Crypto fundamental analysis involves taking a deep dive into the available information about a financial asset. For instance, you might look at its use cases, the number of people using it, or the team behind the project.

Your goal is to reach a conclusion on whether the asset is overvalued or undervalued. At that stage, you can use your insights to inform your trading positions.

Introduction

Trading assets as volatile as cryptocurrencies requires some skill. Selecting a strategy, understanding the vast world of trading, and mastering technical and fundamental analysis are practices that come with a learning curve.

When it comes to technical analysis, some expertise can be inherited from the legacy financial markets. Many crypto traders use the same technical indicators seen in Forex, stock, and commodities trading. Tools like RSI, MACD, and Bollinger Bands seek to predict market behavior irrespective of the asset being traded. As such, these technical analysis tools are also extremely popular in the cryptocurrency space.

In cryptocurrency fundamental analysis, though the approach is similar to that used in legacy markets, you can’t really use tried-and-tested tools to assess crypto assets. To conduct proper FA in cryptocurrencies, we need to understand where they derive value from.

In this article, we will attempt to identify metrics that can be used to craft your own indicators.

What is fundamental analysis (FA)?

Fundamental analysis (FA) is an approach used by investors to establish the "intrinsic value" of an asset or business. By looking at a number of internal and external factors, their main goal is to determine whether said asset or business is overvalued or undervalued. They can then leverage that information to strategically enter or exit positions.

Technical analysis also yields valuable trading data, but it results in different insights. TA users believe they can predict future price movements based on the past performance of assets. This is achieved by identifying candlestick patterns and studying essential indicators.

Traditional fundamental analysts generally look to business metrics to figure out what they view to be its real value. Indicators used include earnings per share (how much profit a company makes for each outstanding share) or the price-to-book ratio (how investors value the company versus its book value). They might do this for several businesses within a niche, for example, to figure out how their prospective investment stands in relation to others.

For a more comprehensive introduction to fundamental analysis, see What is Fundamental Analysis?.

The problem with crypto fundamental analysis

Cryptocurrency networks can't really be assessed through the same lens as traditional businesses. If anything, the more decentralized offerings like Bitcoin (BTC) are closer to commodities. But even with the more centralized cryptocurrencies(such as those issued by organizations), traditional FA indicators can't tell us much.

So, we need to turn our attention to different frameworks. The first step in that process is to identify strong metrics. By strong, we mean ones that can't easily be gamed. Twitter followers or Telegram/Reddit users are probably not good metrics, for example, as it's easy to create fake accounts or buy engagement on social media.

It's important to note that there's no single measure that can give us a full picture of the network we're assessing. We could look at the number of active addresses on a blockchain and see that it has been sharply increasing. But that doesn't tell us much by itself. For all we know, that could be a standalone actor transferring money back and forth to themselves with new addresses each time.

In the following sections, we'll take a look at three categories of crypto FA metrics: on-chain metrics, project metrics, and financial metrics. This list will be non-exhaustive, but it should provide us with a decent foundation for the subsequent creation of indicators.

