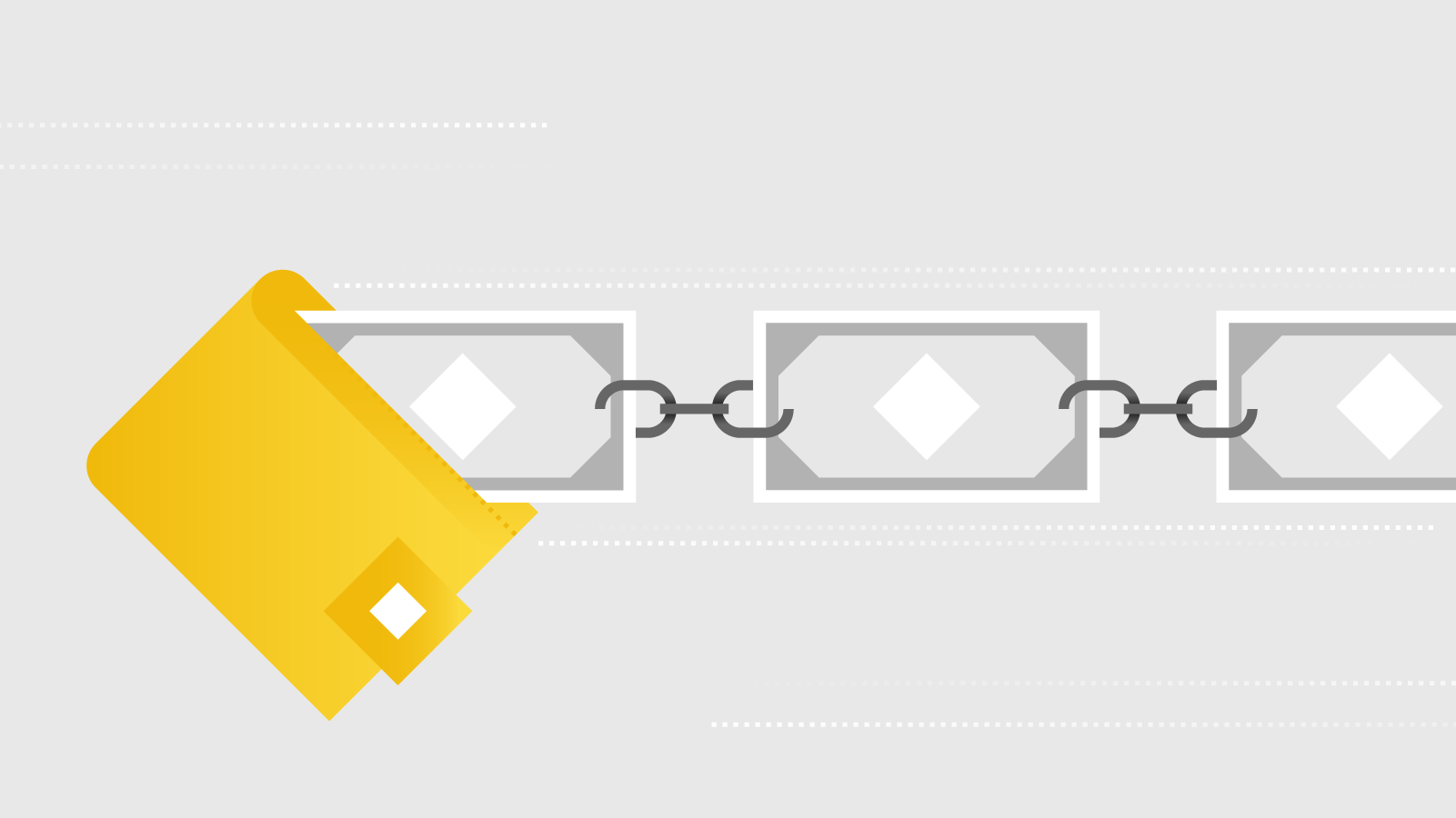

Что такое блокчейн?

Блокчейн - это особый вид базы данных, в которую можно только лишь вносить информацию (а не удалять или изменять). В соответствии со своим названием, структура блокчейна напоминает цепочку из блоков, которые мы можем назвать определенными порциями информации, добавляемые в базу данных. Каждый блок содержит указатель на предыдущий блок и некоторую комбинацию информации о транзакциях, временных меток и других метаданных для подтверждения его достоверности.

