Что такое децентрализованные финансы (DeFi)?

Децентрализованные финансы (или просто DeFi) относятся к экосистеме финансовых приложений, которые построены на основе блокчейн-сетей.

Термин «децентрализованные финансы» может относиться к движению, целью которого является создание открытой, бесплатной и прозрачной экосистемы финансовых услуг, которая доступна каждому и работает без вмешательств со стороны каких-либо органов власти. Пользователи будут сохранять полный контроль над своими активами и взаимодействовать с этой экосистемой через одноранговые (P2P), децентрализованные приложения (dapps).

Основным преимуществом DeFi является легкий доступ к финансовым услугам, особенно для тех, кто по каким-то причинам изолирован от доступа к текущей финансовой системе. Другим потенциальным преимуществом является модульный фреймворк и интероперабельность приложений на базе публичных блокчейнов, что может повлечь за собой появление совершенно новых вид финансовых рынков, продуктов и услуг.

В данной статье мы предлагаем вам погрузиться в DeFi, их потенциально возможные приложения, перспективы, ограничения и многое другое.

Основные преимущества DeFi

Традиционная финансовая система опирается на такие институты, как банки, которые выступают в качестве посредников, и суды для обеспечения разрешения спорных моментов.

DeFi-приложения не нуждаются в посредниках и судах. Код определяет разрешение каждого возможного спора, а пользователи в свою очередь держат под контролем все свои средства. Это снижает затраты на предоставление и использование продуктов, и позволяет создать более безотказную финансовую систему.

Поскольку развертывание программного обеспечения нового вида финансовых услуг осуществляется поверх блокчейн-сетей, исключается наличие единой точки отказа в работе системы. Данные записываются в блокчейне и распределяются среди тысяч узлов, что практически исключает наличие цензуры или шатдаун.

За счет того, что фреймворк позволяет создавать DeFi-приложения заранее, их разработка и развертывание становится менее сложной и более безопасной.

Еще одним весомым преимуществом такой открытой экосистемы является простота доступа к финансовым услугам для людей, у которых по каким-то причинам отсутствует такая возможность. Поскольку традиционная финансовая система основывается на посредничестве для получения прибыли, обычно они не предоставляют свои услуги, в местах с низким доходом населения. Тем не менее, благодаря DeFi, операционные затраты значительно уменьшаются и подобные сообщества также смогут воспользоваться необходимыми финансовыми услугами.

Потенциальные варианты использования

Займ и кредит

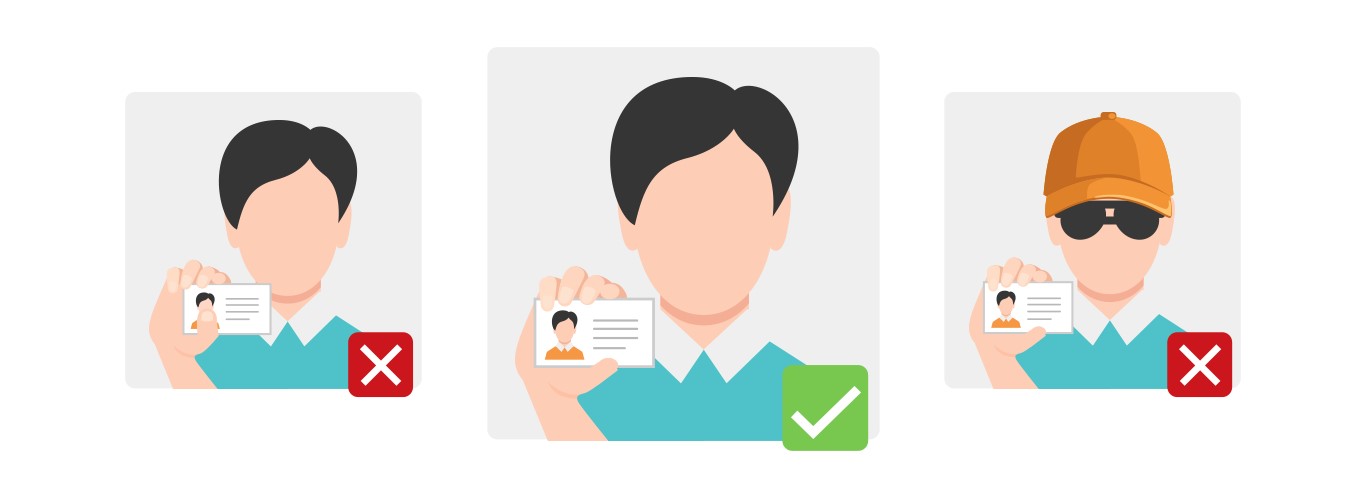

Протоколы открытого кредитования являются одним из самых популярных видов приложений в экосистемы DeFi. Открытые децентрализованные займы и кредитования обладают множеством преимуществ по сравнению с традиционной кредитной системой. К ним относятся: мгновенный расчет транзакций, возможность обеспечения цифровых активов, отсутствие кредитных проверок и потенциальная стандартизация в будущем.

По причине того, что в данном случае кредитные услуги построены на публичных блокчейнах, они сводят к минимуму необходимое к ним доверие и обеспечивают гарантию работы методов криптографической проверки. Кредитные маркетплейсы на блокчейне снижают риск контрагента (от англ. counterparty risk), делают займы и кредиты более дешевыми, быстрыми и доступными для большего числа людей.

Денежно-банковские услуги

Поскольку DeFi-приложения по определению финансовые, для них очевидным является наличие денежно-банковских услуг. Они могут включать в себя выпуск стейблкоинов, ипотеку и страхование.

