just by players but also by NFT collectors.

How to start farming SLP on Axie Infinity

Users can farm SLP from either Arena matches (PvP) or the Adventure mode (PvE). Battling in both of these activities will cost you energy. Once your energy has run out, you’ll then only be able to complete adventures to farm your SLP.

The amount of energy you have depends on the number of Axies you have. You can see how much energy you have through the game’s main menu at the top of the screen.

-

Daily quests will earn you 25 SLP. These tasks involve making a daily check-in, completing 10 Adventure mode levels, and winning 5 Arena matches.

-

The Adventure Mode (PvE) lets you earn up to 50 SLP daily. The specific amount changes based on the level you’re playing on. The first time you play a level, you’ll receive SLP. However, future plays of a certain level aren’t guaranteed to reward SLP. Defeating bosses can also reward you with SLP.

-

Arena (PvP) matches you against other players based on your ranking. Your ranking also alters the amount of SLP you gain per win. Each match will cost energy, so the amount of SLP you earn in a day will depend on the number of matches you play using energy.

Note that you can still play the game even if you run out of energy. However, PvP matches won’t give you SLP rewards, and PvE matches won’t give you any experience. But you can still climb the ranks or do daily quests.

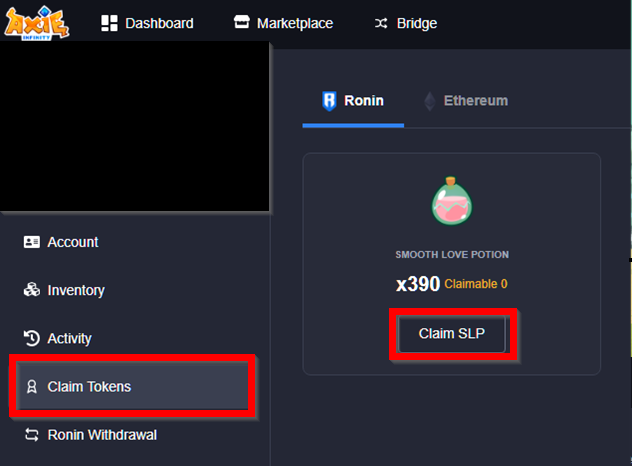

How to claim your SLP from Axie Infinity

Once you’ve earned SLP, you’ll have to claim it manually. You can only claim your SLP once every 14 days.

-

From the Axie Infinity home page, connect your Ronin wallet and select [Claim Tokens] from the menu. Then click [Claim SLP] to transfer the tokens to your Ronin wallet.

-

Go to your account and make sure your Ronin wallet is connected. Click [Claim Tokens] in the menu and then [Claim SLP].

- At this stage, you can then transfer your SLP to your Ethereum wallet if you’d like to sell it. You can also send it directly to your Binance Ronin wallet to avoid paying Ethereum gas fees.

What are Axie Lands?

Axie Land are parcels of land in Lunacia, the world where the Axie creatures live. The universe consists of a 301x301 grid which will be sold off in several sales. 25% is available for the first sale, and all prices will increase by 10% in future sales.

The pink squares will host world events, dungeons, chimera spawn locations, and public resource nodes. The map also contains an area known as Luna’s Landing for content creators and roads for traveling. Chests containing land types are purchasable, and multiple chests bought together will contain land in neighboring spaces.

How to buy and transfer AXS to Ronin wallet

AXS can be used for governance, staking, or breeding. If you are a breeder or want to start breeding Axies, you can send AXS directly from Binance to your Ronin wallet without the Ronin bridge. Doing this will save on Ethereum gas fees as you can skip the step of transferring to an external wallet. Just like ETH, AXS is purchasable on Binance.

- First, log in to your Binance account, hover over [Trade] and choose either the [Classic] or [Advanced] views.

- Next, hover over the displayed trading pair and type AXS in the dropdown menu. Select one of the pairs. In our example, we’ll use [AXS/BUSD].

- Choose your order type and the amount you want to purchase. We’ve gone for a simple market order. Click [Buy AXS] when you’ve confirmed your order’s details.

