-

Dual Investment lets you earn interest no matter the direction of the market.

-

Use Buy Low Dual Investment to buy crypto at a lower price in the future and earn interest.

-

Use Sell High Dual Investment to sell crypto at a higher price in the future and earn interest.

-

If the Target Price is reached, your deposit will be used to buy/sell cryptocurrency. If it isn’t reached, your deposit and interest income will be returned to you.

You can compound your earnings and roll over your positions using the Auto-Compound feature.

Introduction

We all know that to get a return on an investment, we need to buy low and sell high. Investing in cryptocurrency is no different. Binance Dual Investment provides a great way to seize Buy Low and Sell High opportunities while also providing you with additional returns. Let’s dive into how it works and exactly how you can get started.

Key Benefits of Dual Investment

Binance Dual Investment provides users with four key benefits:

-

Buy Low or Sell High: Dual Investment allows you to have a chance to buy crypto at a lower price or sell crypto at a higher price.

-

High Interest Yield: You’ll earn a high passive income no matter which direction the market goes.

-

Wide Selection: You can choose from a wide variety of assets and set the target date and price to your liking.

-

No Trading Fees: Zero trading fees when the target is reached and the buy or sell-order gets executed.

How does Dual Investment work?

Binance Dual Investment provides users a chance to buy crypto at a lower price or sell crypto at a higher price in the future. It also allows users to earn high-interest yield during the subscription period no matter the market direction. For many, Dual Investment offers an alternative to spot trading with limit orders on the Binance trading platform.

There are two types of Dual Investment products: Buy Low and Sell High.

Buy Low products provide the chance to buy your desired crypto at a lower price in the future. Sell High products allow you to have a chance to sell your existing crypto at a higher price in the future.

Buy Low Dual Investment

There are two reasons why you might want to use the Buy Low Dual Investment:

-

Use your existing stablecoin holdings to buy crypto at your desired price, on a desired date, and also make additional earnings.

-

Accumulate more stablecoins through interest income.

Sell High Dual Investment

Similarly, the Sell High Dual Investment product also provides two use cases:

-

Sell your existing crypto holdings at your desired price on a desired date and also make additional earnings.

-

Accumulate more crypto through interest income.

Trading strategies

Buy High and Sell Low can easily be used in a number of different trading strategies. Make sure to check our LINK guide for recommendations on top Dual Investment strategies. These six techniques can help maximize returns and achieve your investment needs.

Key Dual Investment Terminologies

Before we get into how these products work, let’s define some of the terms you’ll need to know:

-

Subscription Amount – The amount deposited when subscribing to Dual Investment.

-

Target Price - A set price at which you want to buy or sell a cryptocurrency.

-

Settlement Date - A set date when you want to buy or sell cryptocurrency. You will also receive your investment return on this date. 08:00 (UTC) is the checkpoint to decide whether the Target Price had been reached or not.

-

Settlement Price - A market price average in the 30 minutes before 08:00 (UTC) on the Settlement Date. The Settlement Price and Target Price determine whether you manage to buy low or sell high.

-

Annual percentage yield (APY) - The interest you’d earn if you would lock your crypto in a Dual Investment product for a year. For example, if your APY is 36.5%, then an estimation of your daily effective return is 36.5% / 365 days = 0.1%.

-

Subscription Period - The number of days from the day of subscription until the Settlement Date.

