Почему мне нужно прочитать эту статью?

Если вас интересует экосистема Ethereum, вам необходимо такое приложение, как MetaMask. Это расширение намного больше, чем просто кошелек, MetaMask позволяет взаимодействовать с сайтами, поддерживающими интеграцию с Ethereum.

MetaMask позволит подключаться к децентрализованным приложениям (DApps) прямо из браузера (или через мобильное приложение). Вы можете совершать сделки без посредников и играть в различные игры с полностью прозрачным исходным кодом (так что вы будете уверены, что вас не обманули).

Ознакомьтесь с руководством, чтобы начать работу с расширением!

Вступление

Создание Ethereum ознаменовалось обещанием появления распределенного Интернета – долгожданного Web 3.0. Это пространство, характеризующееся отсутствием единых точек отказа, истинным владением данными и наличием децентрализованных приложений (DApps).

Строящаяся инфраструктура неуклонно объединяется с акцентом на децентрализованные финансы (DeFi) и протоколы взаимодействия, которые направлены на соединение различных блокчейнов. Теперь можно обменивать токены и криптовалюты, брать криптовалютные займы и даже использовать Bitcoin в сети Ethereum.

Для многих энтузиастов сети Ethereum MetaMask является идеальным кошельком. В отличие от программного обеспечения для смартфонов или настольных компьютеров, кошелек доступен в виде расширения для браузера, в котором пользователи напрямую взаимодействуют с поддерживаемыми веб-страницами. В этой статье мы расскажем, как работает MetaMask, и о том, как начать с ним работу.

Что такое MetaMask?

MetaMask – это кошелек Ethereum с открытым исходным кодом, который поддерживает все виды токенов на основе Ethereum (например, токенов, соответствующих стандарту ERC-20, и невзаимозаменяемых токенов, также известных как NFT). Кроме того, вы можете получать их от других пользователей сети или покупать/обменивать их с помощью встроенной интеграции с Coinbase и ShapeShift.

Отличительной особенностью MetaMask является то, что расширение может взаимодействовать с другими веб-сайтами. При использовании других кошельков, вам необходимо скопировать и вставить адрес для платежа или отсканировать QR-код на отдельном устройстве. С расширением MetaMask сайт просто отправит запрос на кошелек, и вам будет предложено принять или отклонить транзакцию.

MetaMask может служить обычным криптовалютным кошельком, но его главное достоинство заключается в безупречном взаимодействии со смарт-контрактами и децентрализованными приложениями. Давайте узнаем, как создать кошелек.

Установка MetaMask

Кошелек MetaMask можно установить в браузерах Google Chrome, Firefox и Brave. Также он доступен для iOS и Android, но сейчас мы не будем на этом останавливаться. В этом руководстве мы будем использовать Firefox, но независимо от того, какой браузер вы используете, шаги будут примерно одинаковыми.

Перейдите на официальную страницу загрузки metamask.io. Выберите свой браузер, затем вы будете перенаправлены в интернет-магазин Chrome или на сайт дополнений Firefox. Нажмите кнопку установки расширения. Возможно, перед запуском вам потребуется предоставить ему некоторые разрешения. Убедитесь, что вас устраивают требования по доступу к браузеру – если да, то вперед.

Создание кошелька

Вы должны увидеть приветственное сообщение.

Наверное, вы, как и мы, долго игрались с этой милой лисой, прежде чем начать работу с расширением.

Наверное, вы, как и мы, долго игрались с этой милой лисой, прежде чем начать работу с расширением.

Когда вы закончите дразнить лису на странице приветствия, нажмите "Начать". Здесь вам будет предложено либо импортировать seed-фразу, либо создать новую. Нажмите "Создать кошелек". На следующей странице вас спросят, хотите ли вы отправлять разработчикам анонимные данные, чтобы помочь улучшить приложение. Выберите вариант, который вам больше нравится.

Теперь нужно создать пароль. Если вы действительно читаете пользовательские соглашения для программ (должно быть о вас слагают легенды), то можете просмотреть его, нажав "Условия использования". В противном случае придумайте надежный пароль, поставьте галочку и нажмите "Создать".

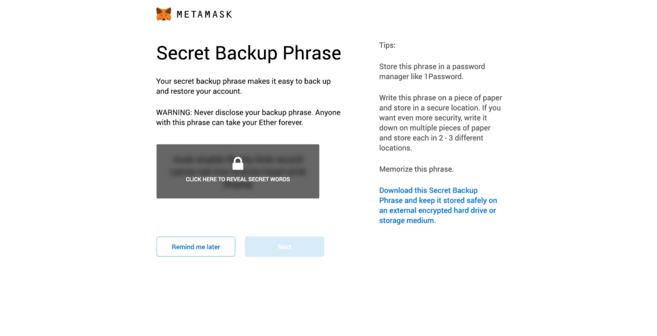

Сделайте резервную копию seed-фразы!

Этот пункт настолько важен, что заслуживает отдельного подзаголовка. MetaMask является некастодиальным сервисом, это означает, что никто другой не может получить доступ к вашим средствам – даже разработчики MetaMask. Можно сказать, ваши токены существуют в зашифрованном хранилище браузера, которое защищено паролем. Это означает, что если ваш компьютер будет потерян, украден или уничтожен, вы не сможете восстановить кошелек. Ваши приватные ключи будут навсегда потеряны в пустоте киберпространства.

Поэтому крайне важно записать резервную фразу. Это единственный способ восстановить вашу учетную запись, если что-то случится. Мы рекомендуем вам записать слова и хранить их в двух или трех разных местах. Не обязательно класть их в несгораемый сейф и закапывать в глухом лесу, но лишним не будет.

Чтобы просмотреть фразу, нажмите на серое поле.

Чтобы просмотреть фразу, нажмите на серое поле.

На случай, если вы перешли на следующую страницу и не выполнили предыдущий шаг, программа попросит вас подтвердить фразу. Если вы не сохранили фразу, нажмите "Назад" и запишите!

Подтвердите фразу и перейдите к следующему шагу. Нажмите "Все готово", и вы увидите интерфейс кошелька.

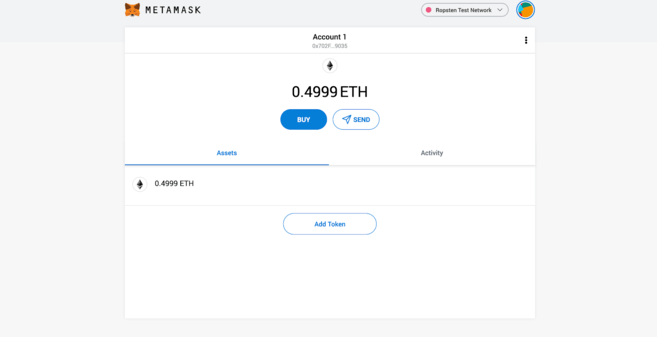

Скучная часть закончена, теперь давайте получим немного денег (в тестовой сети).

Пополнение кошелька

В этом руководстве мы будем использовать тестовую сеть Ropsten. Эта сеть функционирует почти так же, как настоящая сеть Ethereum, но ее монеты не имеют ценности. Они пригождаются, когда вы разрабатываете контракты и хотите убедиться, что в них нет уязвимостей, которые позволили бы злоумышленникам перевести себе 50 миллионов долларов. Каждый шаг, который мы выполняем в этой сети, может быть воспроизведен на реальном устройстве (к сожалению, за исключением той части, где нам дают бесплатный эфир).

