Введение

Стейкинг можно рассматривать как менее ресурсоемкую альтернативу майнингу. Он заключается в хранении средств на криптовалютном кошельке для поддержки безопасности и активности сети. Проще говоря, стейкинг — это блокировка криптовалюты для получения вознаграждения.

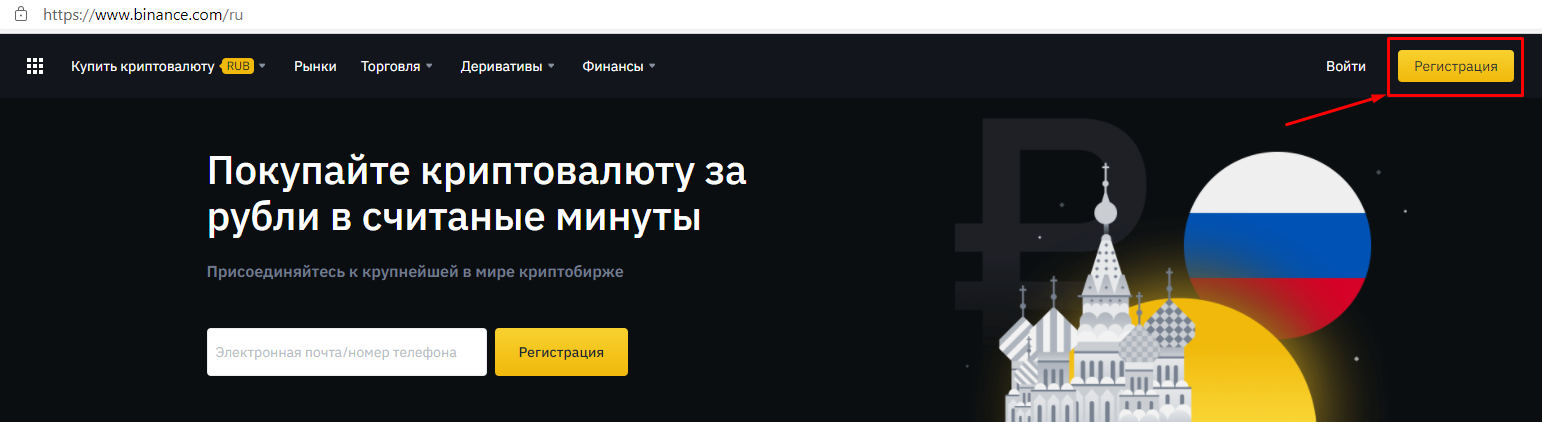

В большинстве случаев для добавления монет в стейкинг достаточно криптовалютного кошелька, такого как Trust Wallet. Многие биржи предлагают пользователям услуги стейкинга. Получить вознаграждение на Binance Staking очень просто — все, что нужно делать, это хранить монеты на бирже. Рассмотрим подробнее.

Чтобы лучше понять, что такое стейкинг, нужно разобраться, как работает Proof of Stake (доказательство владения). PoS — это механизм консенсуса, который повышает энергоэффективность блокчейнов, сохраняя высокую степень децентрализации (по крайней мере, в теории). Давайте изучим, что такое PoS и как работает стейкинг.

Что такое Proof of Stake (PoS)?

Если вы знаете, как работает биткоин, вероятно, вы знакомы с Proof of Work (доказательством выполнения работы). Это механизм, который позволяет собирать транзакции в блоки и соединять их вместе для создания блокчейна. Майнеры соревнуются в решении сложной математической головоломки за право добавить следующий блок в блокчейн.

Proof of Work оказался надежным децентрализованным механизмом консенсуса. Его основной недостаток — большое количество произвольных вычислений. Головоломка, которую пытаются решить майнеры, не служит никакой другой цели, кроме обеспечения безопасности сети. Некоторые считают, что это оправдывает избыток вычислений. Но существуют ли другие способы достижения консенсуса децентрализованным образом без высоких вычислительных затрат?

Ответ: да, это Proof of Stake. Его основная идея в том, что участники могут блокировать свою долю монет (в стейкинге), и через определенные промежутки времени протокол случайным образом предоставляет одному из них право на валидацию следующего блока. При этом вероятность выбора валидатора пропорциональна количеству монет: чем больше монет заблокировано в системе, тем выше шансы получить такую возможность.

Таким образом, выбор участника, который получит право создать блок, зависит не от скорости решения задачи, как в случае с Proof of Work, а от количества монет в стейкинге.

Производство блоков с помощью стейкинга обеспечивает более высокую степень масштабируемости блокчейнов. Это одна из причин, по которой Ethereum планирует переход с PoW на PoS в рамках технических обновлений, называемых ETH 2.0.

Кто создал Proof of Stake?

Впервые о Proof of Stake заговорили Санни Кинг и Скотт Надаль в статье 2012 года о пиринговой платежной системе Peercoin. Они описали механизм как «пиринговую конструкцию криптовалюты, основанную на биткоине Сатоши Накамото».