On-chain metrics

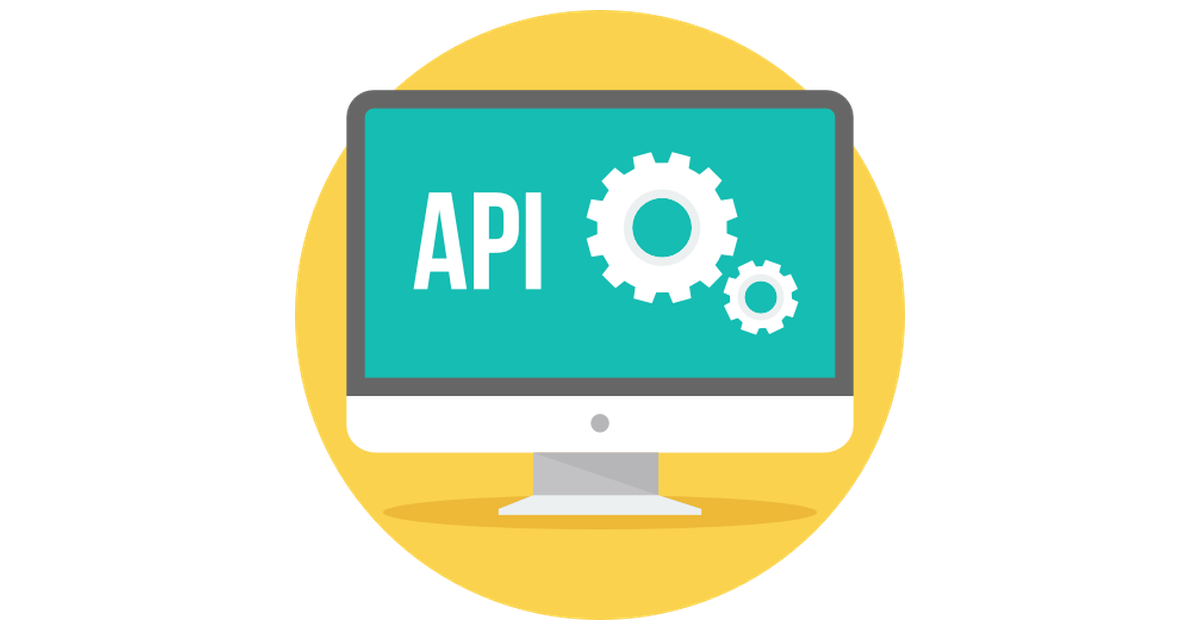

On-chain metrics are those that can be observed by looking at data provided by the blockchain. We could do this ourselves by running a node for the desired network and then exporting the data, but that can be time-consuming and expensive. Particularly if we're only considering the investment, and don't want to waste time or resources on the endeavor.

A more straightforward solution would be to pull the information from websites or APIs specifically designed for the purpose of informing investment decisions. For example, CoinMarketCap's on-chain analysis of Bitcoin gives us a myriad of information. Additional sources include Coinmetrics' Data Charts or Binance Research's project reports.

Transaction count

Transaction count is a good measure of activity taking place on a network. By plotting the number for set periods (or by using moving averages), we can see how activity changes over time.

Note that this metric should be treated with caution. As with active addresses, we can't be sure that there isn't just one party transferring funds between their own wallets to inflate the on-chain activity.

Transaction value

Not to be confused with the transaction count, the transaction value tells us how much value has been transacted within a period. For instance, if a total of ten Ethereum transactions, worth $50 each, were sent on the same day, we would say that the daily transaction volume was $500. We could measure this in a fiat currency like USD, or we could measure it in the protocol's native unit (ETH).

Active addresses

Active addresses are the blockchain addresses that are active in a given period. Approaches to calculating this vary, but a popular method is to count both the sender and receivers of each transaction over set periods (e.g., days, weeks, or months). Some also examine the number of unique addresses cumulatively, meaning that they track the total over time.

Fees paid

Perhaps more important for some crypto assets than others, the fees paid can tell us about the demand for block space. We could think of them as bids at an auction: users compete with each other to have their transactions included in a timely manner. Those bidding higher will see their transactions confirmed (mined) sooner, while those bidding lower will need to wait longer.

For cryptocurrencies with decreasing emission schedules, this is an interesting metric to study. The major Proof of Work (PoW) blockchains provide a block reward. In some, it's made up of a block subsidy and transaction fees. The block subsidy decreases periodically (in events such as the Bitcoin halving).

Because the cost to mine tends to increase over time, but the block subsidy is slowly reduced, it makes sense that transaction fees would need to rise. Otherwise, miners would operate at a loss and begin to drop off the network. This has a knock-on effect on the security of the chain.

Hash rate and the amount staked

Blockchains today use many different consensus algorithms, each with its own mechanisms. Given that these play such an integral role in securing the network, diving into the data surrounding them could prove valuable for fundamental analysis.

Hash rate is often used as a measure of network health in Proof of Work cryptocurrencies. The higher the hash rate, the more difficult it is to successfully mount a 51% attack. But an increase over time can also point to growing interest in mining, likely as a result of cheap overheads and higher profits. Conversely, a decrease in hash rate points to miners going offline ("miner capitulation") as it's no longer profitable for them to secure the network.

Factors that can influence the overall costs of mining include the current price of the asset, the number of transactions processed, and fees being paid, to name a few. Of course, the direct costs of mining (electricity, computing power) are also important considerations.

Staking (in Proof of Stake, for example) is another related concept with similar game theory to PoW mining. Insofar as the mechanisms, though, it works differently. The basic idea is that users stake their own holdings to participate in block validation. As such, we could look to the amount staked at a given time to gauge interest (or lack of it).

Project metrics

Where on-chain metrics are concerned with observable blockchain data, project metrics involve a qualitative approach, which looks to factors like the performance of the team (if any exists), the whitepaper, and the upcoming roadmap.

The whitepaper

It's highly recommended that you read the whitepaper of any project before investing. This is a technical document that gives us an overview of the cryptocurrency project. A good whitepaper should define the goals of the network, and ideally give us an insight into:

- The technology used (is it open source?)