Для подключения к тестовой сети Ropsten нажмите Сеть Ethereum Mainnet в правом верхнем углу и выберите Тестовая сеть Ropsten.

У Ethereum есть много тестовых сетей. Об их различях можно узнать из этого сравнения.

У Ethereum есть много тестовых сетей. Об их различях можно узнать из этого сравнения.

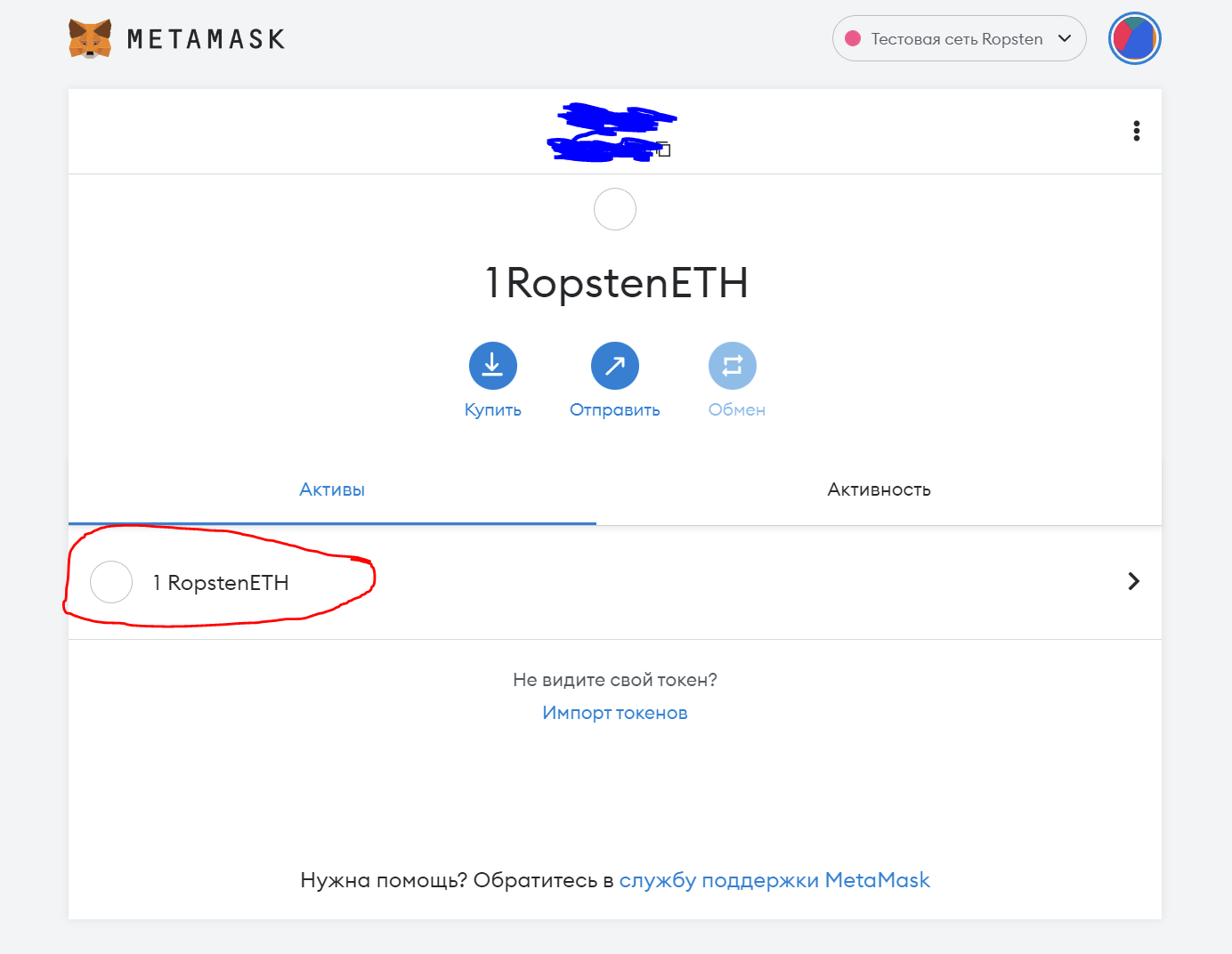

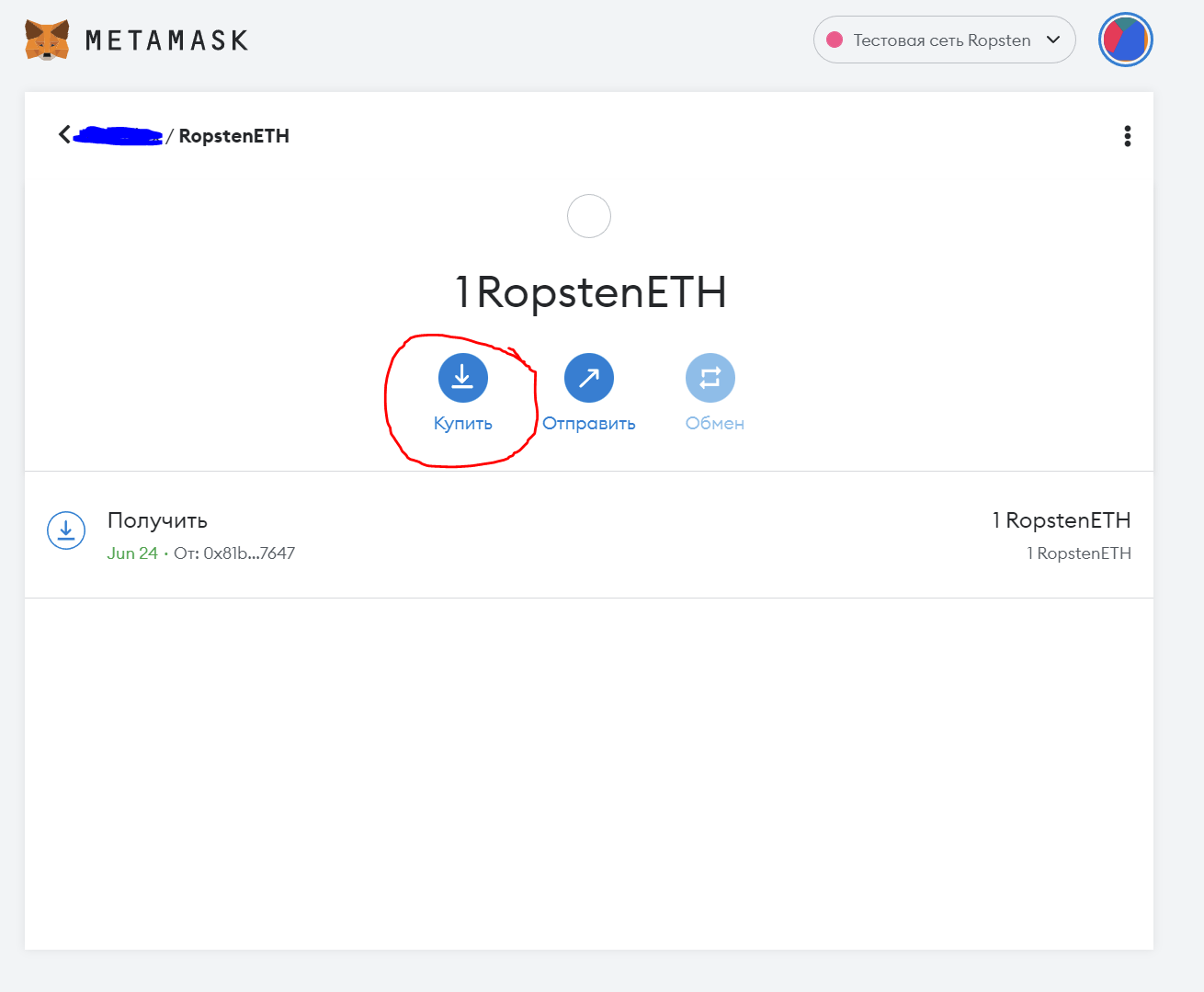

Чтобы получить тестовые средства, мы воспользуемся краном (faucet). Для получения средств нажмите на RopstenETH (на изображении ниже):