По мере развития блокчейн-индустрии, все больше внимания уделяется созданию стейблкоинов. Они представляют собой вид криптовалюты, которая привязана к реальному активу и может относительно легко передаваться в цифровом виде. Поскольку криптовалюты сильно волатильные, децентрализованные стейблкоины могут быть приняты для повседневного использования в качестве цифровых денежных средств, которые не выпускаются и не контролируются со стороны центральных органов.

По причине количества посредников, которые должны принимать участие, процесс получения ипотеки является довольно дорогостоящим и долгим в оформление. С использованием смарт-контрактов, андеррайтинг и юридические сборы могут стать значительно дешевле.

Страхование на блокчейне может устранить необходимость в посредниках и позволить распределять риски между множеством участников. Это может привести к снижению страховых премий не оказывая влияние на качество обслуживания.

Децентрализованные рынки

Данная категория приложений может быть сложной для оценки, поскольку сам по себе сегмент DeFi предоставляет большое число возможностей для различных финансовых инноваций.

Возможно, некоторые из наиболее важных DeFi-приложений, это децентрализованные биржы (DEX). Такие платформы позволяют пользователям торговать цифровыми активами без участия доверенного посредника (биржи) для хранения ваших средств. Сделки совершаются непосредственно между пользовательскими кошельками с помощью смарт-контрактов.

Поскольку такие торговые платформы нуждаются в гораздо меньшем объеме технического обслуживания, децентрализованные биржи взимают более низкую комиссию за осуществление торговых операций, в отличии от своих централизованных аналогов.

Блокчейн-технология также может использоваться для выпуска и разрешений на владение широким спектром традиционных финансовых инструментов. Такие приложения будут работать децентрализованно, это позволяет исключить наличие единой точки отказа и кастодиан.

К примеру, платформы выпускающие security-токены могут предоставлять эмитентам инструменты и ресурсы для запуска токенизированных ценных бумаг на блокчейне с настраиваемыми параметрами.

Другие проекты смогут позволить себе создавать деривативы, синтетические активы, рынки децентрализованного прогнозирования и многое другое.

Роль смарт-контрактов в DeFi

Большинство существующих и потенциальных приложений в области децентрализованного финансирования включают в себя создание и исполнение смарт-контрактов. В то время, как в обычном договоре используется юридическая терминология для определения условий между субъектами заключающими договор, в смарт-контракте используется компьютерный код.

Поскольку все условия описаны в компьютерном коде, смарт-контракты обладают уникальной способностью их применения. Это обеспечивает надежное выполнение и автоматизацию большого числа бизнес-процессов, которые в настоящее время нуждаются в ручном контроле.

Смарт-контракты гораздо проще и быстрее в использовании, что оказывает влияние на уменьшение возможной вероятности неблагоприятных событий для обеих сторон. Но несмотря на это, они предоставляют пространство для появления новых видов риска. Поскольку компьютерный код подвержен ошибкам и различным уязвимостям, ваша конфиденциальная информация, заблокированная в смарт-контрактах, находятся под угрозой.

С какими проблемами сталкиваются DeFi?

-

Низкая производительность. Блокчейны по своей природе работают медленнее, чем их централизованные аналоги, что приводит к созданию дополнительных приложений. Разработчики DeFi-приложений должны учитывать такие ограничения и соответствующим образом оптимизировать свои продукты.

-

Высокий риск ошибки пользователя. DeFi-приложения передают ответственность от посредников к пользователю. Это может быть негативным аспектом для многих. Разработка продуктов, которые минимизируют риск ошибки пользователя является особенно сложной задачей, когда продукты развертываются поверх неизменяемых блокчейн-сетей.

-

Плохой пользовательский опыт. В настоящее время использование DeFi-приложений требует дополнительных усилий со стороны пользователя. Чтобы данные приложения были ключевым элементом глобальной финансовой системы, они должны предоставить ощутимую выгоду, которая повлияет на желание пользователей отказаться от традиционной системы.

-

Беспорядочность экосистемы. Поиск наиболее подходящего приложения может оказаться довольно сложной задачей, наряду с этим, пользователи должны обладать определенным умением, чтобы подобрать лучший вариант. Также проблема состоит не только в создании приложений, но и в размышлениях о том, на сколько идеально они смогут подойти к большой экосистеме децентрализованных финансов.

В чем разница между DeFi и Open Banking?

Открытый банкинг (от англ. Open Banking) - это банковская система, в которой сторонним поставщикам финансовых услуг предоставляется безопасный доступ к финансовым данным через API. Это позволяет объединять счета и данные между банками и небанковскими финансовыми учреждениями, а также предоставлять доступ к новым видам продуктов и услуг в рамках традиционной финансовой системы.

Тем не менее, DeFi представляет собой совершенно новую финансовую систему, независимую от существующей инфраструктуры. Иногда DeFi также упоминается как открытые финансы.

К примеру, открытый банкинг может позволить управлять всеми традиционными финансовыми инструментами в одном приложении путем безопасного получения данных от нескольких банков и учреждений.

В свою очередь, децентрализованные финансы могут предоставить управление совершенно новыми видами финансовых инструментов и новыми способами взаимодействия с ними.

Заключение

Концепция децентрализованных финансов направлена на построение финансовых услуг, отделенных от традиционных финансовых и политических систем. Это позволит создать более открытую финансовую систему и возможно избавить от цензуры и дискриминации по всему мире.

Данная идея выглядит вполне заманчивой, но не во всех случаях децентрализация может быть полезной. Поиск вариантов использования, наиболее подходящих к характеристикам блокчейнов, имеет решающее значение для создания полезного стека открытых финансовых продуктов.

В случае успеха DeFi заберет власть у больших централизованных организаций и передаст её в руки сообщества свободного программного обеспечения. Однако, на данный момент точно неизвестно, на сколько данная финансовая система будет эффективна и тем более, когда децентрализованные финансы станут мейнстримом и будут приняты общественностью.