- The use case(s) it aims to cater to

- The roadmap for upgrades and new features

- The supply and distribution scheme for coins or tokens

It's wise to cross-reference this information with discussions of the project. What are other people saying about it? Are there any red flags raised? Do the goals seem realistic?

The team

If there's a specific team behind the cryptocurrency network, its members' track records can reveal whether the team has the required skills to bring the project to fruition. Have members undertaken successful ventures in this industry previously? Is their expertise sufficient to reach their projected milestones? Have they been involved in any questionable projects or scams?

If there is no team, what does the developer community look like? If the project has a public GitHub, check to see how many contributors there are and how much activity there is. A coin whose development has been constant may be more appealing than one whose repository hasn't been updated in two years.

Competitors

A strong whitepaper should give us an idea of the use case the crypto asset is targeting. At this stage, it's important to identify the projects it's competing with, as well as the legacy infrastructure it seeks to replace.

Ideally, fundamental analysis of these should be just as rigorous. An asset may look appealing by itself, but the same indicators applied to similar crypto assets could reveal ours to be weaker than the others.

Tokenomics and initial distribution

Some projects create tokens as a solution looking for a problem. Not to say that the project itself isn't viable, but its associated token may not be particularly useful in this context. As such, it's important to determine whether the token has real utility. And, by extension, whether that utility is something that the wider market will recognize, and how much it would likely value the utility at.

Another important factor to consider on this front is how the funds were initially distributed. Was it via an ICO or IEO, or could users earn it by mining? In the case of the former, the whitepaper should outline how much is kept for the founders and team, and how much will be available to investors. In the case of the latter, we could look to evidence of the asset's creator premining (mining on the network before it's announced).

Focusing on the distribution might give us an idea of any risk that exists. For instance, if the vast majority of the supply was owned by only a few parties, we might reach the conclusion that this is a risky investment, as those parties could eventually manipulate the market.

Financial metrics

Information about how the asset currently trades, what it traded at previously, liquidity, etc. can all come in handy in fundamental analysis. However, other interesting metrics that might fall under this category are those that concern the economics and incentives of the crypto asset's protocol.

Market capitalization

Market capitalization (or network value) is calculated by multiplying the circulating supply with the current price. Essentially, it represents the hypothetical cost to buy every single available unit of the crypto asset (assuming no slippage).

By itself, market capitalization can be misleading. In theory, it would be easy to issue a useless token with a supply of ten million units. If just one of those tokens was traded for $1, then the market cap would be $10 million. This valuation is obviously distorted – without a strong value proposition, it's unlikely that the wider market would be interested in the token.

On a related note, it's impossible to truly determine how many units are in circulation for a given cryptocurrency or token. Coins can be burned, keys can be lost, and funds can simply be forgotten about. What we see instead are approximations that attempt to filter out coins that are no longer in circulation.

Nonetheless, market capitalization is used extensively to figure out the growth potential of networks. Some crypto investors view "small-cap" coins to be more likely to grow compared to "large-cap" ones. Others believe large-caps to have stronger network effects, and, therefore, stand a better chance than unestablished small-caps.

Liquidity and volume

Liquidity is a measure of how easily an asset can be bought or sold. A liquid asset is one that we'd have no problem selling at its trading price. A related concept is that of a liquid market, which is a competitive market flooded with asks and bids (leading to a tighter bid-ask spread).

A problem we might encounter with an illiquid market is that we're unable to sell our assets at a "fair" price. This tells us there are no buyers willing to make the trade, leaving us with two options: lower the ask or wait for liquidity to increase.

Trading volume is an indicator that can help us determine liquidity. It can be measured in a few ways and serves to show how much value has been traded within a given time period. Typically, charts display the daily trading volume (denominated in native units or in dollars).

Being familiar with liquidity can be helpful in the context of fundamental analysis. Ultimately, it acts as an indicator of the market's interest in a prospective investment.

Supply mechanisms

To some, the supply mechanisms of a coin or token are some of the most interesting properties from an investment standpoint. Indeed, models like the Stock-to-Flow (S2F) ratio are growing in popularity amongst Bitcoin proponents.

Maximum supply, circulating supply, and rate of inflation can inform decisions. Some coins reduce the number of new units they produce over time, making them attractive to investors that believe the demand for new units will outstrip their availability.

On the other hand, different investors might see a rigidly enforced cap as damaging in the long run. Such concerns may be that it disincentivizes the use of the coins/tokens as users opt instead to hoard them. Another criticism is that it disproportionately rewards early adopters, whereas a steady inflationary policy would be fairer for newcomers.