Далее жмем Купить:

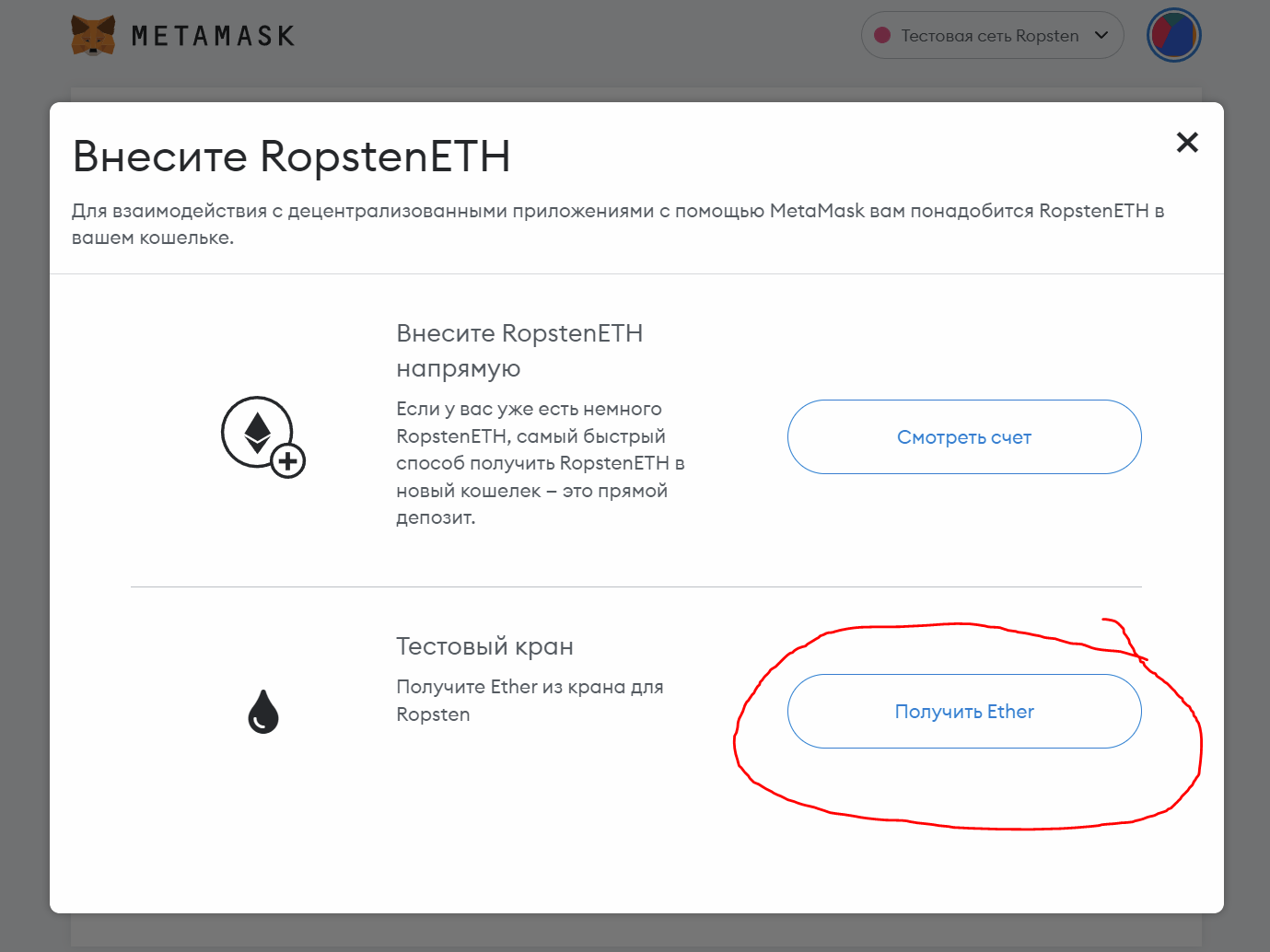

Получить Ether напротив Тестового крана:

Вы попадете на эту страницу. Жмем request 1 ether from fauset и ждем когда на ваш адрес прийдут 1 ether.

Обычно транзакции Ethereum подтверждаются довольно быстро, но прежде чем 1 ETH попадет в ваш кошелек, может пройти некоторое время. Вы можете проверить получение активов, нажав на RopstenETH в списке токенов сети Ropsten.

Как только средства будут перечислены, мы сможем начать работу с DApps.

