Введение

There are countless ways to generate profits in the financial markets. Some traders will use technical analysis, while others will invest in companies and projects using fundamental analysis. As such, you, as a trader or investor, also have many different options to create a profitable trading strategy.

However, what if the market is going through a prolonged bear market, where prices are continually declining? What can traders do then to maintain a source of income from trading?

Shorting the market allows traders to profit off price declines. Entering a short position can also be an excellent way to manage risk and hedge existing holdings against price risk.

In this article, we’ll explain what shorting means, how to short Bitcoin on Binance, and learn about the risks of shorting.

What is shorting?

Shorting (or short selling) means selling an asset in the hopes of rebuying it later at a lower price. A trader who enters a short position expects the asset’s price to decrease, meaning that they are “bearish” on that asset. So instead of just holding and waiting, some traders adopt the short selling strategy as a way to profit off an asset’s price decline. This is why short selling can also be a good way to preserve capital during price declines.

Shorting is very common in essentially any financial market, including the stock market, commodities, Forex, and cryptocurrency. As such, short sales are widely used by retail investors and professional trading firms, such as hedge funds. Short selling stocks or cryptocurrencies is a common strategy for both short-term and long-term traders.

The opposite of a short position is a long position, where a trader buys an asset in the hopes of selling it later at a higher price.

How does shorting work?

Typically, shorting will happen with borrowed funds, though not in all cases. If you’re selling some of your spot Bitcoin position at $10,000 with the plans to rebuy it later at $8,000, that’s effectively a short position. However, shorting is also commonly done with borrowed funds. This is why shorting is closely related to margin trading, futures contracts, and other derivatives products. Let’s see how it works.

Let’s say you’re bearish on a financial instrument, such as a stock or a cryptocurrency. You put up the required collateral, borrow a specific amount of that asset, and immediately sell it. Now, you’ve got an open short position. If the market fulfills your expectations and goes lower, you buy back the same amount that you’ve borrowed and pay it back to the lender (with interest). Your profit is the difference between where you initially sold and where you rebought.

Now let’s look at a more concrete example. You borrow 1 BTC and sell it at $8,000. Now you’ve got a 1 BTC short position that you’re paying interest for. The market price of Bitcoin goes down to $6,000. You buy 1 BTC and return that 1 BTC to the lender (usually, the exchange). Your profit, in this case, would be $2,000 (minus the interest payments and fees).

The risks of shorting

There are a number of risks to consider when it comes to entering a short position. One of them is that, in theory, the potential loss on a short position is infinite. Countless professional traders have gone bankrupt over the years while being short a stock. If the stock price increases thanks to some unexpected news, the spike up can quickly “trap” short sellers.

Naturally, if you’ve been reading Binance Academy, you know that having an invalidation point and setting a stop-loss is crucial for every trade. However, let’s still talk about this concept because it may be helpful to understand.

How much is your potential loss when going long on the spot market? Well, it’s the size of your position. If you’ve got 1 BTC that you’ve bought at $10,000, the absolute worst case that can happen is that the Bitcoin price falls to 0, and you’ve lost your initial investment.

However, what if you’re shorting Bitcoin on a margin trading platform? In this case, your potential downside is infinite. Why? Because the potential upside for price is infinite. In contrast, the price can’t go lower than 0 when you’re long.

So, if you’re shorting a borrowed asset and the price increases and keeps going up, you’ll keep incurring losses. With that said, this is more of a theoretical risk than a practical one, as most platforms will liquidate your position before you’d arrive at a negative balance. Even so, it’s worth keeping in mind, as it shows you why it’s always paramount to keep an eye on margin requirements, and to always use a stop-loss.

Other than that, standard risk management principles apply to shorting. Protect your downside, use a stop-loss, think about position sizing, and make sure you understand the risks of liquidation.

