Эфириум (от англ. Ethereum) – это децентрализованная вычислительная платформа. Можете считать его своего рода ноутбуком или ПК, но с оговоркой на то, что данная система не может функционировать лишь на одном устройстве. Эфириум одновременно работает на тысячах вычислительных машин по всему миру, то есть у него нет одного-единственного владельца.

Эфириум, как и биткоин, и другие криптовалюты, служит для перевода цифровых денег. Однако возможности этой сети гораздо шире – вы можете использовать свой собственный код и взаимодействовать с приложениями, созданными другими пользователями. Благодаря своей гибкости эфириум позволяет запускать множество программ различной сложности.

Простыми словами, суть в том, что разработчики могут создавать и запускать код в распределенной сети вместо централизованного сервера. А значит, теоретически работу таких приложений невозможно просто так остановить или подвергнуть цензуре.

В чем разница между эфириумом и эфиром?

Это может показаться нелогичным, но обменные единицы, используемые в Ethereum, называются не Ethereum и не Эфириумы. Ethereum – это сам протокол, а валюта, с которой он работает, называется эфир (или ETH).

Что делает эфириум ценным?

Ранее мы уже говорили, что Ethereum позволяет запускать код в распределенной системе. Это не позволяет посторонним лицам вносить изменения в программу. Код добавляется в базу данных Ethereum (то есть в блокчейн), и его можно настроить так, чтобы закрыть возможность дальнейшего редактирования. Кроме того, база данных видна всем пользователям, благодаря чему они могут проверять код, прежде чем с ним работать.

Это означает, что любой пользователь в любой точке мира может запустить приложение, которое невозможно перевести в автономный режим. Кроме того, поскольку собственная единица сети эфир имеет ценность, эти приложения могут устанавливать условия перевода криптовалюты. Программы для создания приложений называются смарт-контрактами, и нередко их можно настроить на самостоятельную работу без участия человека.

Очевидно, что такая идея «программируемых денег» не могла не покорить множество пользователей, разработчиков и компаний по всему миру.

Что такое блокчейн?

В основе Ethereum лежит блокчейн. Это база данных, в которой хранится информация, используемая протоколом. Если вы знакомы с нашей статьей Что такое биткоин?, у вас есть базовое представление о том, как работает блокчейн. Блокчейны Ethereum и Bitcoin схожи, хотя информация и способы ее хранения различны.

Блокчейн Ethereum можно представить как книгу, в которую вы добавляете новые страницы. Каждая из них – это блок, содержащий информацию о транзакциях. Когда мы добавляем новую страницу, вверху необходимо вставить специальное значение. Оно служит показателем того, что страницы добавляются последовательно, а не в случайном порядке.

Это значение – своего рода номер страницы, который определяется предыдущим номером. Посмотрев на новую страницу, мы сразу поймем, что она следует за предыдущей. Для этого используется процесс под названием хеширование.

Во время хеширования берется часть данных (в нашем случае информация со страницы) и создается уникальный идентификатор (хеш). Вероятность того, что разные части данных дадут один и тот же хеш, крайне мала. Кроме того, это односторонний процесс: создать хеш на основе информации очень просто, но получить информацию из существующего хеша практически невозможно. В следующей главе мы разберем, почему это важно для майнинга.

На основе вышеупомянутых компонентов, у нас складывается механизм для связывания наших страниц в правильном порядке. Любая попытка изменить установленный порядок или удалить одну страницу будет означать, что вся книга была подделана, по причине вмешательства в каждую из предыдущих страниц.

Эфириум и биткоин – в чем их отличия?

Биткоин использует технологию блокчейн и финансовые стимулы для создания глобальной платежной системы. Он представил несколько нововведений для координации пользователей по всему миру без необходимости в централизованной системе. За счет того, что каждый пользователь запускает программу на своем компьютере, у него появляется возможность работать в децентрализованной среде, где нет риска быть обманутым другими участниками процесса.

Биткоин часто называют блокчейном первого поколения. Он не задумывался как слишком сложная система, и это стало его преимуществом в вопросах безопасности. Отсутствие у биткоина гибкости – это сознательное решение для гарантии большей надежности. Язык смарт-контрактов биткоина чрезвычайно ограничен и плохо подходит для приложений, не связанных с транзакциями.

Второе же поколение блокчейнов, напротив, способно на большее. Помимо осуществления финансовых транзакций, эти платформы обеспечивают бо́льшую степень программируемости. Ethereum дает разработчикам гораздо больше возможностей для экспериментов со своим кодом и создания того, что мы называем децентрализованными приложениями (DApps).

Эфириум был пионером блокчейнов второго поколения и сегодня по-прежнему является самым выдающимся представителем данного сегмента. У эфириума много общего с биткоином, и он может выполнять большинство аналогичных функций. Однако по сути они очень отличаются, причем у каждого есть свои преимущества перед другим.

Как работает эфириум?

Ethereum можно назвать стейт-машиной. Это означает, что в любой момент вы можете сделать снимок файловой системы и посмотреть информацию о всех остатках на счетах и смарт-контрактах в их актуальном виде. Определенные действия приводят к обновлению состояния системы, а это означает, что все ноды также обновляют свои снимки, чтобы отразить изменение.

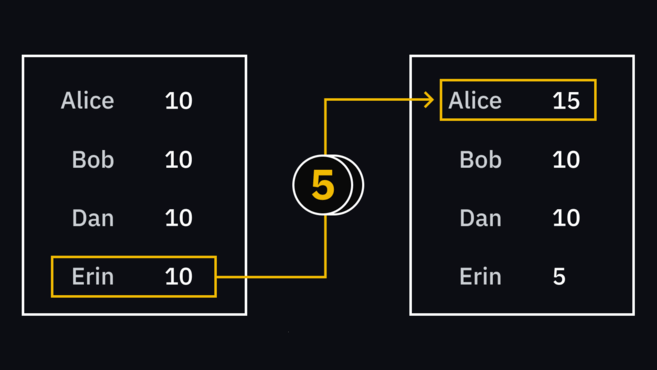

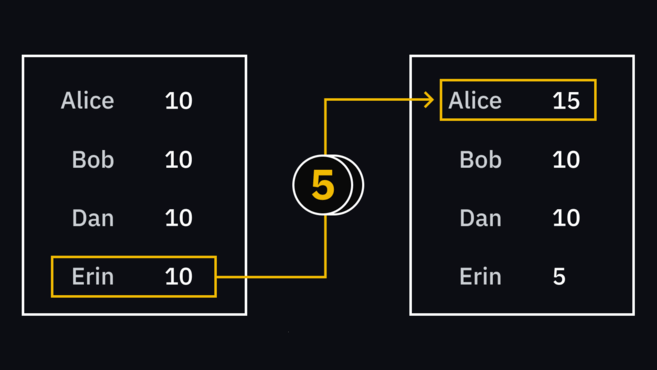

Переход эфириума в другое состояние

Переход эфириума в другое состояние

Смарт-контракты, выполняемые на Ethereum, инициируются транзакциями (от пользователей или других контрактов). Когда пользователь отправляет транзакцию на контракт, каждый нод в сети запускает код контракта и записывает вывод. Для этого используется виртуальная машина Ethereum (EVM), которая преобразует смарт-контракты в понятные компьютеру инструкции.

Для обновления состояния (пока что) используется специальный механизм под названием майнинг. Выполняется он с помощью алгоритма Proof of Work, очень похожего на алгоритм биткоина. Далее мы рассмотрим это подробнее.

Что такое смарт-контракт?

Смарт-контракт – это не более чем код. Сам код не связан ни с «умом», ни с контрактом в буквальном смысле слова.И всё же мы называем его «умным», в силу того, что он выполняется при определенных условиях. Контрактом же его можно считать, поскольку он обеспечивает выполнение соглашений между сторонами.