Как добавить другую сеть в Метамаск

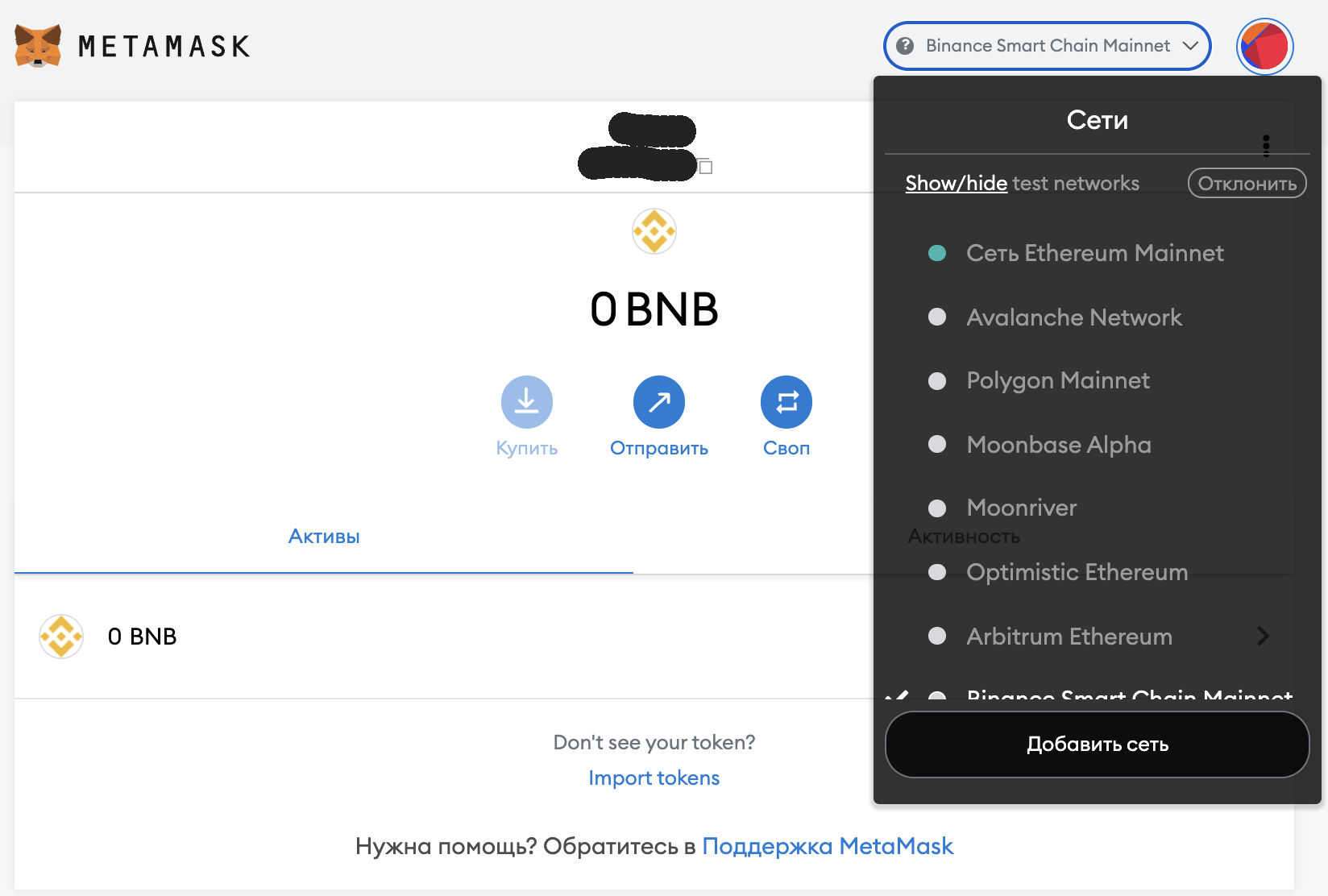

Все сети добавляются по одному алгоритму:

- разворачиваем кошелек (это для удобства, можно пропустить);

- нажимаем на выпадающий список сетей и выбираем добавить сеть;

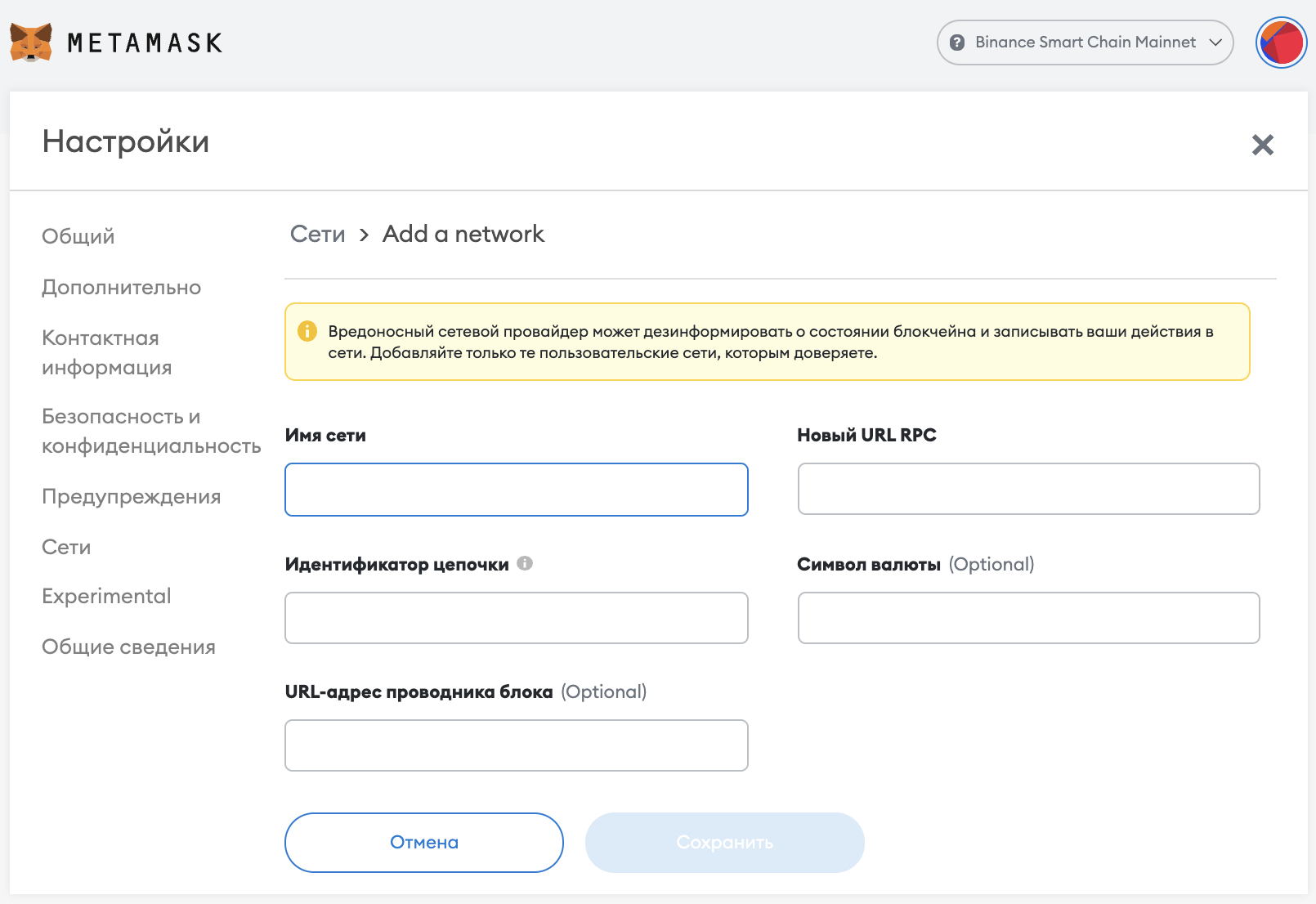

- вводим параметры сети и сохраняем ее.

Для добавления сети нужны следующие данные:

- «Имя сети» – то как сеть будет называться в вашем кошельке;

- «Новый URL RPC» – адрес блокчейна, у некоторых блокчейнов может быть несколько;

- «Идентификатор цепочки» – цифры, разные у всех блокчейнов;

- «Символ валюты» – обозначение основного токена сети;

- «URL-адрес проводника блока» - адрес сайта для обзора транзакций и кошельков в сети.

После заполнения и сохранения, добавленная сеть появиться в выпадающем списке.

Binance Smart Chain или BSC

- «Имя сети» – Binance Smart Chain или BSC

- «Новый URL RPC» – https://bsc-dataseed.binance.org/

- «Идентификатор цепочки» – 56

- «Символ валюты» – BNB

- «URL-адрес проводника блока» - https://explorer.binance.org/smart/

Источник здесь, купить BNB здесь.