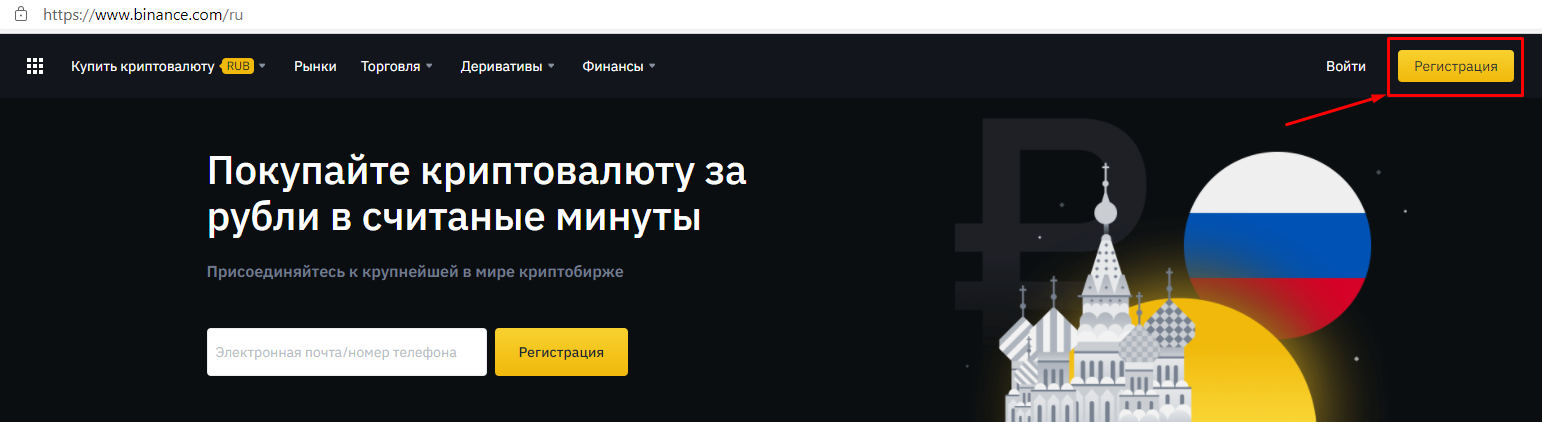

How to Subscribe to Dual Investment?

Using Binance Dual Investment is quite easy if you’re familiar with how the product works. Follow below simple steps to subscribe to Dual Investment.

- Go to the Dual Investment page.

- Select the crypto you want to buy or sell.

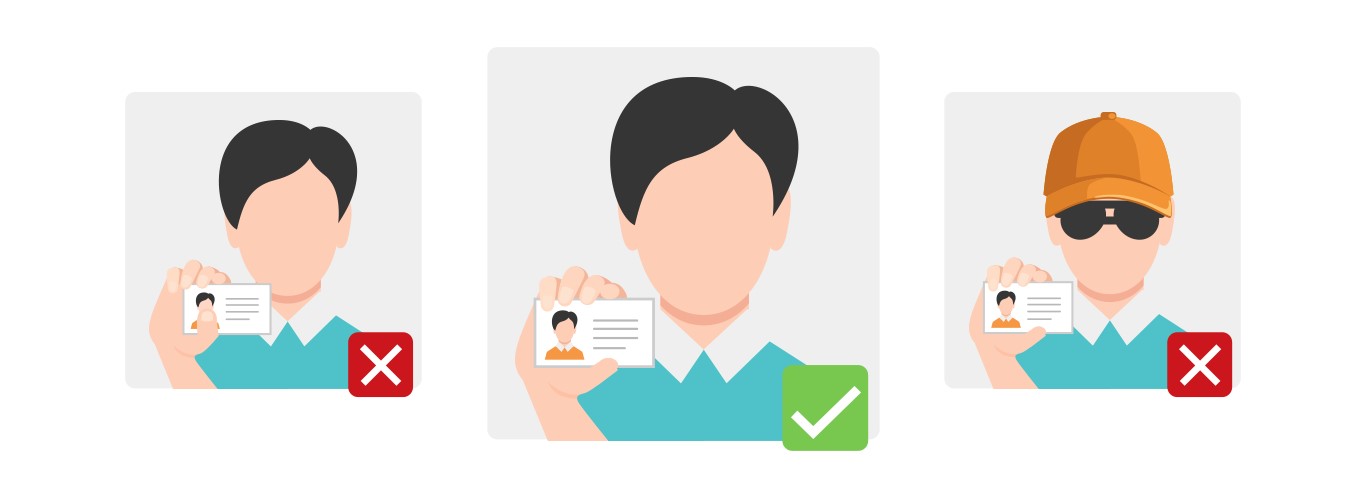

- Complete the Dual Investment quiz if this is your first time using the product.

- Decide to Buy Low or Sell High.