Ученому в области компьютерных технологий Нику Сабо ставят в особую заслугу идею, предложенную им еще в конце 1990-х годов. На примере торгового автомата с едой Ник объяснил концепцию смарт-контракта и заявил, что в качестве предшественника современного смарт-контракта можно рассматривать именно подобный автомат. В случае с торговым автоматом выполняется простой контракт. Пользователи вставляют в него свои монеты, а взамен автомат выдает продукт.

Смарт-контракт применяет схожую логику в цифровой среде. Вы можете указать в коде что-то простое. Например: ответь «Здравствуй, мир!», когда на этот контракт будет отправлено два эфира.

В эфириуме разработчик создает такой код, который потом может прочитать EVM. Затем программист публикует его, отправляя на специальный адрес, который регистрирует контракт. На этом этапе каждый может им воспользоваться, и контракт не может быть удален, если разработчик при его написании не обозначил данное условие.

Также у контракта есть адрес. Чтобы взаимодействовать с этим адресом, пользователям нужно отправить на него 2 ETH. Это активирует код контракта. Все компьютеры в сети запустят его, увидят, что платеж был произведен, и запишут его вывод («Здравствуй, мир!»).

Все вышесказанное – один из самых простых примеров применения эфириума. Бывают и более сложные приложения, которые устанавливают взаимосвязь сразу для множества контрактов. Такие коды уже существуют, и в дальнейшем их будет становиться только больше.

Кто создал эфириум?

В 2008 году неизвестный разработчик (или группа разработчиков) под псевдонимом Сатоши Накамото опубликовал whitepaper биткоина. Это навсегда изменило представление людей о цифровых деньгах. Несколько лет спустя молодой программист по имени Виталик Бутерин смог развить эту идею и придумал способ ее применения к любому типу приложений. В конечном итоге концепция была воплощена в Ethereum.

В 2013 году в своем блоге Бутерин создал пост под названием Ethereum: The Ultimate Smart Contract and Decentralized Application Platform. В нем он описал идею создания блокчейн-сети в соответствии с полнотой по Тьюрингу в виде децентрализованного компьютера, который при наличии времени и ресурсов мог бы запускать любое приложение.

В будущем типы приложений, которые можно запускать на блокчейне, будут ограничены только фантазией разработчиков. Ethereum стремится выяснить, имеет ли технология блокчейн потенциал для использования за пределами изначальных ограничений системы биткоина.

Как произошло распределение эфира?

Ethereum был запущен в 2015 году с первоначальным капиталом в 72 миллиона эфиров. Более 50 миллионов этих единиц были распределены в рамках публичного токенсейла под названием первичное предложение монет (ICO), где все желающие могли купить токены эфира в обмен на биткоины или фиатную валюту.

Что такое DAO и как появился эфириум классик (Ethereum Classic)?

С появлением Ethereum стали возможны совершенно новые способы открытого сотрудничества через интернет. Один из таких примеров – DAO (децентрализованные автономные организации), которые управляются кодом, схожим с компьютерной программой.

The DAO была одной из первых и самых амбициозных попыток создания подобной системы. Она должна была состоять из сложных смарт-контрактов, работающих поверх Ethereum, который выступал бы как автономный венчурный фонд. Токены DAO распределялись в рамках ICO и давали держателям токенов долю владения вместе с правом голоса.

Однако вскоре после его запуска злоумышленники воспользовались уязвимостью в открытом коде проекта и украли почти треть средств The DAO. Следует отметить, что в тот период в The DAO находилось 14% от общего предложения эфиров и такое событие по факту было очень разрушительным для все еще развивающейся сети эфириума.

После некоторых обсуждений цепь претерпела разделение (хардфорк) на две цепи. В новой цепи злонамеренные транзакции эффективно отменялись, а средства «разворачивались» и возвращались владельцу. Сегодня эта цепь известна как блокчейн Ethereum. Оригинальная же цепь, в которой сохранялась необратимость транзакций, теперь называется Ethereum Classic.

Атака на DAO послужила напоминанием о связанных с этой технологией рисках и о печальных последствиях, к которым может привести доверие крупных сумм автономному коду. Кроме того, это стало поучительным примером того, как принятие коллективных решений в открытой среде может создавать серьезные проблемы. Тем не менее, несмотря на уязвимости в системе безопасности, DAO прекрасно проиллюстрировали потенциал смарт-контрактов в обеспечении надежного не требующего доверия крупномасштабного сотрудничества через интернет.

Как появился эфир?

Как создаются новые эфиры?

Ранее мы уже говорили кратко о майнинге. Если вы знаете, что такое биткоин, то вам, скорее всего, известно, что майнинг является неотъемлемым элементом защиты и обновления блокчейна. В Ethereum действует тот же принцип: чтобы вознаградить пользователей, которые майнят (что обходится дорого), система награждает их эфиром.

Сколько всего эфиров?

По состоянию на июнь 2022 года общее количество единиц эфира в обороте составляло около 120 миллионов.

В отличие от биткоина, график эмиссии токенов Ethereum не был определен во время запуска платформы. Биткоин пытался сохранить свою ценность путем ограничения количества единиц биткоина и постепенного уменьшения количества выпускаемых монет. Ethereum же стремится обеспечить основу для децентрализованных приложений (DApps). А поскольку неясно, какой график эмиссии токенов подходит для этого лучше всего, вопрос остается открытым.

Как работает майнинг в эфириуме?

Майнинг – это важнейший фактор безопасности сети. Он гарантирует, что правильное обновление блокчейна и позволяет сети самостоятельно функционировать. В процессе майнинга множество нод (название придумано майнерами) выделяют вычислительные мощности для решения криптоголоволомок.

Эти ноды хешируют ряд пендинг-транзакций вместе с некоторыми другими данными. Чтобы блок считался валидным, хеш должен быть ниже определенного числового значения, установленного протоколом. Если работа по разгадке вычислительной задачи не увенчались успехом, ноды могут изменить некоторые данные и попытаться найти решение снова.

Поэтому, чтобы быть конкурентноспособными, майнеры должны как можно быстрее хешировать информацию – мощность измеряется в хешрейте. Чем больше хешрейт в сети, тем сложнее становится решать задачу. Только майнеры имеют право находить решение блока. Как только оно будет известно, всем остальным участникам уже легко будет проверить его валидность.

Разумеется, непрерывное хеширование на высоких скоростях обходится дорого. Чтобы мотивировать майнеров обеспечивать защиту сети, им предлагается вознаграждение, которое включает все комиссии за транзакции в блоке. Кроме того, майнеры получают только что сгенерированный эфир – 2 ETH на момент написания статьи.

Что такое газ в эфириуме?

Помните, мы упоминали контракт «Здравствуй, мир!»? Это была несложная программа с довольно небольшими вычислительными затратами. Но ведь вы не единственные, кто запускает ее на своем ПК. Вы также просите об этом всех в экосистеме Ethereum.

Это подводит нас к следующему вопросу: что происходит, когда тысячи людей запускают сложные контракты? Если кто-то настроит свой контракт на повторение одного и того же кода, каждая нода должна будет запускать его бесконечно. Это создаст огромную нагрузку, и система, вероятно, рухнет.

К счастью, для снижения этого риска в сети Ethereum ввели концепцию газа. Так же, как машина не может ехать без топлива, контракты не могут работать без газа. Для успешной работы контракта пользователи должны заплатить некоторое количество газа. Если его не хватит, контракт прекратит работу.

В сущности, это своеобразный механизм дополнительных комиссионных сборов по аналогии с обычными транзакциями: поскольку майнеры принимают решения на основе потенциальной прибыли за свою работу, они могут игнорировать транзакции с более низкой комиссией.

Обратите внимание: эфир и газ – это разные вещи. Средняя цена на газ колеблется и в значительной степени зависит от майнеров. Чтобы совершить транзакцию, вы платите за газ в ETH. Это похоже на комиссию биткоина: если сеть перегружена и большое количество пользователей пытается совершать транзакции, средняя цена на газ, скорее всего, вырастет. И наоборот: если активности не так много, цена опустится.