Polygon Mainnet

- «Имя сети» – Polygon Mainnet

- «Новый URL RPC» – https://rpc-mainnet.maticvigil.com/

- «Идентификатор цепочки» – 137

- «Символ валюты» – MATIC

- «URL-адрес проводника блока» - https://polygonscan.com/

Купить MATIC здесь.

Avalanche Mainnet

- «Имя сети» – Avalanche Mainnet

- «Новый URL RPC» – https://api.avax.network/ext/bc/C/rpc

- «Идентификатор цепочки» – 43114

- «Символ валюты» – AVAX

- «URL-адрес проводника блока» - https://cchain.explorer.avax.network/

Купить AVAX здесь.

Optimistic Ethereum

- «Имя сети» – Optimistic Ethereum

- «Новый URL RPC» – https://mainnet.optimism.io/

- «Идентификатор цепочки» – 10

- «Символ валюты» – OETH

- «URL-адрес проводника блока» - https://optimism.io

Arbitrum One

- «Имя сети» – Arbitrum One

- «Новый URL RPC» – https://arb1.arbitrum.io/rpc

- «Идентификатор цепочки» – 42161

- «Символ валюты» – AETH

- «URL-адрес проводника блока» - https://arbiscan.io

Купить ETH в сети Arbitrum здесь.

Aurora Network

- «Имя сети» – Aurora Network

- «Новый URL RPC» – https://mainnet.aurora.dev

- «Идентификатор цепочки» – 1313161554

- «Символ валюты» – ETH

- «URL-адрес проводника блока» - https://aurorascan.dev/

Источник – официальный сайт проекта.

BitTorrent Chain Mainnet

- «Имя сети» – BitTorrent Chain Mainnet

- «Новый URL RPC» – https://rpc.bt.io/

- «Идентификатор цепочки» – 199

- «Символ валюты» – BTT

- «URL-адрес проводника блока» - https://scan.bt.io/

Проверить источник здесь.

Cronos

- «Имя сети» – Cronos

- «Новый URL RPC» – https://evm.cronos.org

- «Идентификатор цепочки» – 25

- «Символ валюты» – CRO

- «URL-адрес проводника блока» - https://cronoscan.com

Адрес сети Cronos testnet здесь.

Harmony Mainnet

- «Имя сети» – Harmony Mainnet

- «Новый URL RPC» – https://api.harmony.one

- «Идентификатор цепочки» – 1666600000

- «Символ валюты» – ONE

- «URL-адрес проводника блока» - https://explorer.harmony.one/

Альтернативные адреса – здесь, купить ONE здесь.

Fantom Opera

- «Имя сети» – Fantom Opera

- «Новый URL RPC» – https://rpc.ftm.tools/

- «Идентификатор цепочки» – 250

- «Символ валюты» – FTM

- «URL-адрес проводника блока» - https://ftmscan.com/

Страница на официальном сайте проекта – здесь, купить FTM здесь.

Fantom testnet

- «Имя сети» – Fantom testnet

- «Новый URL RPC» – https://rpc.testnet.fantom.network/

- «Идентификатор цепочки» – 0xfa2

- «Символ валюты» – FTM

Источник – официальный сайт проекта.

Polis Mainnet

- «Имя сети» – Polis Mainnet

- «Новый URL RPC» – https://rpc.polis.tech

- «Идентификатор цепочки» – 333999

- «Символ валюты» – POLIS

- «URL-адрес проводника блока» - https://polis.tech

Aquachain

- «Имя сети» – Aquachain

- «Новый URL RPC» – https://c.onical.org

- «Идентификатор цепочки» – 61717561

- «Символ валюты» – AQUA

- «URL-адрес проводника блока» - https://aquachain.github.io

Celo Mainnet

- «Имя сети» – Celo Mainnet

- «Новый URL RPC» – https://forno.celo.org

- «Идентификатор цепочки» – 42220

- «Символ валюты» – CELO

- «URL-адрес проводника блока» - https://explorer.celo.org

Expanse Network

- «Имя сети» – Expanse Network

- «Новый URL RPC» – https://node.expanse.tech

- «Идентификатор цепочки» – 2

- «Символ валюты» – EXP

- «URL-адрес проводника блока» - https://expanse.tech

Metadium Mainnet

- «Имя сети» – Metadium Mainnet

- «Новый URL RPC» – https://api.metadium.com/prod

- «Идентификатор цепочки» – 11

- «Символ валюты» – META

- «URL-адрес проводника блока» - https://metadium.com

Aurora MainNet

- «Имя сети» – Aurora MainNet

- «Новый URL RPC» – https://mainnet.aurora.dev

- «Идентификатор цепочки» – 1313161554

- «Символ валюты» – aETH

- «URL-адрес проводника блока» - https://aurora.dev

PrimusChain Мainnet

- «Имя сети» – PrimusChain Мainnet

- «Новый URL RPC» – https://ethnode.primusmoney.com/mainnet

- «Идентификатор цепочки» – 78

- «Символ валюты» – PETH

- «URL-адрес проводника блока» - https://primusmoney.com

TomoChain

- «Имя сети» – TomoChain

- «Новый URL RPC» – https://rpc.moonriver.moonbeam.network

- «Идентификатор цепочки» – 1285

- «Символ валюты» – MOVR

- «URL-адрес проводника блока» - https://tomocoin.io

Moonriver

- «Имя сети» – Moonriver

- «Новый URL RPC» – https://rpc.tomochain.com

- «Идентификатор цепочки» – 88

- «Символ валюты» – TOMO

- «URL-адрес проводника блока» - https://blockscout.moonriver.moonbeam.network/

Theta Mainnet

- «Имя сети» – Theta Mainnet

- «Новый URL RPC» – https://eth-rpc-api.thetatoken.org/rpc

- «Идентификатор цепочки» – 361

- «Символ валюты» – TFUEL

- «URL-адрес проводника блока» - https://explorer.thetatoken.org

Купить TFUEL здесь.

Callisto Mainnet

- «Имя сети» – Callisto Mainnet

- «Новый URL RPC» – https://clo-geth.0xinfra.com

- «Идентификатор цепочки» – 820

- «Символ валюты» – CLO

- «URL-адрес проводника блока» - https://callisto.network

Wanchain

- «Имя сети» – Wanchain

- «Новый URL RPC» – https://gwan-ssl.wandevs.org:56891/

- «Идентификатор цепочки» – 888

- «Символ валюты» – WAN

- «URL-адрес проводника блока» - https://www.wanscan.org

Velas EVM Mainnet

- «Имя сети» – Velas EVM Mainnet

- «Новый URL RPC» – https://evmexplorer.velas.com/rpc

- «Идентификатор цепочки» – 106

- «Символ валюты» – VLX

- «URL-адрес проводника блока» - https://evmexplorer.velas.com

Evrice Network

- «Имя сети» – Evrice Network

- «Новый URL RPC» – https://meta.evrice.com

- «Идентификатор цепочки» – 1010

- «Символ валюты» – EVC

- «URL-адрес проводника блока» - https://evrice.com

IoTeX Network Mainnet

- «Имя сети» – IoTeX Network Mainnet

- «Новый URL RPC» – https://babel-api.mainnet.iotex.io

- «Идентификатор цепочки» – 4689

- «Символ валюты» – IOTX

- «URL-адрес проводника блока» - https://iotexscan.io

RSK Mainnet

- «Имя сети» – RSK Mainnet

- «Новый URL RPC» – https://public-node.rsk.co:443

- «Идентификатор цепочки» – 30

- «Символ валюты» – RBTC

- «URL-адрес проводника блока» - https://rsk.co

Проверить актуальность здесь.