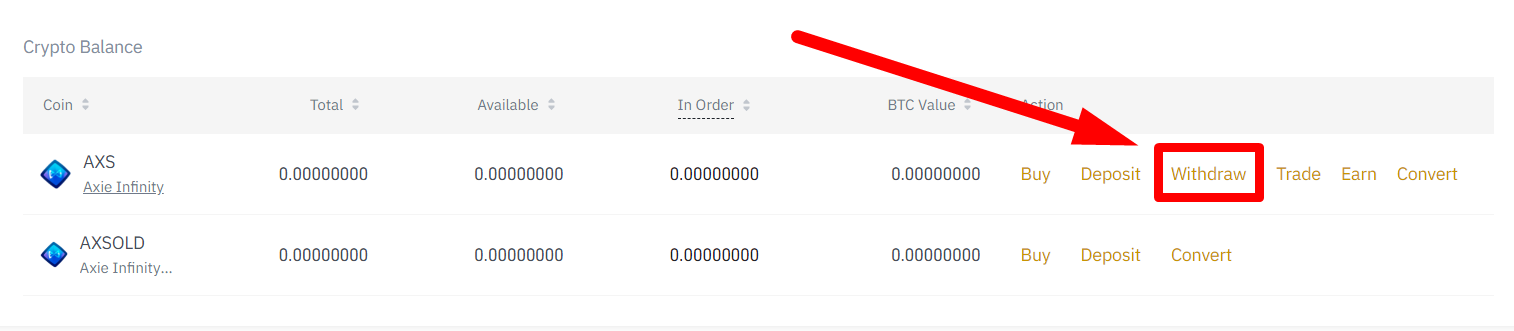

- To start withdrawing to your Ronin wallet, you’ll need to hover over the [Wallet] button and select [Fiat and Spot].

- Search for AXS and click [Withdraw].