Несмотря на то, что цена на газ может меняться, для каждой операции требуется фиксированное минимальное количество газа, то есть сложные контракты потребуют гораздо больше газа, чем простая транзакция. Таким образом, газ выступает мерой вычислительной мощности. Это гарантирует, что система назначает пользователям справедливую плату за использование ресурсов Ethereum.

Обычно газ стоит небольшую долю эфира. Для ее обозначения используется меньшая единица (гвей). Один гвей соответствует одной миллиардной части эфира.

Проще говоря, вы могли бы запустить зацикленную программу на продолжительное время, но такой контракт быстро поподорожает. Благодаря этому ноды в сети Ethereum успешно фильтруют спам.

Средняя цена на газ в гвеях с течением времени.

Источник: etherscan.io

Средняя цена на газ в гвеях с течением времени.

Источник: etherscan.io

Газ и лимит газа

Предположим, что Алиса выполняет транзакцию на контракт. Она рассчитала, сколько готова потратить на газ (например, используя ETH Gas Station). Она может установить и более высокую цену, чтобы побудить майнеров быстрее запустить ее транзакцию.

Но также нужно будет установить и ограничение газа, которое служит для обеспечения ее защиты. Если с контрактом что-то пойдет не так, это может привести к бо́льшему потреблению газа, чем она рассчитывала. Ограничение газа устанавливается, чтобы гарантировать прекращение работы, как только будет израсходовано x количество газа. Контракт не сработает, но Алисе не придется платить больше, чем она изначально рассчитывала.

На первых порах можно немного путаться в этих понятиях, но волноваться не стоит. Да, вы всегда можете установить цену, которую готовы заплатить за газ (и лимит газа) вручную, однако большинство кошельков готовы вам в этом помочь. Простыми словами, цена на газ определяет, как быстро майнеры обработают вашу транзакцию, а лимит газа определяет максимальную сумму, которую вы готовы заплатить им.

Сколько времени майнится блок в сети эфириума?

Обычно на добавление нового блока в цепь требуется 12–19 секунд. Однако это время может сократиться, когда сеть перейдет на метод Proof of Stake, одна из целей которого – ускорить создание блоков. Если вы хотите узнать больше, ознакомьтесь с разделом Ethereum Casper.

Что такое эфириум-токены?

Своей привлекательностью Ethereum во многом обязан тому, что пользователи могут добавлять свои собственные активы в цепь, хранить и передавать их в виде эфира. Регулируются они смарт-контрактами, что позволяет разработчикам устанавливать определенные параметры для своих токенов. Смарт-контракт определяет, сколько их, как их запускать, делимы ли они, взаимозаменяемы или нет, а также многое другое. Наиболее известный технический стандарт для создания токенов в Ethereum — ERC-20, поэтому их чаще всего называют токенами ERC-20.

Функциональный потенциал таких токенов открывает новаторам огромную экспериментальную площадку с самыми современными приложениями на стыке финансов и технологий – будь то эмиссия однородных токенов, выступающих в приложении в качестве валюты, или выпуск уникальных токенов, подкрепленных физическими активами. Платформа демонстрирует огромный набор возможностей и исключительную гибкость в проектировании. При этом вполне вероятно, что лучшие варианты простого, рационализированного порядка разработки токенов еще впереди.

Как начать пользоваться эфириумом

Как купить ETH?

Как купить ETH с помощью кредитной/дебетовой карты

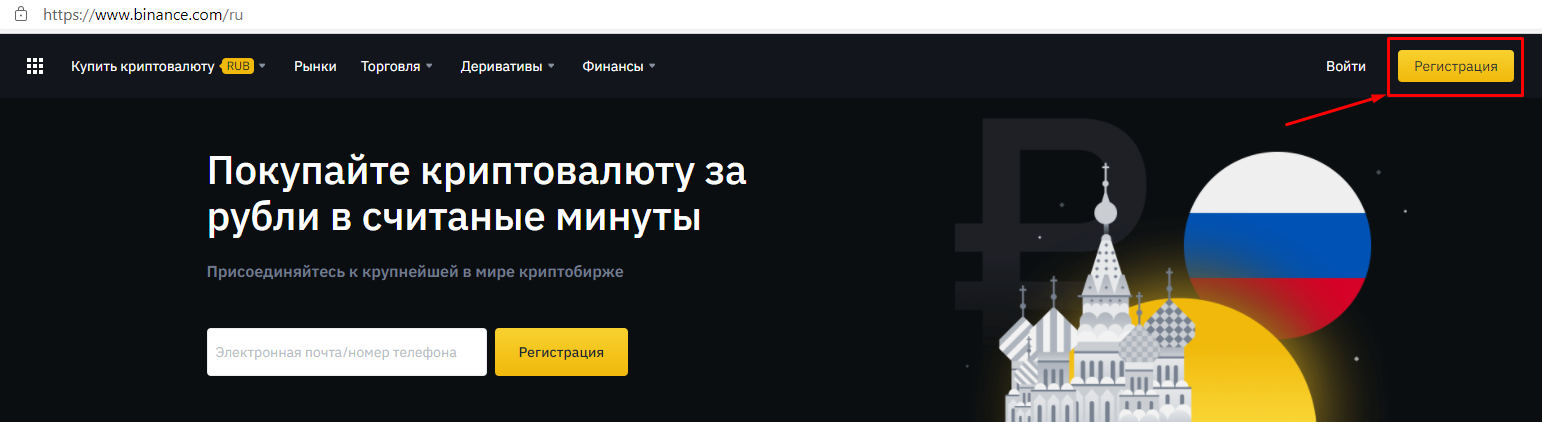

Binance позволяет вам без проблем покупать ETH через ваш браузер. Для этого необходимо выполнить следующие действия:

- Перейдите на портал покупки и продажи криптовалюты.

- Выберите криптовалюту, которую вы хотите купить (ETH), и валюту, в которой будете совершать оплату.

- Зайдите на Binance или зарегистрируйтесь, если у вас еще нет своего аккаунта.

- Выберите способ оплаты.

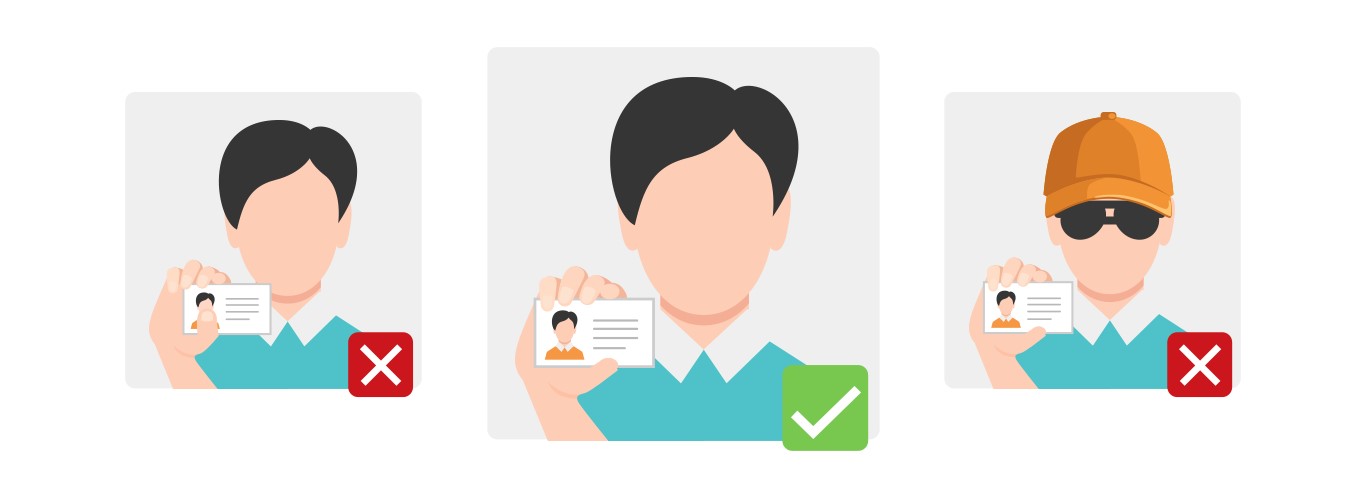

- При необходимости введите данные карты и пройдите подтверждение вашей личности.