GoodData Mainnet

- «Имя сети» – GoodData Mainnet

- «Новый URL RPC» – https://rpc.goodata.io

- «Идентификатор цепочки» – 33

- «Символ валюты» – GooD

- «URL-адрес проводника блока» - https://www.goodata.org

Newton

- «Имя сети» – Newton

- «Новый URL RPC» – https://global.rpc.mainnet.newtonproject.org

- «Идентификатор цепочки» – 1012

- «Символ валюты» – NEW

- «URL-адрес проводника блока» - https://www.newtonproject.org/

Lightstreams Mainnet

- «Имя сети» – Lightstreams Mainnet

- «Новый URL RPC» – https://node.mainnet.lightstreams.io

- «Идентификатор цепочки» – 163

- «Символ валюты» – PHT

- «URL-адрес проводника блока» - https://explorer.lightstreams.io

Проверить актуальность здесь.

EOS

- «Имя сети» – Mainnet

- «Новый URL RPC» – https://api.eosargentina.io

- «Идентификатор цепочки» – 59

- «Символ валюты» – EOS

- «URL-адрес проводника блока» - https://bloks.eosargentina.io

Купить EOS здесь.

xDAI Chain

- «Имя сети» – xDAI Chain

- «Новый URL RPC» – https://dai.poa.network

- «Идентификатор цепочки» – 100

- «Символ валюты» – xDAI

- «URL-адрес проводника блока» - https://forum.poa.network/c/xdai-chain

XinFin Network Mainnet

- «Имя сети» – XinFin Network Mainnet

- «Новый URL RPC» – https://rpc.xinfin.network

- «Идентификатор цепочки» – 50

- «Символ валюты» – XDC

- «URL-адрес проводника блока» - https://xinfin.org

OKExChain Mainnet

- «Имя сети» – OKExChain Mainnet

- «Новый URL RPC» – https://exchainrpc.okex.org

- «Идентификатор цепочки» – 66

- «Символ валюты» – OKT

- «URL-адрес проводника блока» - https://www.oklink.com/okexchain

GoChain

- «Имя сети» – GoChain

- «Новый URL RPC» – https://rpc.gochain.io

- «Идентификатор цепочки» – 60

- «Символ валюты» – GO

- «URL-адрес проводника блока» - https://explorer.gochain.io

Meter Mainnet

- «Имя сети» – Meter Mainnet

- «Новый URL RPC» – https://rpc.meter.io

- «Идентификатор цепочки» – 82

- «Символ валюты» – MTR

- «URL-адрес проводника блока» - https://www.meter.io

ThunderCore Mainnet

- «Имя сети» – ThunderCore Mainnet

- «Новый URL RPC» – https://mainnet-rpc.thundercore.com

- «Идентификатор цепочки» – 108

- «Символ валюты» – TT

- «URL-адрес проводника блока» - https://thundercore.com

Fuse Mainnet

- «Имя сети» – Fuse Mainnet

- «Новый URL RPC» – https://rpc.fuse.io

- «Идентификатор цепочки» – 122

- «Символ валюты» – FUSE

- «URL-адрес проводника блока» - https://fuse.io/

Huobi ECO Chain

- «Имя сети» – Huobi ECO Chain

- «Новый URL RPC» – https://http-mainnet.hecochain.com

- «Идентификатор цепочки» – 128

- «Символ валюты» – HT

- «URL-адрес проводника блока» - https://hecoinfo.com

Energy Web Chain

- «Имя сети» – Energy Web Chain

- «Новый URL RPC» – https://rpc.energyweb.org

- «Идентификатор цепочки» – 246

- «Символ валюты» – EWT

- «URL-адрес проводника блока» - https://energyweb.org

Тестовые сети Ethereum в Метамаске

Как добавить в Метамаск сеть Rinkeby, сеть Kovan и другие тестовые сети, в кошельке по умолчанию отображается только сеть Ethereum Mainnet – это основная сеть блокчейна, но помимо её есть ещё несколько, а именно:

- сеть Ropsten Ethereum;

- сеть Rinkeby Ethereum;

- сеть Goerli Ethereum;

- сеть Kovan Ethereum.