Поскольку они взаимосвязаны, записи не могут быть отредактированы, удалены или изменены каким-либо образом, так как это сделает недействительными все предыдущие блоки.

Как работает блокчейн?

На этапе знакомства с данной технологией, блокчейн может показаться вам не совсем подходящим для использования, вам также может быть интересно, какие преимущества предлагает такая система по сравнению с традиционной. Когда блокчейны разрастаются, сеть позволяет пользователям координировать свои действия вокруг общего источника истинны, при отсутствии необходимого доверия друг к другу. В распределенной сети нет ни одной стороны, способной взломать хорошо построенный блокчейн.

Чтобы самостоятельно проверить состояние блокчейн-сети, пользователь должен загрузить специальное программное обеспечение. После установки и запуска на компьютере пользователя данная программа взаимодействует с экземплярами сети на других компьютерах с целью загрузки/скачивания информации (такой как транзакции или блоки). Новый пользователь загружает блок, чтобы убедится в том, что он был создан в рамках правил системы, и передает эту информацию другим пирам.

Таким образом у нас получается экосистема, которая может состоять из сотен, тысяч или десятков тысяч объектов, которые запускают и синхронизируются с одной и той же копией базы данных (мы называем такие объекты узлы или ноды). Это делает сеть крайне избыточной и круглосуточно доступной.

Как информация добавляется в блокчейн?

Целостность блокчейна подрывается в последствии записи ложной информация о финансовых операциях. В то же время, в распределенной системе отсутствует администратор или руководитель, который мог бы поддерживать работу регистра. Кто тогда может дать нам гарантию того, что все участники будут действовать честно?

Сатоши предложил систему, под названием Proof-of-Work, которая предоставила возможность добавлять блоки в сеть. Чтобы подтвердить блок, субъект данного процесса должен пожертвовать своей вычислительной мощностью, чтобы подобрать правильное решение, установленное протоколом (такая работа включает в себя многократное хеширование данных для получения числа, ниже определенного числового значения).

Мы называем этот процесс майнингом. Если майнер правильно угадывает решение блока, ему предоставляется возможность его сформировать (из неподтвержденных транзакций, отправленных ему от пиров), и таким образом расширит цепочку. В результате своей работы, он получает вознаграждение, выраженное в нативном токене данного блокчейна.

Хеширование с помощью односторонней функции означает, что основываясь на выходе практически невозможно угадать вход. Но учитывая вход, представляется возможность тривиально проверить данные на выходе. Таким образом, любой участник может проверить, что майнер сформировал «правильный» блок, и отклонил все недействительные. В случае, когда майнера обнаружили в попытке добавить недопустимый блок, он не получает вознаграждение за это и впустую расходует свои ресурсы.

В криптовалютных системах, зависимость от криптографии с публичным/приватным ключом также гарантирует, что взаимодействующие стороны не смогут потратить средства, которыми они не владеют. Монеты привязаны к приватным ключам (известным только владельцу), и только действительная подпись, подтверждающая их перемещение, позволяет осуществить транзакцию.

Proof-of-Work, это самая проверенная схема достижения консенсуса среди пользователей, но она не является единственной в своем роде. Альтернативы, такие как Proof-of-Stake, все лучше изучаются, но данному алгоритму еще необходимо подобрать наиболее подходящий вариант реализации в правильной для него форме (некоторые разновидности гибридных механизмов консенсуса на данный момент уже функционируют).

Кто изобрел технологию блокчейн?

Основная идея неизменной цепочки данных зарождалась в начале 90-х годов. Исследователи У. Скотт Сторнетта и Стюарт Хабер опубликовали статью под названием «How to Time-Stamp a Digital Document», в которой рассматривались эффективные методы создания временных отметок для файлов, которые не могут быть отредактированы или подделаны.

Однако подход Сторнетты и Хабера был несовершенен и все еще не исключал наличия доверия к третьим лицам. Технология блокчейн включает в себя инновации множества разных ученых в области компьютерных технологий, но только Сатоши Накамото считается создателем системы, которую мы описали в предыдущих параграфах.

Что блокчейны позволяют реализовывать?

Криптовалюта была лишь верхушкой айсберга. Многие увидели потенциал децентрализованных вычислений после появления децентрализованных денег. Подобно тому, как блокчейны первого поколения, такие как биткоин, представили общую базу данных с транзакциями, второе поколение сетей, подобные Ethereum, привели к появлению смарт-контрактов. Смарт-контракты – это программы, которые устанавливаются поверх блокчейнов, чтобы управлять обусловленным перемещением токенов.