Fundamental analysis indicators, metrics, and tools

We’ve already defined metrics as quantitative and sometimes qualitative data used in basic analysis. But on their own, these metrics often don’t tell the whole story. To get deeper insights into a coin’s fundamentals, we should also take a look at indicators.

An indicator often combines multiple metrics using statistical formulas to create easier to analyze relationships. However, there is still a lot of overlap between a metric and an indicator, making the definition quite loose.

While the number of active wallets is valuable, we can combine it with other data to gain deeper insights. You could take this as a percentage of total wallets or divide a coin’s market cap by the number of active wallets. This calculation would give you an average amount held per active wallet. Both of these would allow you to draw conclusions on the network’s activity and users’ confidence in holding the asset. We’ll dive into this deeper in the next section.

Fundamental analysis tools make gathering all these metrics and indicators easier. While you can look at the raw data on blockchain explorers, an aggregator or dashboard is a more efficient use of your time. Some tools allow you to create your own indicators with your chosen metrics.

Combining metrics and creating FA indicators

Now that we're familiar with the difference between metrics and indicators, let's talk about how we combine metrics to better understand the financial health of the assets we're dealing with. Why do this? Well, as we've outlined in the previous sections, there are shortcomings with every metric. Furthermore, if you're just looking at a collection of numbers for each cryptocurrency project, you're overlooking a lot of crucial information. Consider the following scenario:

Coin A | Coin B | |

Market Capitalization | $100,000,000 | $5,000,000 |

Transaction count (6mo) | 20,000,000 | 40,000,000 |

Avg. transaction value (6mo) | $50 | $100 |

Active addresses (6mo) | 30,000 | 2,000 |

In isolation, active addresses tell us nothing of substance if we compare the two offerings. We could certainly say that Coin A has had more active addresses in the past six months than Coin B, but that's far from a comprehensive analysis. How does this figure relate to the market cap? Or the transaction count?

A more prudent approach would be to create some kind of ratio that we could apply to some of Coin A's statistics, then compare it with that same ratio used on Coin B's. That way, we're not blindly comparing each coin's individual metrics. Instead, we can create a standard for valuing coins independently.

For example, we might decide that the relationship between market cap and transaction count is a lot more telling than market cap alone. In which case, we might divide the market cap by the transaction count. For Coin A, we end up with a ratio of 5, and for Coin B our ratio is 0.125.

Going on this ratio alone, we might think that Coin B is more intrinsically valuable than Coin A because the number calculated is lower. What that means is that there is a much higher amount of transactions in relation to the market cap in Coin B. Therefore, it could seem that Coin B has more utility, or that Coin A is being overvalued.

Neither of these observations should be construed as investment advice – this is simply an example of how we might paint a small piece of the bigger picture. Without understanding the projects' goals and the coins' function, you can't determine whether the comparatively smaller transaction number on Coin A is a positive or negative development.

A similar ratio that has seen some popularity in the cryptocurrency markets is the NVT ratio. Coined by analyst Willy Woo, the network value-to-transaction ratio has been called the "price-to-earnings ratio of the crypto world." In simple terms, it involves dividing the market capitalization (or network value) by the amount transacted (typically on a daily chart).

We're only scratching the surface on the kinds of indicators that can be used. Fundamental analysis is all about developing a system that can be used to value projects across the board. The more quality research we do, the more data we have to work with.

Key FA indicators and metrics

There are a huge number of indicators and metrics available to choose from. For a beginner, start with some of the most popular ones first. Each indicator only tells part of the story, so use a variety of them in your analysis.

Network Value to Transactions Ratio (NVT)

If you’ve heard of the price-to-earnings ratio used to analyze stocks, then the network transaction value indicator (daily) provides a similar analysis. It’s calculated simply by dividing a coin’s market capitalization by the daily transaction volume.

We use the daily transaction volume as a stand-in for the underlying, inherent value of a coin. This concept works on the assumption that the more volume moving around the system, the more value the project has. If a coin’s market cap increases while daily transaction volume lags, the market could enter bubble territory. Prices are rising without there being a matched increase in the underlying value. In the opposite case, a coin or token’s price may stay stable while daily transaction volume increases. This scenario could suggest a possible buying opportunity.

The higher the value of the ratio, the more likely a bubble will occur. This point is usually seen when the NVT ratio is above 90-95. A decreasing ratio indicates that the crypto is becoming less overvalued.