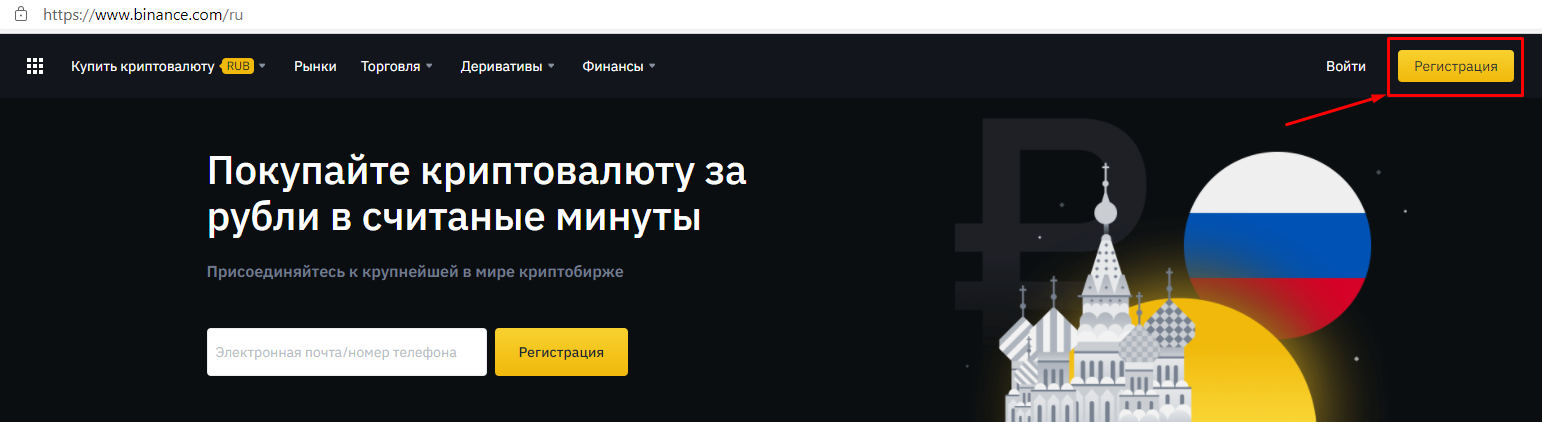

How to short Bitcoin and cryptocurrencies on Binance

So, let’s say you’d like to short Bitcoin or another cryptocurrency on Binance. You could do so in a few different ways.

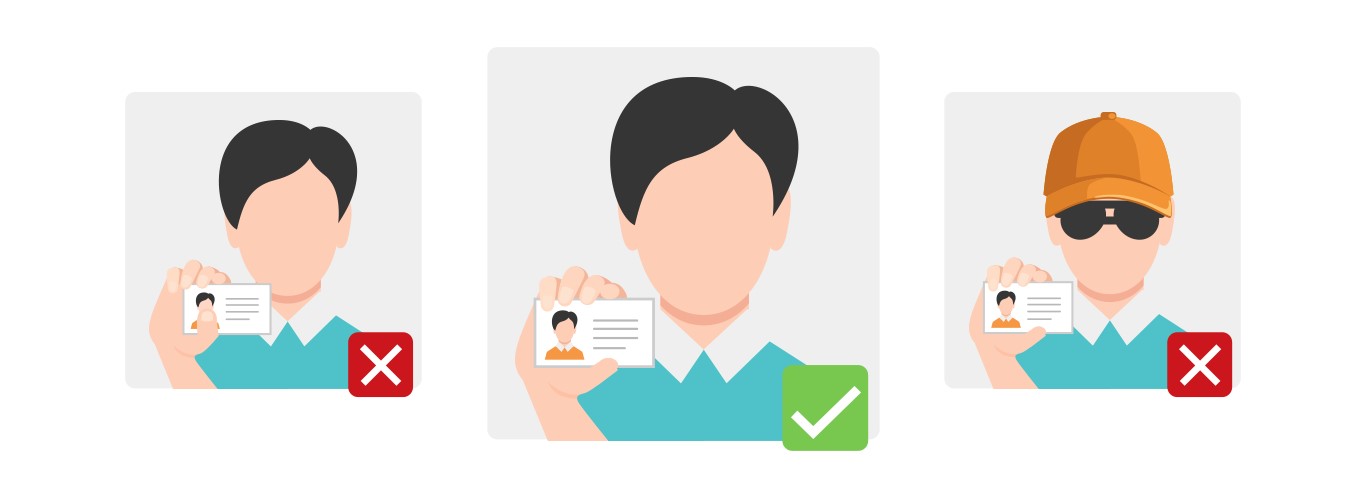

How to short Bitcoin on Binance Margin Trading

Firstly, you could short Bitcoin and altcoins on the Binance Margin Trading platform:

- Open a margin account, if you haven’t already.

- Go to the Binance Margin Trading platform.

- Go to your preferred market pair, such as BTC/USDT or BTC/BUSD.

- Follow the instructions in this video.

How to short Bitcoin on Binance Futures

You could also short Bitcoin and altcoins on Binance Futures:

- Go to Binance Futures.

- Select between perpetual or quarterly futures contracts.

- Make sure you understand how the platform works.

- Follow the instructions in this video.

If you’d like to try out paper trading first, you can go to the Binance Futures testnet. This way, you can test how shorting works without risking real funds.

How to short Bitcoin on Binance Options

Thirdly, you could also try the Binance Options platform that’s available for iOS and Android. Options contracts can also be an excellent way to enter a short position. If you expect the price of Bitcoin to go down, you could buy put options. These give you the right, but not the obligation, to sell Bitcoin at a certain price. Here’s how to do it:

- Download the Binance mobile app. The options platform is available for both iOS and Android.

- If you haven’t already, activate your Binance Futures account. This is needed to access the options platform on Binance.

- Follow the instructions on this page.

It’s worth noting that this is one of the most difficult and high-risk ways to short Bitcoin and cryptocurrencies.

Closing thoughts

Now we know what entering a short position is, and why traders would want to do so. As we’ve seen, traders who are in a short position usually have a bearish outlook on the market. Short selling allows traders to profit off price declines, and they can do it without necessarily holding the asset.