-

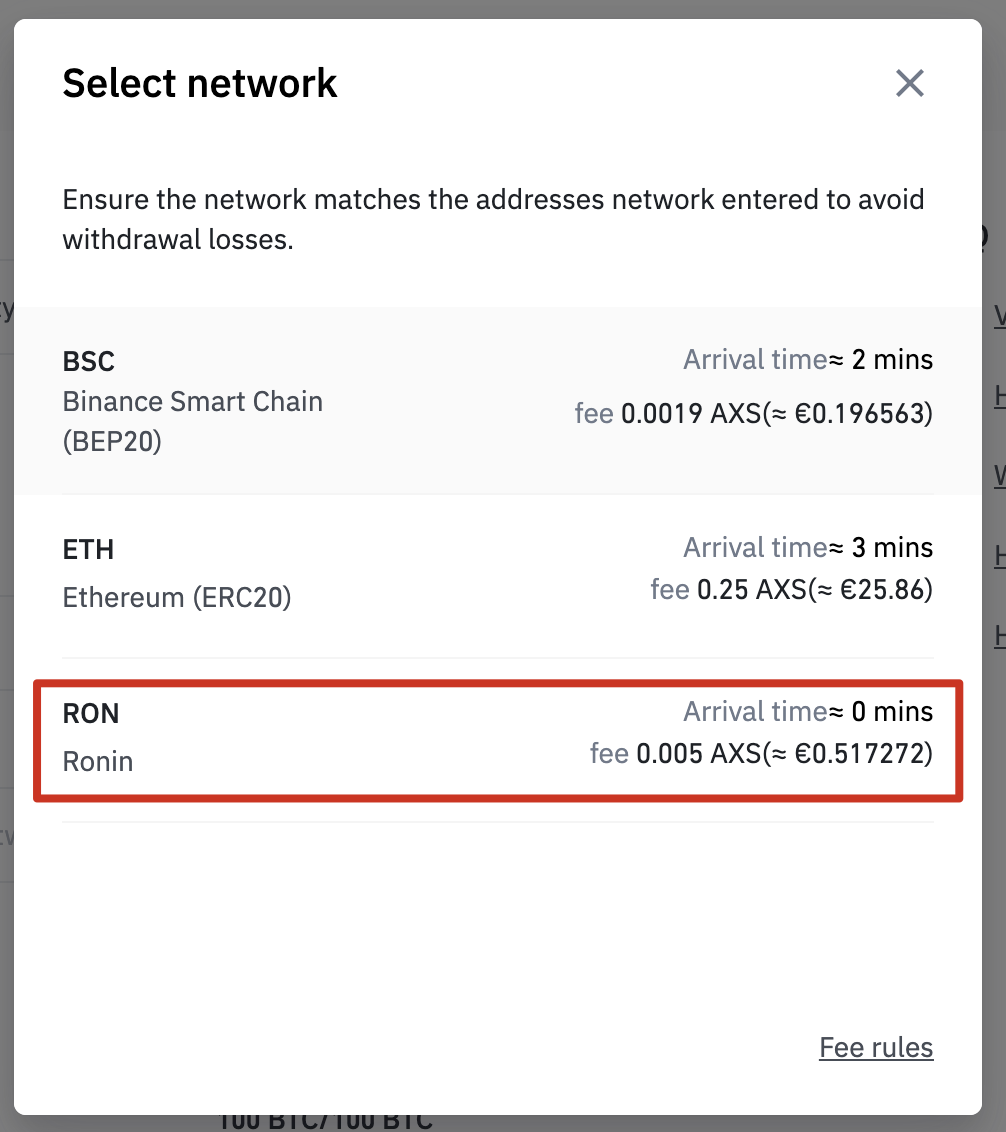

- Select the [Network] field.

- Choose the Ronin network from the selection.

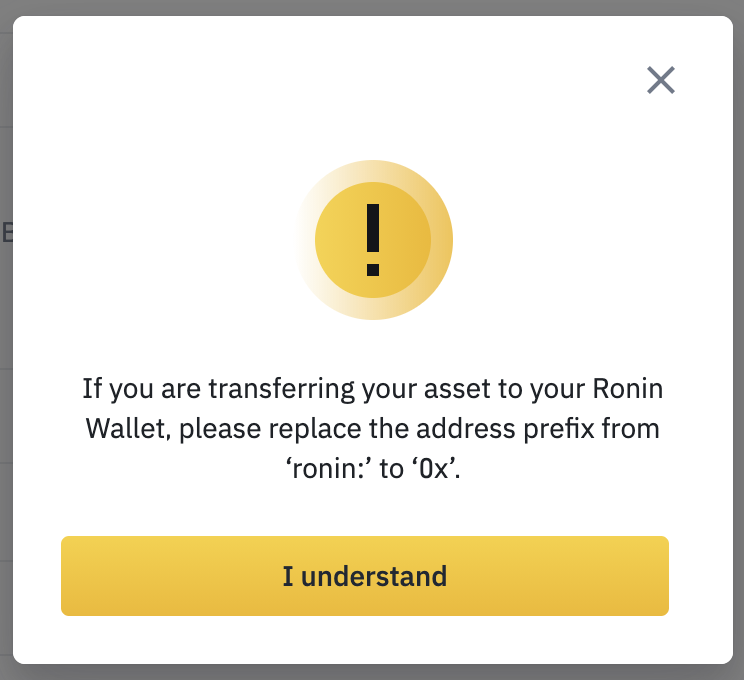

- Make sure you read and understand the warning shown. You will need to replace the ronin: prefix with 0x before proceeding.

- Finally, input the amount you want to send and click [Withdraw].

- When the withdrawal is completed, you should see your AXS or WETH in your Ronin wallet. You can then use the tokens for breeding or buying Axies in their marketplace.

Closing thoughts

The future of the AXS and SLP tokens relies on the continued playability and popularity of Axie Infinity. The gameplay is fun, fleshed out, and still has room to grow with its reputation as a play-to-earn game. It has attracted many players as the team continues to work on updates and add new features. Axie Infinity and NFT games will likely keep evolving in the blockchain space.