- На этом всё! Ваш ETH вскоре будет зачислен на ваш Binance-аккаунт.

Как купить ETH на P2P-рынках

ETH можно покупать и продавать на P2P-рынках. Иными словами, вы можете приобретать монеты у других пользователей прямо из мобильного приложения Binance. Чтобы сделать это, необходимо:

- Запустить приложение, пройти процесс регистрации, если у вас нет своего аккаунта, и войти в систему.

- Нажать Купить и продать в один клик и перейти на вкладку Купить в левом верхнем углу экрана.

- Вам будет предложено несколько вариантов: выберите нужный и нажмите Купить.

- Оплата возможна также криптовалютой или фиатной валютой на соответствующих вкладках.

- Ниже вас попросят указать способ оплаты. Выберите тот, который вам больше всего подходит.

- Нажмите Купить ETH.

- Далее необходимо произвести оплату. После этого нажмите Отметить как оплаченное и Подтвердить.

- Сделка завершается, когда продавец отправляет вам монеты.

Что я могу купить с помощью эфириума (ETH)?

В отличие от биткоина, Ethereum – это не просто криптовалютная платформа. Она служит для создания децентрализованных приложений, а эфир, как обменный токен, выступает в качестве топлива этой экосистемы. Таким образом, основная ценность эфира заключается в его многофункциональности в сети Ethereum.

При этом эфир может использоваться и как традиционная валюта, т.е. вы можете оплачивать товары и услуги с помощью ETH, как и с помощью любой другой валюты.

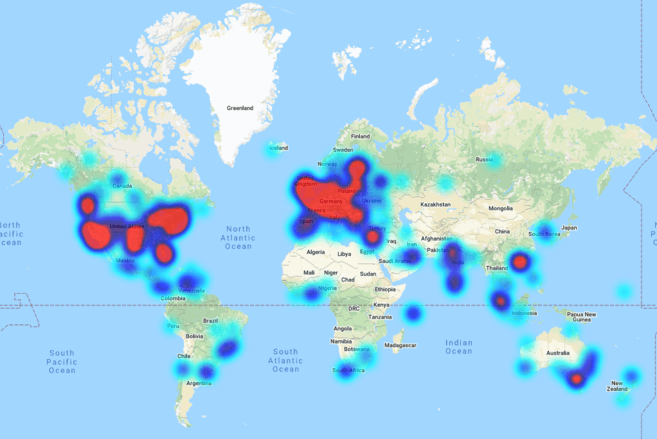

Тепловая карта ритейлеров, которые принимают эфир в качестве оплаты. Источник: cryptwerk.com/coinmap

Тепловая карта ритейлеров, которые принимают эфир в качестве оплаты. Источник: cryptwerk.com/coinmap

В каких целях можно использовать эфириум?

Собственную валюту Ethereum ETH можно использовать в качестве цифровых денег или залоговых средств. Кроме того, многие используют этот актив для долгосрочных инвестиций (как и биткоин). Однако, в отличие от биткоина, блокчейн Ethereum более программируемый, поэтому с ETH у вас появляется больше возможностей для работы. Он может служить в качестве источника жизнеобеспечения децентрализованных финансовых приложений и рынков, бирж, игр и многого другого.

Что случится, если я потеряю свои ETH?

Поскольку в этом процессе не участвуют банковские организации, пользователи сами отвечают за свои средства. Вы можете хранить монеты на бирже или в своем кошельке. Важно отметить, что, если вы используете кошелек, вам необходимо внимательно относиться к своей сид-фразе. Не доверяйте ее посторонним людям, так как при потере доступа к кошельку только с ее помощью будет возможно восстановить ваши средства.

Могу ли я отменять эфириум-транзакции?

После добавления данных в блокчейн Ethereum изменить или удалить их практически невозможно. Иными словами, вы уже ничего не сможете сделать с подтвержденной транзакцией. Поэтому всегда тщательно проверяйте указанные данные и особенно адрес, на который вы отправляете средства. Если вам нужно отправить большую сумму, безопаснее будет сначала отправить часть, чтобы убедиться в правильности адреса.

Тем не менее один случай взлома смарт-контракта подтолкнул Ethereum к кардинальным изменениям в работе, а именно хардфорку в 2016 году в целях борьбы со злонамеренными транзакциями. Это, впрочем, можно считать исключением, а не нормой. А для предотвращения подобного в будущем были предприняты серьезные меры.

Являются ли эфириум-транзакции приватными?

Короткий ответ: Нет. Все транзакции, добавленные в блокчейн эфириума, являются общедоступными. Даже если ваше настоящее имя не указано в эфириум-адресе, сторонний наблюдатель может различными методами идентифицировать вашу личность.

Могу ли я зарабатывать деньги на эфириуме?

Поскольку актив нестабилен, вы можете как зарабатывать деньги с помощью ETH, так и терять их. Некоторые люди хранят эфир в течение долгого времени, надеясь, что однажды сеть станет глобальной программируемой системой расчетов. Некоторые, напротив, предпочитают обменивать его на прочие альткоины. В любом случае ни та, ни другая стратегия не способна защитить вас от финансовых рисков.

Являясь основой развития децентрализованных финансов (DeFi), ETH также может быть использован для заимствования, в качестве залога для кредита, создания синтетических активов и – однажды в будущем – для стейкинга.

Некоторые инвесторы работают исключительно с биткоинами и не принимают иные цифровые активы. Некоторые, напротив, выбирают работу с ETH и прочими альткоинами или выделяют определенный процент для краткосрочной торговли (например, дневной торговли или свинг-трейдинга). Не существует универсального подхода к зарабатыванию денег на рынках – каждый инвестор выбирает оптимальную стратегию с учетом особенностей своего портфеля и обстоятельств.

Как правильно хранить ETH?

Существует множество вариантов хранения монет, у каждого из которых есть свои плюсы и минусы. Если присутствует хоть какой-то риск, лучше выбрать диверсификацию, предполагающую сочетание различных решений.

В целом, варианты хранения делятся на кастодиальные и некастодиальные. Кастодиальный метод означает, что вы доверяете свои монеты третьей стороне (например, бирже). В этом случае вам придется заходить на платформу хранителя, чтобы совершать транзакции.

Некастодиальный метод, напротив, позволяет вам сохранять контроль над вашими средствами путем использования кошелька с криптовалютой. Кошелек не хранит ваши монеты буквально, как физический кошелек. Он содержит криптографические ключи, которые дают вам доступ к вашим активам в блокчейне. Важно еще раз отметить: удостоверьтесь в том, что вы создали резервную копию сид-фразы при использовании некастодиального кошелька!

Как сделать депозит ETH на Binance

Если у вас уже есть эфир и вы хотите перечислить его на Binance, вы можете просто и быстро сделать это, выполнив следующий порядок действий:

- Зайдите на Binance или зарегистрируйтесь, если у вас еще нет своего аккаунта.

- Перейдите в кошелек и выберите Ввод.

- Выберите ETH из списка всех доступных монет.

- Выберите сеть и отправьте свой ETH на соответствующий адрес.

- На этом всё! После определенного количества подтверждений в сети, эфириум зачислится на ваш Binance-аккаунт.

Как хранить ETH на Binance

Если вы собираетесь активно торговать эфиром, вам необходимо хранить его на своей учетной записи Binance. Хранение ETH на Binance просто и безопасно, а также дает вам возможность пользоваться преимуществами экосистемы Binance через кредитование, стейкинг, аирдропы и розыгрыши.

Как вывести ETH из Binance

Если у вас уже есть эфир, который вы хотите вывести из Binance, вы можете просто и быстро сделать это, выполнив следующий порядок действий:

- Зайдите на Зайдите на Binance.

- Перейдите в ваш кошелек и выберите Вывод средств.

- Выберите ETH из списка всех доступных монет.

- Выберите сеть.