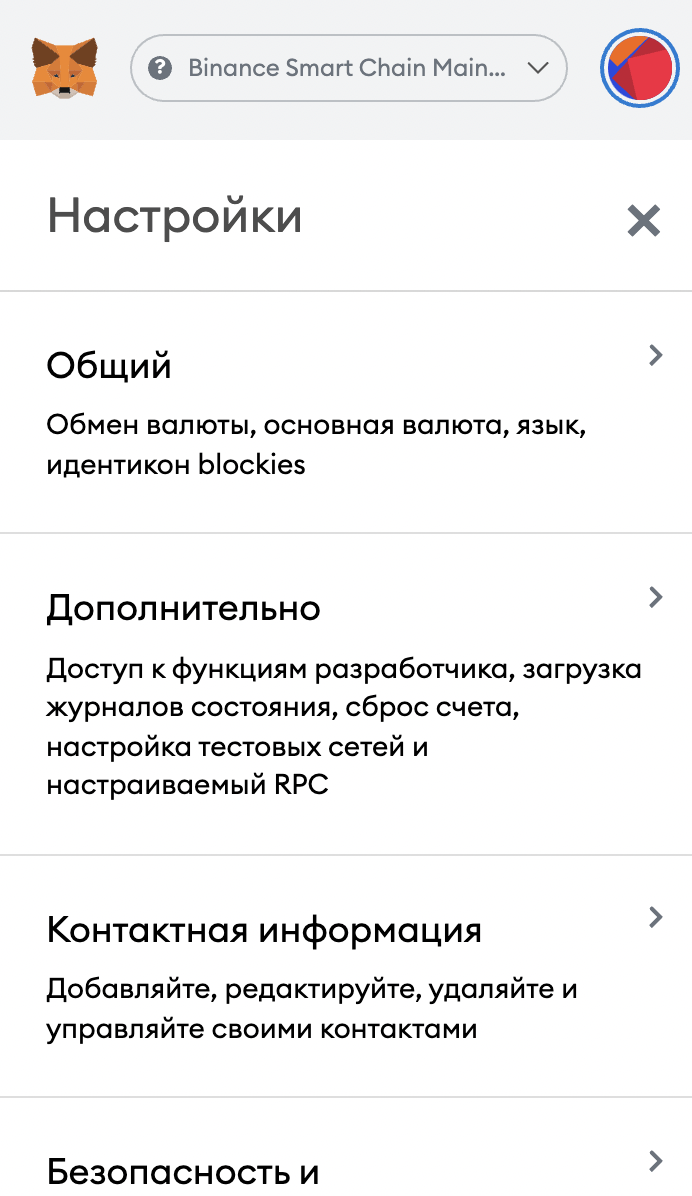

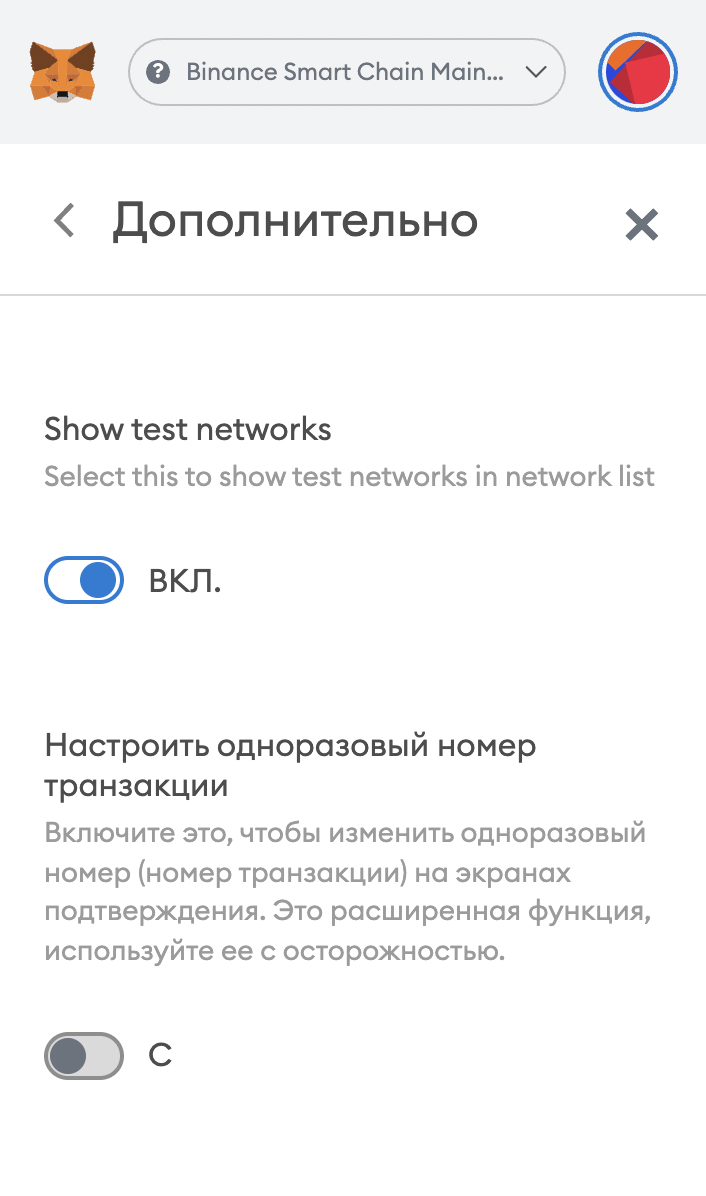

Для того чтобы пользоваться этими сетями нужно просто включить их отображение в настройках кошелька.

Для этого переходим в настройки кошелька, далее заходим в дополнительные настройки, пролистываем до пункта «Show test networks» и переводим переключатель в положение «вкл».

Сети которые не работают в Метамаске

Метамаск изначально разрабатывался для сети Ethereum, но при этом он поддерживает и другие «эфироподобные» блокчейны совместимые с EVM (Ethereum Virtual Machine). Ниже список сетей которые не работают в Метамаске.

Сеть Tron (TRX) и токены TRC20 в Метамаске

Не смотря на то, что сеть Tron это почти полная копия Ethereum, Tron не поддерживает EVM, а это значит, её нельзя добавить в Метамаск. Соответственно монеты TRX и все токены стандарта TRC20 Метамаск не поддерживает. Но при этом в метамаск можно добавить токен TRX выпущенный в сети BSC, адрес смарт контракта здесь.

Сеть Solana (SOL) в Метамаске не поддерживается

У монеты SOL есть свой нативный блокчейн – Solana, он не совместим с EVM и не поддерживается Метамаском, но так же как и в случае с TRX, в Метамаск можно добавить токены SOL (Wrapped Solana) выпущенные в сетях Ethereum, BSC и Polygon, адреса всех смарт-контрактов здесь.

Сеть Terra (LUNA) в Метамаск добавить нельзя

Terra это отдельный блокчейн со своей нативной монетой LUNA, Метамаском эта сеть не поддерживается. Можно добавить токены LUNA выпущенные в других блокчейнах – Ethereum, BSC и Polygon, адреса смарт-контрактов здесь.

Доступ к децентрализованной сети

Поскольку мы находимся в тестовой сети, у нас не такой большой выбор приложений, с которыми можно взаимодействовать.

Мы будем использовать DApp Uniswap. Uniswap – это децентрализованная биржа (DEX), на которой можно размещать сделки, не полагаясь на посредников. Механизмы, лежащие в ее основе, довольно изящны.

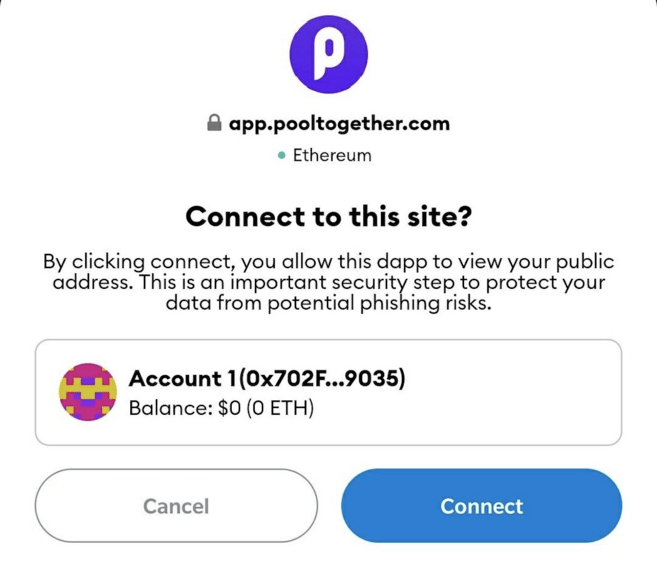

Получить доступ к Uniswap можно здесь. В правом верхнем углу вы должны увидеть запрос "Подключиться к кошельку". Такой запрос будет появляться на всех сайтах, совместимых с MetaMask, поскольку расширение не подключается автоматически по соображениям безопасности. Нажмите на него, и вам будет предложено выбрать кошелек. Если вы не были перенаправлены на другую страницу, то таким кошельком будет MetaMask.

Когда сайт впервые попытается подключиться, появится диалоговое окно MetaMask с просьбой подтвердить действие. Здесь вы можете выбрать учетную запись (пока у нас только одна, так что оставьте все как есть), а затем просмотреть, какие разрешения собираетесь предоставить сайту. В этом случае, как и во многих других, сайт запрашивает информацию об адресе кошелька вашей учетной записи.

MetaMask и конфиденциальность

Важно помнить о том, какую информацию вы предоставляете сайтам. Если сайт знает ваш адрес, он может отслеживать все входящие и исходящие транзакции с эфиром и токенами. Более того, адрес в сети Ethereum можно сопоставить с вашим IP-адресом.