Сеть Peercoin была запущена с гибридным механизмом консенсуса PoW/PoS, где PoW использовался в основном для создания первичного предложения монет. Однако такое решение не смогло обеспечить долгосрочную устойчивость сети, поэтому его ценность постепенно уменьшалась. В итоге большая часть безопасности Peercoin основывалась на PoS.

Что такое Delegated Proof of Stake (DPoS)?

В 2014 году Дэниел Лаример разработал альтернативную версию PoS — Delegated Proof of Stake (DPoS). Изначально алгоритм DPoS использовался только как часть блокчейна BitShares, но вскоре был позаимствован и другими сетями. К ним относятся Steem и EOS, которые также были созданы Дэниелом.

DPoS позволяет пользователям обменивать монеты с их баланса на право голоса, где количество голосов пропорционально числу удерживаемых монет. Они необходимы для выбора ряда делегатов, которые управляют блокчейном от имени своих избирателей, обеспечивая своими действиями безопасность сети и ее консенсус. Как правило, вознаграждения от стейкинга распределяются между избранными делегатами, которые затем начисляют часть вознаграждений своим избирателям в соответствии с их индивидуальными взносами.

Модель DPoS может повысить производительность сети путем достижения консенсуса с меньшим количеством нод, осуществляющих валидацию. Однако механизм также приводит к более низкой степени децентрализации, так как сеть опирается на небольшую выбранную группу валидирующих нод. Такие ноды обрабатывают операции, осуществляют управление блокчейном, участвуют в процессах достижения консенсуса и определяют ключевые параметры управления.

Выражаясь простым языком, DPoS предоставляет пользователям возможность сигнализировать о своем влиянии через других участников сети.

Как работает стейкинг?

Блокчейны с Proof of Work используют майнинг для добавления новых блоков в блокчейн, а сети с Proof of Stake производят и проверяют новые блоки с помощью стейкинга. В стейкинге участвуют валидаторы, которые блокируют свои монеты, чтобы получить возможность быть выбранными для создания блока. Обычно участники, которые добавляют в стейкинг большие суммы, имеют больше шансов быть выбранными в качестве валидатора следующего блока.

Стейкинг позволяет создавать блоки без использования специализированного оборудования для майнинга, такого как интегральные схемы специального назначения (ASIC). В то время как майнинг требует значительных инвестиций в оборудование, стейкинг подразумевает прямые инвестиции в саму криптовалюту. Таким образом, вместо того, чтобы конкурировать за следующий блок с помощью вычислительной мощности, валидаторы PoS выбираются на основе количества заблокированных монет. Монеты, размещенные в стейкинге, или доля — это то, что стимулирует валидаторов поддерживать безопасность сети. Если они не будут соблюдать данное условие, их средства могут оказаться под угрозой.

В большинстве цепочек работающих на Proof of Stake присутствует своя валюта для стейкинга, а некоторые сети используют систему с двумя токенами для разделения выплат в качестве вознаграждения.

На практике стейкинг — это просто хранение средств на специальном кошельке, которое позволяет любому пользователю выполнять различные сетевые функции в обмен на вознаграждение. Механизм также предлагает возможность добавления средств в стейкинг-пул, о котором мы расскажем чуть позже.

Как рассчитывается награда за стейкинг?

На этот вопрос вы не получите четкий и короткий ответ, по той простой причине, что каждая блокчейн-сеть может использовать свой способ расчета вознаграждений за стейкинг.

Некоторые из блокчейнов корректируют награду от блока к блоку, принимая во внимание множество различных факторов. Это может включать в себя:

- Количество монет валидатора

- Продолжительность нахождения доли валидатора в стейкинге

- Общее количество монет выделенных на стейкинг

- Уровень инфляции

- Другие факторы

В некоторых сетях вознаграждение за стейкинг определяется в виде фиксированного процента. Эти вознаграждения распределяются между валидаторами как компенсация за инфляцию. Инфляция побуждает пользователей тратить монеты вместо того, чтобы размещать их в стейкинге, что может увеличить спрос на них в качестве криптовалюты. На основе такой финансовой модели валидаторы могут точно рассчитать, какое вознаграждение за стейкинг им следует ожидать.

Предсказуемый график вознаграждений может оказаться более привлекательным для некоторых пользователей, чем вероятность получения вознаграждения за блок. А поскольку такая информация является еще и общедоступной, это становится одним из основных стимулов для присоединения большого количества пользователей.

Что такое стейкинг-пул?

Стейкинг-пул — это группа владельцев монет, которые объединяют ресурсы, чтобы с большей вероятностью получить право на валидацию блоков и вознаграждение. Они объединяют свои ресурсы и делят вознаграждение пропорционально взносам в пул.