- Вставьте адрес получателя и введите необходимую сумму.

- Подтвердите данную операцию в своей электронной почте.

- На этом всё! После определенного количества подтверждений в сети, ETH зачислится на предоставленный вами адрес.

Как хранить ETH на эфириум-кошельке

Если вы хотите хранить ETH на своем собственном кошельке, вы можете выбрать один из двух основных вариантов: горячий или холодный кошелек.

Горячие кошельки

Кошелек для криптовалюты, подключенный к интернету, называется горячим кошельком. Как правило, это мобильное или компьютерное приложение, с помощью которого вы можете проверять баланс, а также отправлять и получать токены. Поскольку горячие кошельки находятся в сети, они более уязвимы для атак, но при этом более удобны для ежедневных платежей. Trust Wallet – пример простого и удобного мобильного кошелька с поддержкой множества различных монет.

Холодные кошельки

Холодный кошелек – это криптокошелек, который не подключен к интернету. Поскольку отсутствует угроза онлайн-атаки, риски в целом ниже. В то же время холодные кошельки обычно не так удобны в использовании, как горячие. Примерами холодных кошельков могут быть аппаратные или бумажные кошельки, однако бумажные кошельки на сегодняшний день считаются устаревшим и даже опасным вариантом, а потому их использование не рекомендуется.

Что означает логотип и символ эфириума?

Виталик Бутерин разработал самую первую эмблему Ethereum. Она состояла из двух повернутых символов суммы Σ (сигма из греческого алфавита). Окончательный дизайн логотипа (основанный на этой эмблеме) представляет собой ромбовидную форму – восьмигранник, окруженным четырьмя треугольниками. Подобно другим валютам, эфиру необходим стандартный символ в Unicode, чтобы приложения и веб-сайты могли отображать данную валюту. Наиболее часто используемый символ для эфира – Ξ, хотя он и не так распространен, как, например, $ для доллара США.

Масштабируемость, ETH 2.0 и будущее эфириума

Что такое масштабируемость?

Говоря простым языком, масштабируемость – это способность системы к росту. Например, в компьютерных системах сеть или сервер могут быть масштабированы с целью увеличения общего количества обрабатываемых операций за счет реализации различных методов.

В криптовалюте масштабируемость означает возможность расширения блокчейн-сети в целях обслуживания большего количества пользователей. Чем больше пользователей, тем больше операций и транзакций «конкурируют» между собой за включение в блокчейн.

Для чего эфириуму масштабируемость?

Поклонники Ethereum считают, что следующая итерация интернета будет построена именно на этой платформе. Так называемый Web 3.0 приведет к созданию децентрализованной топологии, характеризующейся отсутствием посредников, акцентом на конфиденциальность и сдвигом в сторону истинного владения собственными данными. Ее основа будет базироваться на использовании распределенных вычислений в форме смарт-контрактов и распределенных протоколов хранения/связи.

Однако для этого Ethereum необходимо значительно увеличить возможное количество обрабатываемых транзакций не в ущерб децентрализации сети. В настоящее время Ethereum не ограничивает объем транзакций через размер блока, как это делает биткоин. Вместо этого используется ограничение газа: в блок может поместиться лишь определенное его количество.

К примеру, лимит газа в блоке составляет 100 000 гвей. Вы хотите включить десять транзакций с 10 000 гвей для каждой, в таком случае система обработает операцию. То же самое произойдет и для двух транзакций по 50 000 гвей, но любые дополнительные транзакции, представленные вместе с ними, будут ждать включения в следующий блок.

Однако такой механизм не подходит для системы, которой будет пользоваться каждый. Если пендинг-транзакций будет больше, чем доступного пространства в блоке, вскоре образуется журнал оставшейся работы, известный как бэклог. Цена на газ будет расти, и пользователям нужно будет перебивать другие ставки, чтобы в первую очередь сеть обработала именно их транзакции. В зависимости от загруженности сети, операции могут стать слишком дорогими для определенных случаев использования.

Всплеск популярности CryptoKitties был отличным примером ограничений Ethereum в этой сфере. В 2017 году игра на основе Ethereum побудила множество пользователей совершать транзакции, чтобы участвовать в разведении собственных цифровых кошек (представленных в виде невзаимозаменяемых токенов). Она оказалась настолько популярна, что количество ожидающих транзакций резко возросло, став даже причиной торможения сети.

Трилемма масштабируемости блокчейна

Может показаться, что простое повышение лимита газа в блоке способно помочь в решении проблем масштабируемости, ведь чем выше предел, тем больше транзакций может быть обработано за определенное время, правильно?

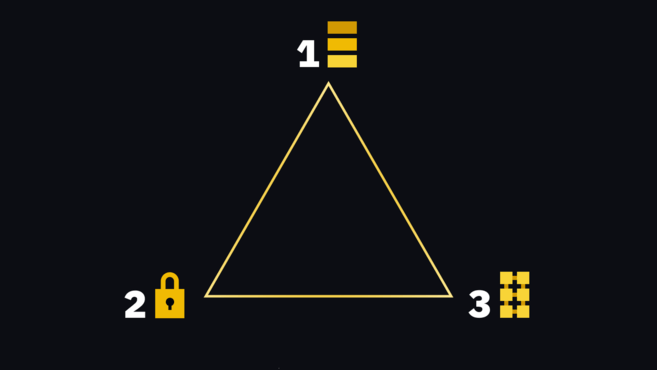

К сожалению, без ущерба для ключевых свойств Ethereum это невозможно. Виталик Бутерин предложил трилемму блокчейна (представленную ниже), чтобы проиллюстрировать хрупкий баланс в цепи.

Трилемма блокчейна: масштабируемость (1), безопасность (2) и децентрализация (3).

Трилемма блокчейна: масштабируемость (1), безопасность (2) и децентрализация (3).

При оптимизации вышеперечисленных характеристик одной из трех придется пожертвовать. Блокчейны, такие как Ethereum и Bitcoin, отдают приоритет безопасности и децентрализации. Их алгоритмы консенсуса обеспечивают безопасность сетей, состоящих из тысяч нодов, что, к сожалению, приводит к низкой масштабируемости. При таком большом количестве нод, принимающих и проверяющих транзакции, децентрализованная система работает медленнее, чем централизованные альтернативы.

Также есть вариант снятия ограничения по газу, чтобы сеть достигла безопасности и масштабируемости, но в этом случае она уже не будет такой децентрализованной.

Это связанно с тем, что большое количество транзакций в блоке напрямую влияет на его размер. Тем не менее ноды в сети всё так же должны периодически загружать и распространять их среди других нод, поддерживая интенсивность работы своего оборудования. Когда лимит газа в блоках увеличивается, нодам становится труднее проверять, хранить и транслировать блоки в сеть.

В результате ноды, не выдерживающие такую нагрузку, начнут отключаться. Лишь немногие из них смогут остаться и продолжать конкурировать между собой, что приведет к большей централизации. В итоге мы получим безопасный и масштабируемый блокчейн, у которого отсутствует одно из основных свойств – децентрализация.

Наконец, давайте представим блокчейн, основными приоритетами которого являются децентрализация и масштабируемость. Чтобы быть быстрым, и децентрализованным одновременно, приходится идти на компромиссы в использовании алгоритма консенсуса, что в свою очередь ведет к ослаблению безопасности.

Какое количество транзакций может обрабатываться в сети эфириума?

За последние годы Ethereum редко превышал десять транзакций в секунду (TPS). Для платформы, стремящейся стать «глобальным компьютером», этот показатель на удивление мал.

Однако увеличение масштабирования уже давно является целью Ethereum. Plasma – одна из возможных мер в решении этого вопроса. Она направлена на повышение эффективности Ethereum, но может применяться и к другим блокчейн-сетям.

Что такое эфириум 2.0?