- Select a Target Price and Settlement Date.

- Enter your subscription amount, agree to our terms, and click [Subscribe].

- You’re all set! Your funds will be settled within 6 hours after the Settlement Date checkpoint time (08:00 UTC). You can check your previous orders on the Dual Investment History page.

Beginner Mode

If you are not familiar with Dual Investment, we have a “Beginner Mode” option available with a toggle button. The Beginner Mode provides a step-by-step guide to help you through the subscription process.

Once you are familiar with Dual Investment, you can use the same toggle button to switch off Beginner Mode and enjoy our advanced features.

How are the returns calculated?

There are two returns components in Dual Investment: Interest Income and Subscription Amount. Your return will vary depending on whether the Target Price has been reached or not.

Let’s first take a look at how interest income is calculated. Interest Income is calculated by using below formula:

Interest Income = Subscription Amount x APY% x Subscription Period (in days) / 365

For Buy Low Dual Investment, there are two possible scenarios.

1)When the Target Price is reached on the Settlement Date (i.e. price is on or below the Target Price):

a) Your Subscription Amount and Interest Income will be used to buy crypto at the Target Price.

b) Formula: (Subscription Amount + Interest Income) / Target Price

2)When the Target Price is NOT reached on the Settlement Date:

a) You receive your Subscription Amount and Interest Income without any conversion.

b) Formula: Subscription Amount + Interest Income

For Sell High Dual Investment, there are also two possible scenarios.

1)When the Target Price is reached on the Settlement Date (i.e. price is on or above the Target Price):

a) Your Subscription Amount and Interest Income will be used to sell crypto at the Target Price.

b) Formula: *(Subscription Amount + Interest Income) x Target Price *

2)When the Target Price is NOT reached on the Settlement Date:

a) You receive your Subscription Amount and Interest Income without any conversion.

b) Formula: Subscription Amount + Interest Income

On every Settlement Date, Binance uses 08:00 UTC as the checkpoint to decide whether the Settlement Price has reached the Target Price or not. The Settlement Price is the market price average in the 30 minutes before 08:00 UTC on the Settlement Date. Your funds will be returned to you within 6 hours after the Settlement Date checkpoint time (08:00 UTC).

How to auto-compound your Dual Investment returns

A common investment strategy is to compound your earnings to increase returns. Dual Investment can automate this process for you with its Auto-Compound feature.

On the Settlement Date of any open Dual Investment position, you can automatically re-subscribe to a new position with a Settlement Date occuring on the next available Settlement Date.

The Settlement Dates for BTC and ETH occur every Tuesday and Friday. The Settlement Date for all other digital assets is every Friday. Up to 30 minutes before the Settlement Date, you can choose to turn on/off the Auto-Compound feature.

There are two Auto-Compound plans available:

- Basic Plan

-

If the Target Price is reached, Auto-Compound will stop. The system will close the position and distribute the returns.

-

If the Target Price is not reached, Auto-Compound will continue. The system will automatically subscribe to a new position with settlement occuring on the next available Settlement Date until the Target Price is reached.

Imagine, if the current Sell High Target Price is not reached, at the Settlement Date your funds will auto-compound to a new Sell High position. If the Target Price is reached, Dual Investment will end the Auto-Compound function.

- Advanced Plan

-

If the Target Price is reached, the system will automatically subscribe to a new position with settlement occuring on the next available Settlement Date in the opposite direction.

-

If the Target Price is not reached, the system will automatically subscribe to a new position with settlement occuring on the next available Settlement Date in the same direction. For example, you subscribed to a Sell High product and the Target Price is not reached. Auto-Compound will open a new Sell High position for you.

In our example, if the current Sell High Target Price is reached, Dual Investment will open a new Buy Low position with settlement on the next available Settlement Date. If the Target Price isn’t reached, at the Settlement Date your funds will auto-compound to a new Sell High position.

Closing thoughts

Binance Dual Investment allows you to earn passive income no matter which direction the market goes. If you’re an investor or trader with a Binance account that wants to do more than stake or lend your HODLed coins, Dual Investment can be a good way to diversify.