Благодаря использованию смарт-контрактов исключается наличие центрального сервера не исполняющего код, это означает, что единая точка отказа на уровне хостинга не является значимой. Пользователи могут проводить аудит программного обеспечения (учитывая его общедоступность), а разработчики разрабатывать контракты таким образом, чтобы их работу нельзя было отключить или изменить в одностороннем порядке.

Приложение на блокчейне могут включать в себя:

-

Криптовалюты: Цифровые валюты являются чрезвычайно мощным инструментов передачи средств при отсутствии единой точки отказа и всяческих посредников. Пользователи могут отправлять и получать средства по всему миру за короткий промежуток времени (и зачастую за счет небольшого количества операционных затрат), которое потребуется для банковского перевода. Монеты не могут быть конфискованы и транзакции нельзя отменить или заморозить.

-

Обусловленные платежи: Между Алисой и Бобом отсутствует доверие друг к другу, но они хотят сделать ставку на исход спортивного матча. Они отправляют 10 ETH на смарт-контракт, который передает данные через оракула. В конце матча контракт определяет, какая команда выиграла, и выплачивает победителю выигрыш за ставку, в размере 20 ETH.

-

Распределенные данные: Блокчейны сталкиваются с некоторыми проблемами в отношении масштабируемости, но они могут взаимодействовать с распределенными хранилищами для менеджмента файлов. Управлять доступом можно с помощью смарт-контракта, в то время как данные хранятся в оф-чейн контейнере.

-

Ценные бумаги: Поскольку активы представляют определенную степень риска контрагента, security-токены основанные на блокчейне считаются крайне необходимым нововведением для финансового сектора. Они предполагают собой новый вид ликвидности и портируемость в области безопасности, а также позволяют токенизировать активы, собственность или капитал.

Для чего используется блокчейн?

Технология блокчейн предполагает широкий спектр вариантов использования. Ниже вы можете ознакомится с дополнительной информацией об этом в рамках Binance Academy:

-

Цепочки поставок: Эффективные цепочки поставок лежат в основе многих успешных предприятий, их основная задача заключается в обработке и доставке товаров от поставщика к потребителю. Тем не менее, координация деятельности нескольких заинтересованных сторон в данной отрасли по традиционной схеме оказалась очень трудоемкой. Благодаря использованию технологии блокчейн, интероперабельная экосистема, которая вращается вокруг неизменной базы данных, может привести к появлению новых уровней прозрачности для множества отраслей.

-

Гейминг: Геймеры находятся во власти компаний, которые контролируют игровые сервера. В отношении конечного пользователя данной индустрии отсутствует реальное право собственности, а внутриигровые активы существуют исключительно в пределах предположений. Выбирав подход основанный на блокчейне, пользователям предоставляется возможность фактически владеть своими активами (в форме взаимозаменяемых/не взаимозаменямых токенов, NFT) а также передавать их между играми или рынками.

-

Здравоохранение: Прозрачность и безопасность технологии блокчейн делают ее идеальной платформой для хранения медицинских карт. Медицинские учреждения (состоящий из больниц, клиник и других поставщиков медицинских услуг) невероятно фрагментированы, а зависимость от централизованных серверов оставляет конфиденциальную информацию пациентов в уязвимом месте. Благодаря криптографической защите медицинских записей на блокчейне, пациенты сохраняют свою конфиденциальность, в то же время имея возможность легко обмениваться информацией с любым учреждением, которое подключается к глобальной базе данных.

-

Римесса (международные денежные переводы): Отправка денег на международном уровне является проблемой традиционных банковских систем. Тарифы и сроки проведения операций делают их очень дорогостоящими и ненадежными для срочного перевода средств, по причине сложной сети посредников. Криптовалюты и блокчейны устраняют экосистему посредников, и в настоящее время целый ряд проектов использует данную технологию для обеспечения дешевой и быстрой передачи денег.