При всем своем потенциале эфириум – в сегодняшнем состоянии – сопряжен со значительными ограничениями и недостатками, один из которых мы расмотрели выше. Проще говоря, если эфириум стремится стать основой для новой финансовой системы, он должен иметь возможность обрабатывать намного больше транзакций в секунду. Учитывая распределенную природу сети, эту проблему будет очень трудно решить, по крайней мере, разработчики эфириума занимаются этим уже многие годы.

С одной стороны, для того чтобы сеть была достаточно децентрализованной, все же необходимо применять некоторые ограничения. Чем выше требования для работы ноды, тем меньше участников и тем более централизованной становится сеть. Таким образом, увеличение количества транзакций, которые способен обработать эфириум, может поставить под угрозу всю целостность системы, поскольку это также увеличит нагрузку на каждую ноду.

Еще один недостаток Ethereum (и других криптовалют Proof of Work) заключается в том, что она очень ресурсоемкая. Чтобы успешно добавить блок в блокчейн, нужно майнить, а для этого необходимо быстро выполнять вычисления, что потребляет огромное количество электроэнергии.

Для устранения вышеуказанных ограничений был предложен основной набор обновлений, известных под общим названием эфириум 2.0 (или ETH 2.0). После полного развертывания ETH 2.0 значительно улучшит производительность всей сети.

Что такое шардинг эфириума?

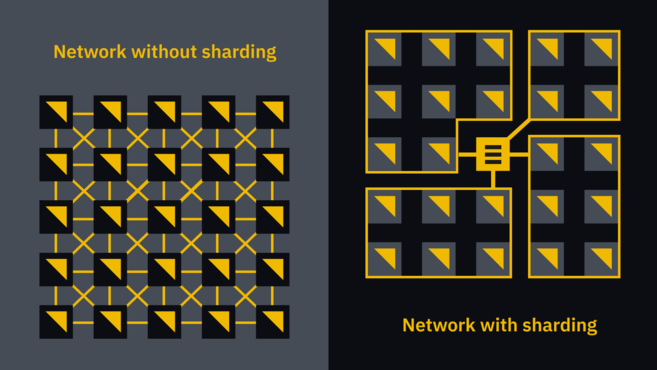

Как уже было отмечено, все ноды хранят копию блокчейна. Когда сеть расширяется, каждая нода должна обновиться, что, в свою очередь, потребляет их пропускную способность и доступную память на жестком диске.

Однако при использовании шардинга в этом уже нет необходимости. Название относится к процессу разделения сети на подмножество нод — шардов. Каждый из этих шардов обрабатывает свои собственные транзакции и контракты, но может при необходимости связываться с более широкой сетью шардов. Поскольку каждый шард проверяется независимо, хранить данные других шардов не нужно.

Сеть в марте 2020 года по сравнению с аналогичной сетью с реализованным шардингом.

Сеть в марте 2020 года по сравнению с аналогичной сетью с реализованным шардингом.

Шардинг – один из наиболее сложных подходов к масштабированию, который нуждается в большом количестве разработок и их дальнейших реализаций. Но в случае успешного внедрения это также будет и одним из наиболее эффективных способов увеличения пропускной способности сети в несколько раз.

Что такое эфириум-плазма?

Ethereum Plasma – это решение масштабируемости офчейн, то есть он стремится увеличить пропускную способность, проводя транзакции вне цепи. В этом отношении он напоминает сайдчейны и платежные каналы.

В плазме вторичные цепи привязаны к основному блокчейну эфириума, поддерживая между собой связь на минимальном уровне. Они работают более или менее независимо, но пользователям по-прежнему приходится полагаться на основную цепочку для разрешения споров или «завершения» своей деятельности на вторичных цепочках.

Сокращение объема данных, которые должны храниться на нодах, является жизненно важным условием для успешного масштабирования эфириума. Подход с плазмой позволяет разработчикам определить функционирование «дочерних» цепочек в смарт-контракте, созданном на основной цепи. Затем на таких цепочках можно будет свободно создавать приложения или процессы, которые слишком дорого запускать или хранить на основной цепи.

Что такое роллапс эфириума?

Роллапс похож на Plasma в том смысле, что также стремится масштабировать Ethereum путем перемещения транзакций из основной цепи. Каким же образом он устроен?

Один контракт в основной цепи содержит все средства и криптографическое подтверждение текущего состояния второй цепочки. Операторы второй цепи, которые обеспечивают связь контрактов основной цепи, следят за тем, чтобы в контракте фиксировались только достоверные изменения. Поскольку это состояние поддерживается вне цепочки, хранить информацию в блокчейне нет необходимости. Однако ключевое отличие роллапса от Plasma заключается в том, что все транзакции передаются в основную цепочку. С использованием специального типа транзакций большое их количество может быть «свернуто» (от англ. rolled up) в специальный блок под названием роллап-блок.

Существует два типа роллапов: оптимистический и ZK-роллап. Оба по-своему гарантируют правильность переходов между состояниями сети.

ZK-роллап отправляет транзакции с использованием криптографической проверки под названием доказательство с нулевым разглашением. Более точное названием этого подхода – zk-SNARK. Мы опустим детали его работы, но поясним, в чем его польза для роллапов. Он дает возможность разным сторонам доказать друг другу, что у них есть определенная информация, при этом не раскрывая ее.

В случае с ZK-роллапами эта информация представляет собой переходы состояния вторичной цепи, которые транслируются в основную цепь. Большим преимуществом такого решения является то, что данный процесс может произойти практически мгновенно, а вероятность появления искаженных представлений о состоянии крайне низкая.

Оптимистический роллап жертвует масштабируемостью ради большей гибкости. Используя виртуальную машину под названием «Оптимистическая виртуальная машина» (OVM), он может запускать смарт-контракты на вторичных цепочках. С другой стороны, нет криптографических доказательств того, что переход состояния, переданный в основную цепочку, будет достоверен. Чтобы нивелировать эту проблему, существует небольшая задержка, позволяющая пользователям оспаривать и отклонять недействительные блоки, отправленные в основную цепочку.

Что такое proof of stake (PoS) эфириума?

Proof of Stake (PoS) – это альтернатива методу Proof of Work для проверки блоков. В системе Proof of Stake блоки не майнятся как таковые, а вместо этого используется минтинг (также иногда называемый форжингом). Вместо майнеров, соревнующихся между собой в хешрейте, периодически случайным образом выбирается нода (или валидатор) для проверки блока-кандидата. Если все выполнено правильно, валидатор получит все комиссии с транзакций этого блока, а в зависимости от протокола, возможно, и вознаграждение за блок.

В силу отсутствия майнинга Proof of Stake считается менее вредным для окружающей среды. PoS-валидаторы не потребляют много электроэнергии, а также обладают возможностью минтить блоки на оборудовании потребительского уровня.

Ethereum планирует перейти с PoW на PoS в Ethereum 2.0 – обновлении под названием Casper. Хотя точная дата еще не известна, первая итерация, скорее всего, будет скоро запущена.

Что такое стейкинг эфириума?

По протоколам Proof of Work безопасность сети обеспечивается майнерами. Майнеры не заинтересованы обманывать сеть, так как это приведет к трате электроэнергии и потере потенциальных наград. В Proof of Stake такая теория игры отсутствует, а вместо этого сетевую безопасность обеспечивают различными криптоэкономическими мерами.

Нечестное поведение предотвращается не риском потенциальных убытков, а риском потери собственных средств. Валидаторы должны предоставить свою долю (то есть предложить токены), чтобы иметь право на валидацию. Если нода попытается обмануть, именно эта сумма в эфирах будет изъята у нее, либо же будет постепенно списываться, если валидатор не отвечает или находится офлайн. Однако если валидатор запускает дополнительные ноды, он может получить бо́льшее количество наград.

Сколько ETH составляет одна доля (стейк) в эфириуме?

Минимальная доля для Ethereum составляет 32 ETH на одного валидатора. Этот порог настолько завышен для того, чтобы попытка атаки в 51% обходилась злоумышленникам в огромные суммы.

Как много ETH я смогу зарабатывать, участвуя в стейкинге эфириума?