Некоторые предпочитают разделять свои адреса, чтобы предотвратить любое совпадение, в то время как других эти риски не волнуют (в конце концов, блокчейн является публичным). Уровень конфиденциальности, которого вы хотите достичь, в конечном итоге зависит только от вас. Общее правило: не давайте доступ к своим данным сайтам, которым вы не доверяете.

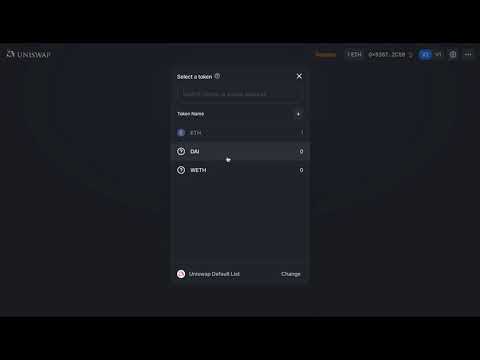

Обмен ETH на DAI

Пора сделать наш первый обмен. Мы проведем обмен со стейблкоином DAI, токеном ERC-20. Однако, как и наш эфир, этот DAI не имеет реальной ценности. Нажмите "Выбрать токен", добавьте список Uniswap по умолчанию, а затем нажмите "DAI". Как вариант, вы можете выбрать WETH (wrapped эфир).

Теперь осталось только ввести количество ETH, которое мы хотим обменять. После ввода вы увидите количество DAI, которое должны получить. Готово! Нажмите "Обменять".

*Завершите обмен с помощью MetaMask.*

*Завершите обмен с помощью MetaMask.*

Затем еще раз отобразится запрос на подтверждение действия с MetaMask. В этом случае вам необходимо подтвердить транзакцию до ее создания. Когда вы делаете это в основной сети, убедитесь, что комиссия приемлема для вас, поскольку ее сумма может быть велика. Комиссия зависит от текущего состояния сети.

После этого нам нужно дождаться подтверждения транзакции.

Где хранятся мои токены?

Итак, ваш эфир пропал, но новые токены не отображаются в аккаунте. Без паники – нужно добавить их вручную. Другими словами в сети Ropsten (как и в любой блокчейн сети) у Вас есть один публичный адрес, на который вы переводите собственно сам эфир, или токены из этой сети. Но для отображения токена в кошельке Metamask, Вам необходимо добавить адрес контракта данного токена.

Если это популярные токены, выберите пункт "Добавить токен" и выполните поиск по имени или тикеру. Если вы обменяли менее популярные (или те, что находятся в тестовой сети), то нужно добавить вручную адрес контракта – идентификатор, который сообщает MetaMask, где искать наш баланс.

- Откройте кошелек, нажав на расширение.

- Нажмите на три точки в верхней панели.

- Выберите "Посмотреть на Etherscan".

- В разделе "Overview" нажмите на выпадающий список "Token" и выберите DAI.

- В разделе "Profile Summary", вы должны увидеть адрес контракта. Скопируйте адрес наведя на него.

- Вернитесь в MetaMask и нажмите "Добавить токен".

- Нажмите на вкладку "Пользовательский токен".

- Вставьте скопированный адрес в форму "Адрес контракта токена".

- Остальные поля должны быть заполнены автоматически. Нажмите "Далее", затем "Добавить токены".

- Вернитесь на главный экран, чтобы просмотреть полный баланс.

Поздравляем! Вы только что воспользовались своим первым DApp, надежно обменяв эфир на DAI. Все, что вы узнали, теперь можно сделать в реальной сети. Когда вы будете готовы пользоваться приложениями основной сети, не забудьте переключиться с Ropsten на основную сеть.

Что ещё нужно знать о MetaMask?

В MetaMask есть и другие полезные функции, о которых мы здесь не говорили. Вы можете подключить аппаратный кошелек (поддерживаются как Trezor, так и Ledger), создать список контактов и, конечно, получать и отправлять средства, как на обычном кошельке. Вы можете настроить расширение под свои нужды.

Помимо этого, применяются обычные принципы безопасности: MetaMask – это горячий кошелек, что означает, он работает на устройстве, подключенном к интернету. Это подвергает вас большему риску, чем использование холодного кошелька, который находится офлайн в целях минимизации поверхности векторов атак.

Наконец, при использовании MetaMask вы должны понимать, к каким сайтам предоставляете доступ.

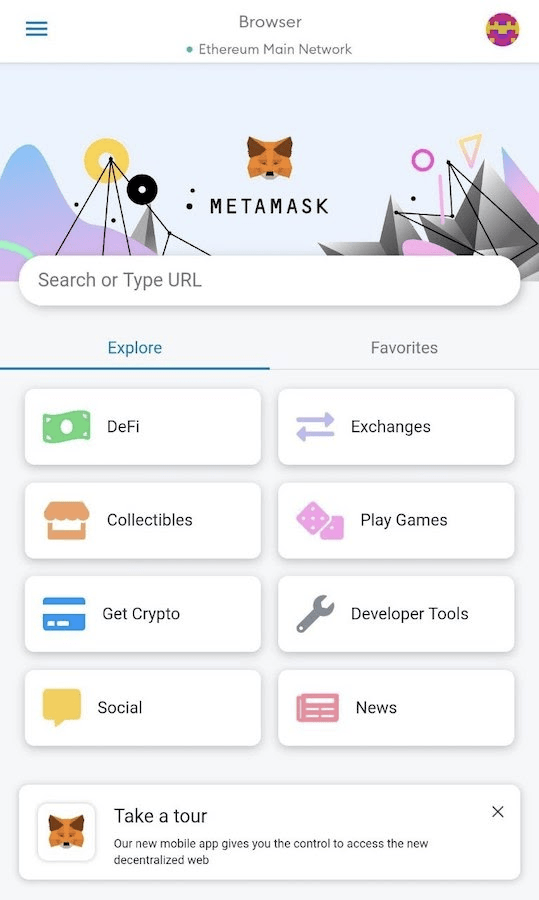

Приложение MetaMask

Приложение MetaMask для Android/iPhone представляет собой удобное решение для взаимодействия с приложениями Web3 внутри вашего смартфона. В приложение, обладающее большей частью той же функциональности, что и расширение, встроен браузер DApp, поэтому вы можете получить доступ к различным децентрализованным приложениям одним касанием.

Браузер приложений внутри MetaMask.

Браузер приложений внутри MetaMask.

Работа в приложении очень похожа на работу с расширением браузера. Вы можете напрямую переводить эфир или токены из своего кошелька или даже взаимодействовать с Uniswap, как было показано выше.

Запрос приложения на подтверждение при подключении к PoolTogether.

Запрос приложения на подтверждение при подключении к PoolTogether.

Заключение

MetaMask – мощный инструмент для работы в децентрализованных сетях. Если вы выполнили действия, описанные в этом руководстве, то уже увидели потенциал кошелька. Очевидно, увидели и другие: сейчас у MetaMask более десяти миллионов пользователей.

По мере развития стека Ethereum такие приложения, как MetaMask, несомненно, станут неотъемлемыми компонентами, интегрирующими существующие технологии и зарождающуюся криптовалютную инфраструктуру.