-

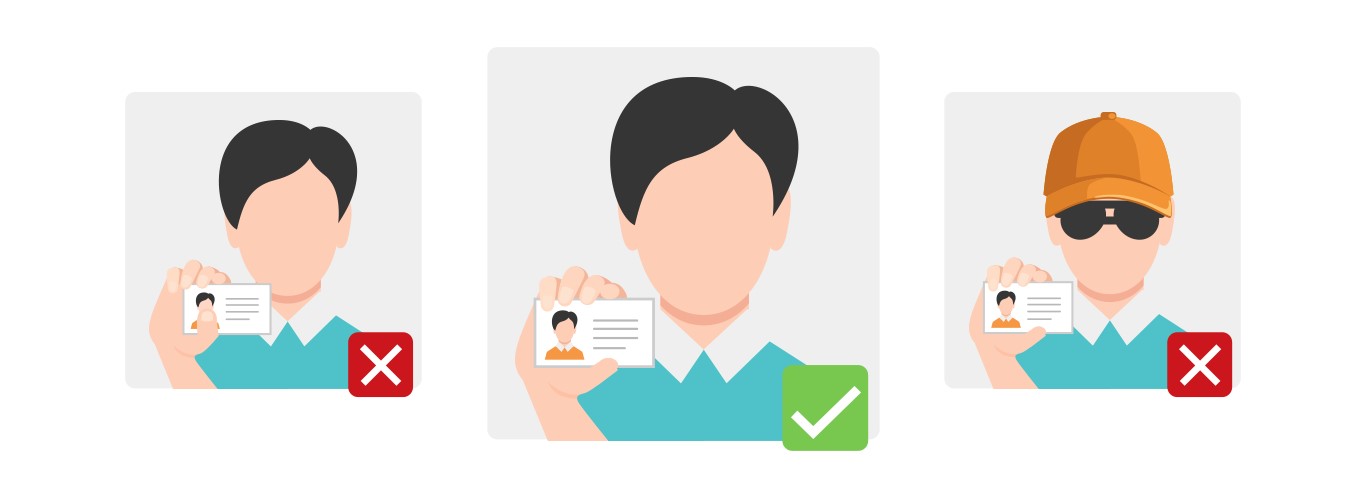

Цифровая идентификация: Современный мир крайне нуждается в решениях для идентификации личности в эпоху цифровых технологий. Физические лица подвержены подделке, в то время как традиционные меры защиты недоступны для множества рядовых пользователей. Так называемая личностная суверенная идентификация (от англ. self-sovereign identity) будет закреплена в регистре блокчейн-сети и привязана к его владельцу, который может выборочно раскрывать информацию о себе третьим сторонам, при этом сохраняя свою конфиденциальность.

-

Интернет вещей: Некоторые полагают, что растущий список подключенных к интернету физических устройств может быть в значительной степени расширен технологией блокчейн, как в домашних, так и в промышленных условиях. Предполагается, что для распространения такого вида устройств потребуется новая экономическая модель платежей, под названием «machine-to-machine» (сокр. M2M), которая в свою очередь нуждается в системе с высокой пропускной способностью для осуществления микроплатежей.

-

Государственное управление: Учитывая, что распределенные сети реализуют свою собственную форму регулирования, неудивительно, что они могут найти себе применение в процессах дезинтермедиации на местном, национальном или даже международном уровнях. Государственное управление на блокчейне обеспечивает привлечение всех участников в процессе принятия решений, и предоставляет прозрачный обзор политической деятельности.

-

Благотворительность: Благотворительным организациям часто препятствуют ограничения на получение средств. «Крипто-филантропия» связана с использованием технологии блокчейн, чтобы обойти данный недостаток. Опираясь на свойства данной технологии, для благотворительных организаций открываются большие возможности стремительного развития данной области благодаря прозрачности всех операций, участию благодетелей при отсутствии территориальных ограничений и сокращению операционных расходов.

Заключение

Публичные блокчейны являются общедоступными, это означает, что вам не нужно проходить процедуру аутентификации, прежде чем стать участником данной экосистемы. Для того, чтобы начать пользоваться биткоином или другими криптовалютами пользователю требуется только лишь загрузить программное обеспечение с открытым исходным кодом, чтобы присоединиться к сети.

Учитывая доступность регистров, запретить принимать участие со стороны третьих лиц невероятно сложно, и практически невозможно насильно прекратить работу всей сети. Такая доступность делает данную систему привлекательным инструментом для множества пользователей.

В то время, как самые популярные приложения связаны с финансовыми операциями, есть множество других секторов, где их применение может быть крайне продуктивным и полезным в будущем.