Это довольно специфичный вопрос. В целом, всё зависит от вашей доли, общего количества выделенных ETH в сети и уровня инфляции. По очень приблизительной оценке, текущие расчеты будут равны 6% дохода в год. Имейте в виду, что это лишь предположение и итоговая сумма может измениться в будущем.

Как долго мои ETH будут заблокированы в рамках стейкинга?

Для того чтобы получить вывод ETH из валидатора, ваша транзакция должна будет выстоять очередь. Если очереди нет, минимальное время на вывод составляет 18 часов, но это динамический показатель, который корректируется в зависимости от того, сколько валидаторов осуществляют вывод в данный момент.

С какими рисками связан стейкинг ETH?

Поскольку вы являетесь валидатором, в обязанности которого входит поддержание безопасности сети, необходимо учитывать связанные с этим риски. Если ваша нода валидатора отключается на длительный период, вы можете потерять значительную часть своего депозита. Кроме того, если в какой бы то ни было момент ваш депозит упадет ниже 16 ETH, вы будете лишены прав на валидацию.

Также важно учитывать более системный фактор риска. Proof of Stake раньше не реализовывался в таком масштабе, поэтому мы не можем быть полностью уверены в надежности такой системы. В программном обеспечении всегда присутствуют ошибки и уязвимости, что может иметь разрушительный эффект, особенно когда на кону миллиарды долларов.

Эфириум и децентрализованные финансы (DeFi)

Что такое децентрализованные финансы (DeFi)?

Децентрализованные финансы (или просто DeFi) – это движение, направленное на децентрализацию финансовых приложений. DeFi базируется на публичных блокчейнах с открытым исходным кодом, к которым может получить доступ любой, кто имеет подключение к интернету (общедоступный). Это важнейший элемент для перехода миллиардов людей в эту новую глобальную финансовую систему.

В растущей экосистеме DeFi пользователи взаимодействуют со смарт-контрактами и друг с другом через сети P2P и децентрализованные приложения (DApps). Важным преимуществом DeFi является то, что пользователи всегда оставляют за собой право владения своими средствами.

Говоря простым языком, движение децентрализованных финансов (DeFi) направлено на создание новой финансовой системы, свободной от нынешних ограничений. По причине относительно высокой степени децентрализации и большой базы разработчиков, основная часть DeFi в настоящее время строится на эфириуме.

Для чего можно использовать децентрализованные финансы (DeFi)?

Как вам может быть известно, одно из важнейших преимуществ биткоина заключается в том, что сеть функционирует самостоятельно, не нуждаясь в центральном управлении. Но что если использовать это в качестве основной идеи для создания программируемых приложений? Именно здесь и кроется потенциал приложений DeFi. В этой системе нет ни центрального управления, ни посредников, а значит, нет и изъянов.

Мы уже говорили, что преимуществом DeFi является открытый доступ. В мире насчитывается более миллиарда людей, которые не имеют возможности получить доступ к каким-либо финансовым услугам. Попробуйте представить, как бы вы управляли своей повседневной жизнью без какой-либо уверенности в своих финансах? Между тем так живут миллиарды людей, и в конечном счете именно эту аудиторию пытается обслуживать DeFi.

Децентрализованные финансы (DeFi) когда-нибудь станут мейнстримом?

Но если все так здорово, то почему DeFi еще не захватили мир? В настоящее время большинство приложений, связанных с децентрализованными финансами, трудно использовать: они довольно неуклюжи, часто ломаются и имеют очень экспериментальный вид. Разработка даже фреймворков для подобной экосистемы чрезвычайно сложна, особенно в распределенной среде.

На пути построения экосистемы DeFi возникает множество проблем и препятствий для инженеров-программистов, игровых теоретиков, дизайнеров механизмов и многих других. Поэтому вопрос о широком распространении DeFi остается открытым.

Какие существуют приложения, связанные с децентрализованными финансами (DeFi)?

Один из самых популярных вариантов использования децентрализованных финансов (DeFi) – стейблкоины. По сути, это токены на блокчейне, стоимость которых привязана к активу из реального мира, такому как фиатная валюта. Так, например, BUSD привязан к стоимости доллара США. Удобство этих токенов в том, что их очень легко хранить и передавать, поскольку они существуют в цепочке блоков.

Еще один популярный вид приложений – лендинговые приложения. Существует множество P2P-сервисов, которые позволяют давать свои средства в долг и получать взамен процентные платежи. Один из самых удобных сервисов – Binance Lending. Достаточно просто перевести средства на свой кошелек, и вы можете начать зарабатывать проценты уже на следующий день!

Одним из интереснейших аспектов DeFi являются разнообразные приложения, которые сложно классифицировать. К ним относят всевозможные децентрализованные P2P-маркетплейсы, на которых пользователи могут обмениваться уникальными криптоколлекционными предметами и другими цифровыми вещами. Они также могут включать создание синтетических активов, где любой желающий может открыть рынок любых ценных предметов. Кроме того, на DeFi могут работать рынки прогнозирования, деривативы и многое другое.

Децентрализованные биржи (DEX) на эфириуме

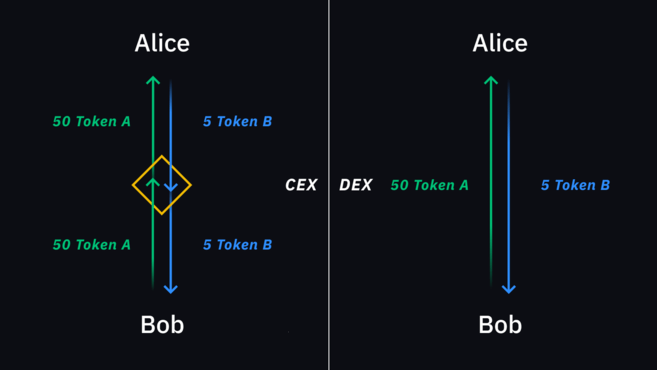

Децентрализованная биржа (DEX) – это площадка, на которой можно совершать сделки напрямую между кошельками пользователей. Когда вы торгуете на централизованной бирже Binance, вы отправляете на нее свои средства и торгуете через ее внутренние системы.

Децентрализованные биржи устроены по-разному. Благодаря удивительным способностям смарт-контрактов, они дают возможность торговать прямо из вашего криптокошелька, исключая возможность взлома биржи и другие риски.

Отличный пример децентрализованной биржи – Binance DEX. Помимо нее также есть Uniswap, Kyber Network и IDEX. Многие из них даже дают возможность торговать с аппаратного кошелька для максимальной безопасности.

Централизованные и децентрализованные биржи.

Централизованные и децентрализованные биржи.

Выше мы рассмотрели различия между централизованными и децентрализованными биржами. Слева мы видим, что Binance выступает посредником в транзакциях между пользователями. Например, если Алиса хочет обменять свой токен A на токен Бориса Б, сначала они оба должны внести свои активы на биржу. После сделки Binance соответствующим образом распределит средства на их балансы.

Справа вариант с использованием децентрализованной биржи. Вы можете заметить, что в такой операции не участвует третья сторона. Вместо этого токены Алисы напрямую обмениваются на токены Боба с помощью смарт-контракта. Таким образом, участвующим сторонам нет необходимости доверять посреднику, поскольку условия их контракта автоматически исполняются системой.

По состоянию на февраль 2020 года, DEX являются наиболее часто используемыми приложениями, работающими на блокчейне Ethereum. Хотя, по сравнению с централизованными биржами, объем торгов все еще невелик. Тем не менее, если разработчики и дизайнеры DEX сделают взаимодействие с пользователями более привлекательным, в будущем DEX смогут составить конкуренцию многим централизованным биржам.

Участие в работе сети эфириума

Что такое нода эфириума?

Нода эфириума – это термин, который может использоваться для описания программы, каким-либо образом взаимодействующей с его сетью. Нода эфириума может быть чем угодно – от простого мобильного кошелька до компьютера, на котором хранится полная копия блокчейн-сети.

Все ноды работают как обратные точки связи, в сети эфириума существует несколько видов таких точек.