Market Value to Realized Value Ratio (MVRV)

Before we dive into this statistic, we need to understand what realized value means for a crypto asset. Market value, otherwise known as market cap, is simply the total supply of coins multiplied by the current market price. Realized value, on the other hand, discounts for coins lost in inaccessible wallets.

Coins sat in wallets are instead valued using the market price at the time of their last movement. For example, a Bitcoin lost in a wallet since February 2016 will only be valued at around $400.

To get our MVRV indicator, we simply divide the market cap by the realized cap. If the market cap is much higher than the realized cap, we’ll end up with a relatively high ratio. A ratio over 3.7 suggests a sell-off may occur as traders take their profits due to the coin’s overvaluation.

This number signifies that the coin may currently be overvalued. You can see this before two large Bitcoin sell-offs in 2014 (MRVR of roughly 6) and 2018 (MRVR of approximately 5). If the value is too low and under 1, the market is undervalued. This situation would be a good point to buy as buying pressure increases and drives up the price.

Stock-to-flow model

The stock-to-flow indicator is a popular indicator of the price of a cryptocurrency, typically with a limited supply. The model looks at each cryptocurrency as a fixed, scarce resource similar to precious metals or stones. Because there is a known limited supply without new sources to be found, investors use these assets as a store of value.

We calculate the indicator by taking the total circulating global supply and dividing it by the amount produced per year. In Bitcoin, you can do this with easily found circulation figures and data on newly mined coins. Decreasing returns from mining leads to a higher ratio reflecting its scarcity, making the asset more valuable. As Bitcoin goes through a reward halving event periodically, we can see this reflected in the flow of new coins into the market.

As you can see, stock-to-flow has been a reasonably good indicator of the price of Bitcoin. Bitcoin’s price has been superimposed on the 365 day average of the ratio and shows a good match. The model does have some drawbacks, however.

For example, gold currently has a stock-to-flow ratio of around 60, meaning it would take 60 years to mine the current supply of gold at the current flow. Bitcoin will roughly be on track to have a ratio of 1600 in around 20 years, setting price predictions and a market cap higher than the world’s current wealth.

Stock-to-flow models also struggle when deflation happens, as this would suggest a minus price. As people lose the keys to their wallets and no more bitcoins are produced, we would see a negative ratio. We would see the stock-to-flow ratio flow go towards infinity and then become minus if we displayed this graphically.

Examples of Fundamental Analysis tools

Baserank

Baserank is a research platform for crypto assets that aggregates information and reviews from analysts and investors. The crypto receives an overall score from 0 to 100 after taking an average of each review’s score. While there are some premium reviews for subscribers, free users can still see a comprehensive overview of reviews broken down into sections, including team, utility, and investment risk. If you’re short of time and need a rapid overview of a project or coin, an aggregator like Baserank is suitable for the task. You should always, however, dive deeper into projects you’re interested in before investing.

Crypto Fees

As you might have guessed from the name, this tool shows you each network’s fees for the past 24 hours or seven days. It’s an easy metric to use when analyzing the traffic and usage of a blockchain network. Networks with high fees are typically experiencing great demand.

However, you shouldn’t just take this metric at face value. Some blockchains are built with low fees in mind, making a comparison with other networks challenging. In these cases, it’s best to look at the figure in tandem with the transaction amount or another metric. For example, large market cap coins such as Dogecoin or Cardano are low in the overall charts due to their cheap transaction fees.

Glassnode Studio

Glassnode Studio offers a dashboard displaying a wide range of on-chain metrics and data. Like most tools on offer, it is subscription-based. However, the amount of free on-chain data it offers is suitable for amateur investors and quite in-depth. It’s much easier to find all the information in one place rather than gather it yourself using blockchain explorers. Glassnode’s main strength is the vast number of metric categories and subcategories you can browse. However, if you’re interested in Binance Smart Chain projects, you’re very limited here.

For anyone who wants to combine their metrics with technical analysis, Glassnode Studio also has built-in TradingView with all its charting tools. It’s common for investors and traders to combine multiple types of analysis when making decisions. Being able to do this all in one place is a plus.

Closing thoughts

Done correctly, fundamental analysis can provide invaluable insights into cryptocurrencies in a way that technical analysis cannot. Being able to separate the market price from the "true" value of a network is an excellent skill to have when trading. Of course, there are things that TA can tell us that can’t be predicted with FA. That’s why many traders use a combination of both these days.

As with many strategies, there's no one-size-fits-all FA playbook. Hopefully, this article will have helped you understand some of the factors to consider before entering or exiting positions with crypto assets.