Создание и поддержание стейкинг-пула зачастую требует много времени и опыта. Они, как правило, наиболее эффективны в сетях, где барьер входа (технический или финансовый) относительно высок. За счет этого, многие провайдеры пулов взимают небольшую комиссию от вознаграждений за стейкинг, которые распределяются среди участников.

Помимо этого, пулы могут обеспечить участникам дополнительную гибкость. Это связано с тем, что доля монет должна быть заблокирована на определенный период и обычно имеет время вывода или выхода из стейкинга, установленное протоколом. Кроме того, для добавления монет в стейкинг требуется существенный минимальный баланс, что является своеобразной мерой безопасности.

Большинство стейкинг-пулов предлагают своим пользователям минимальную сумму для входа и не ограничивают вывод средств. Таким образом, присоединение к стейкинг-пулу вместо соло-стейкинга может быть идеальным вариантом для новичков.

Что такое холодный стейкинг?

Холодный стейкинг — это процесс стейкинга с использованием кошелька, не подключенного к интернету. Для этого подойдет как аппаратный кошелек, так и программный кошелек без интернета.

Сети, поддерживающие холодный стейкинг, предоставляют своим пользователям возможность получения наград, в условиях холдинга средств в автономном режиме. Стоит отметить, что если стейкхолдер выведет свои монеты из кошелька, он перестанет получать награды.

Холодный стейкинг особенно полезен для крупных стейкхолдеров, которые хотят обеспечить максимальную защиту своих средств, а также поддержать работу сети.

Как пользоваться стейкингом на Binance

В некотором смысле хранение монет на Binance можно сравнить с добавлением их в стейкинг-пул. Однако за это не взимаются комиссии, и вы можете пользоваться всеми преимуществами, которые приносит хранение монет на Binance!

Единственное, что вам нужно сделать, это холдить ваши PoS монеты на Binance, в то время, как все технические требования будут выполнены за вас. Награды за стейкинг в основном распределяются в начале каждого месяца.

Вы можете проверить ранее распределенные награды выбранного вами актива во вкладке «Историческая доходность» или «Historical Yield» на странице стейкинга каждого проекта.

Резюме

Proof of Stake и стейкинг открывают больше возможностей для тех, кто хочет участвовать в консенсусе и управлении блокчейнами. Кроме того, это легкий способ получать пассивный доход, просто храня монеты. Поскольку добавлять монеты в стейкинг становится проще, исчезают барьеры для входа в экосистему блокчейна.

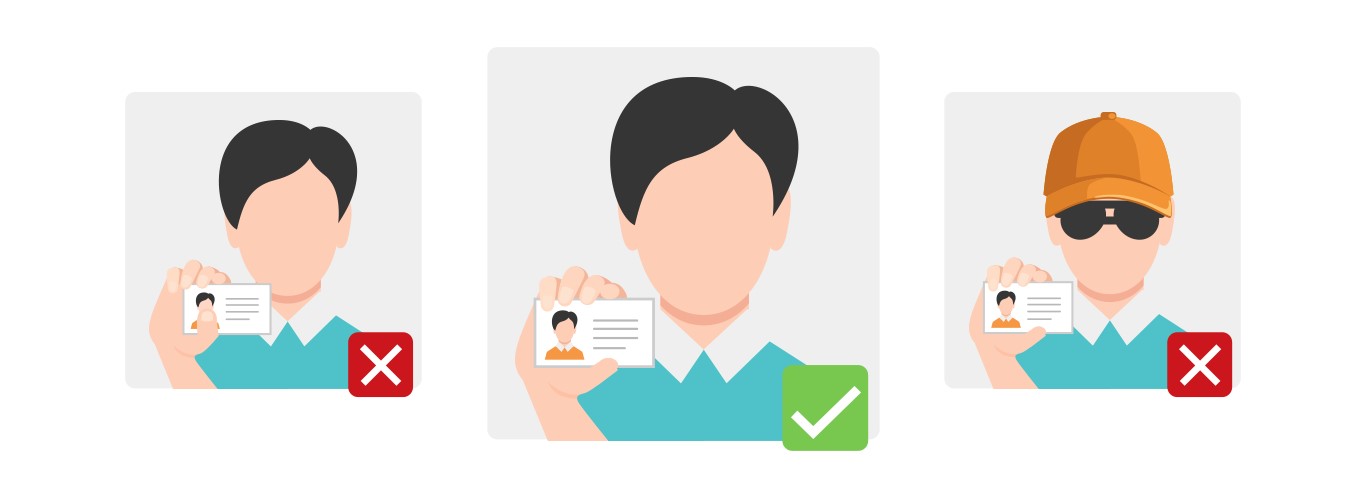

Однако стоит отметить, что стейкинг связан с определенными рисками. Блокировка средств в смарт-контракте подвержена ошибкам, поэтому всегда проводите собственное исследование и используйте только надежные кошельки, такие как Trust Wallet.