Как работает нода эфириума?

В отличие от Bitcoin, у Ethereum нет единой эталонной программы. Если в экосистеме Bitcoin в качестве программного обеспечения основной ноды используется Bitcoin Core, то у Ethereum есть ряд самостоятельных (но совместимых) программ, основанных на его Yellow Paper. Наиболее популярные из них – Geth и Parity.

Полная нода эфириума

Для того чтобы взаимодействовать с сетью эфириума и получить возможность независимо проверять данные в блокчейне, вам необходимо запустить полную ноду с использованием программного обеспечения, подобного тому, что было описано выше.

Такое программное обеспечение загружает все блоки с других нод на ваше устройство и проверяет правильность их включения в транзакции. На основе этой программы также можно запускать все смарт-контракты, которые были вызваны для гарантии того, что все участники сети (вы и все остальные пиры) получают одну и ту же информацию. Если все пойдет по плану, каждая нода будет иметь идентичную и полную копию блокчейна на своих компьютерных устройствах.

Полные ноды жизненно важны для функционирования эфириума. Если бы все эти ноды не распространяли всю полученную информацию по всему земному шару, сеть потеряла бы свои основные свойства: устойчивость к цензуре и децентрализацию.

Упрощеннные ноды эфириума

Запуск полной ноды напрямую способствует здоровью и безопасности сети, но такая нода нуждается в отдельном устройстве для работы, которое в свою очередь требует периодического обслуживания. Упрощенные ноды стать лучшим вариантом для пользователей, которые не могут запустить полную ноду (или для тех, кто просто предпочитает не делать этого).

Как следует из названия, упрощенные ноды потребляют меньше ресурсов и места на жестком диске. Таким образом, они могут работать на устройствах с более низкими техническими характеристиками, такими как телефоны или ноутбуки. В свою очередь эти низкие накладные расходы связаны с тем, что упрощенные ноды не являются целиком самодостаточными. Они не полностью синхронизируются с блокчейном и, следовательно, нуждаются в полных нодах для передачи им соответствующей информации.

Упрощенные ноды популярны среди продавцов, поставщиков различных услуг и пользователей. Они широко используются для совершения и получения платежей в тех случаях, когда запуск и содержание полной ноды является не совсем подходящим решением.

Майнинг нода эфириума

Майнинг нода может быть как полным, так и упрощенным клиентом. В действительности, термин «майнинг нода» не используется так, как это происходит в экосистеме биткоина; тем не менее все же стоит идентифицировать данных участников сети.

Для майнинга Ethereum пользователям необходимо дополнительное оборудование. Обычно это подразумевает создание майнинговой фермы. В ней объединяется несколько видеокарт, что обеспечивает высокую скорость хеширования.

У майнеров есть два варианта: соло-майнинг и майнинг-пул. В соло-майнинге пользователь работает в одиночку для создания блоков, и в случае успеха все награды достаются ему самому. Если же он присоединяется к майнинг-пулу, он объединяет свои мощности с мощностями других пользователей. Это повышает вероятность того, что вместе они найдут блок, но награды им придется разделить между собой.

Запуск ноды в сети эфириума

Одним из основных преимуществ блокчейнов является их открытый доступ. Это означает, что любой может запустить ноду и укрепить сеть эфириума путем проверки транзакций и блоков.

Как и в случае с Bitcoin, есть ряд компаний, предлагающих подключение в формате plug-n-play к нодам Ethereum. Это будет удобно для тех, кто просто хочет иметь работающую ноду, однако за такое удобство придется дополнительно заплатить.

Мы уже говорили о том, что Ethereum имеет ряд программ для запуска нод, в их числе Geth и Parity. Если вы хотите запустить свою собственную ноду, вам будет необходимо ознакомиться с процессом установки нужного вам варианта.

Если вы не планируете запускать специальную архивную ноду, то мощности обычного ноутбука потребительского уровня должно хватить. Однако лучше не использовать компьютер, который необходим вам для повседневной работы, так как это может значительно замедлить его процессы.

Запуск собственной ноды лучше всего работает на устройствах, которые всегда остаются в онлайн-режиме. Если ваша нода переходит в автономный режим, может потребоваться значительное время для синхронизации с сетью, прежде чем она снова подключится к сети. Таким образом, лучшим решением для этого будут устройства, которые дешевы в сборке и просты в обслуживании. Например, вы можете запустить упрощенную ноду даже на Raspberry Pi.

Как майнить эфириум

Поскольку сеть планирует переходить на Proof of Stake, майнинг на Ethereum – не самый безопасный и долгосрочный вариант. После перехода майнеры, скорее всего, переключатся на другую сеть или вовсе продадут свое оборудование.

Тем не менее, если вы намерены участвовать в майнинге Ethereum, вам понадобится специальное оборудование, такое как видеокарты или ASIC. Если вы рассчитываете на достойную прибыль, вам, скорее всего, потребуется майнинговая ферма и доступ к дешевому электричеству. Кроме того, вам будет необходимо настроить кошелек Ethereum и программное обеспечение для фермы. Все это требует немалых средств и времени, поэтому тщательно обдумайте, готовы ли вы этим заниматься.

Что такое ProgPow эфириума?

ProgPoW расшифровывается как Programmatic Proof of Work и означает «программируемое доказательство выполнения работы». Это расширение алгоритма майнинга Ethereum называется Ethash. Его задача – сделать графические процессоры более конкурентоспособными по сравнению с ASIC.

Устойчивость к ASIC в течение многих лет была предметом жарких споров как в сообществе Bitcoin, так и в Ethereum. В случае с Bitcoin ASIC стали доминирующим майнинговым оборудованием в сети.

В сети эфириума асики также присутствуют, но в гораздо меньшем количестве; большая часть майнеров все еще использует видеокарты. Однако эта ситуация может вскоре измениться, так как всё больше и больше компаний вводят на рынок майнинга эфириума ASIC-оборудование. Но почему асики могут стать проблемой?

Во-первых, машины ASIC могут значительно снизить децентрализацию сети. Если майнеры на GPU не cмогут получить прибыль и будут вынуждены прекратить свои операции, хешрейт сосредоточится в руках нескольких майнеров. Более того, разработка микросхем ASIC очень дорога: не многие компании имеют для нее достаточные возможности и ресурсы. Всё это создает угрозу монополизации производства, потенциально централизуя майнинговую индустрию Ethereum в руках нескольких корпораций.

Интеграция ProgPow является предметом споров и дискуссий начиная с 2018 года. И хотя некоторые считают, что это может быть полезно для экосистемы Ethereum, многие выступают против из опасения вызвать хардфорк. С приближением перехода на Proof of Stake реализация ProgPow все еще остается под вопросом.

Как разрабатывается программное обеспечение эфириума?

Как и Bitcoin, Ethereum имеет открытый исходный код. Любой желающий может свободно участвовать в разработке самого протокола или создавать приложения на его основе. Фактически Ethereum имеет сегодня самое большое сообщество блокчейн-разработчиков.

Такие ресурсы, как Mastering Ethereum за авторством Андреаса Антонопулоса и Гэвина Вуда, а также Материалы для разработчиков от Ethereum.org, – отличная отправная точка для разработчиков, которые в будущем хотели бы участвовать в развитии экосистемы.

Что такое масштабируемость?

Первоначально смарт-контракты были описаны в 1990-х годах, но последующее их использование поверх блокчейнов определило совершенно новый набор задач, которые можно выполнять с их помощью. Основным языком программирования для разработки смарт-контрактов на Ethereum стал Solidity, предложенный Гэвином Вудом в 2014 году. Синтаксически он похож на Java, JavaScript и C++.

По сути, Solidity позволяет разработчикам писать код, который можно разбить на инструкции, понятные виртуальной машине Ethereum (EVM). Если вы хотите лучше разобраться в этом, начните с Solidity GitHub.

Важно отметить, что Solidity – не единственный язык, доступный разработчикам Ethereum. Еще один популярный вариант – Vyper, который по синтаксису больше напоминает Python.