Законы о борьбе с отмыванием денег направлены на то, чтобы остановить отмывание незаконных средств. Законодательные меры против отмывания денег принимают правительства отдельных стран и многонациональные организации, такие как FATF.

Отмыванием денег называют процесс превращения «грязных» денег в чистые. Делается это путем сокрытия происхождения средств, смешивания их с законными транзакциями или инвестирования в законные активы.

Криптовалюта – довольно привлекательный способ отмывания денег ввиду ее конфиденциальности, сложности получения средств и еще не сформировавшейся законодательной базы. Злоумышленники часто используют ее для отмывания огромных сумм.

Binance и многие другие криптобиржи отслеживают подозрительное поведение в рамках соблюдения требований AML и сообщают о нем в правоохранительные органы.

Введение

Законы о борьбе с отмыванием денег (AML) помогают бороться с оборотом незаконных средств. Данные законы требуют от централизованных бирж криптовалюты обеспечения безопасности клиентов и борьбы с финансовыми преступлениями. Ввиду анонимного характера криптовалют их регулирование в значительной степени зависит от мониторинга поведения и личности клиентов.

Что такое AML?

AML – это положения и законы, которые препятствуют перемещению и отмыванию незаконных средств. AML тесно связаны с организацией FATF (Группа разработки финансовых мер борьбы с отмыванием денег), созданной в 1989 году для содействия международному сотрудничеству. Так, например, меры по борьбе с отмыванием денег нацелены на борьбу с финансированием терроризма, налоговым мошенничеством и международной контрабандой. AML-процедуры могут различаться в зависимости от страны, однако многие страны мира пытаются прийти к единым стандартам.

По мере развития технологий появляются и новые методы отмывания денег. Программное обеспечение AML нацелено на распознавание поведения, которое может расцениваться как подозрительное. Примером такого поведения могут быть крупные переводы денег, неоднократные поступления средств на счет и перекрестные проверки пользователей в розыскных списках. AML применяются не только к криптовалютам. Любые активы или фиатные валюты могут отслеживаться и удерживаться в соответствии с положениями AML.

На то, чтобы начать эффективно выполнять свои функции в работе с криптовалютой, законам о борьбе с отмыванием денег потребовалось некоторое время. Технология блокчейн постоянно развивается, и процедуры AML также меняются вместе с мерами регулирования. Однако это не всегда имеет положительный эффект. Владельцы криптовалюты ценят анонимность и децентрализацию своих активов. По этой причине усиленное регулирование и документирование личности пользователей рассматривается как мера, противоречащая этике криптовалюты.

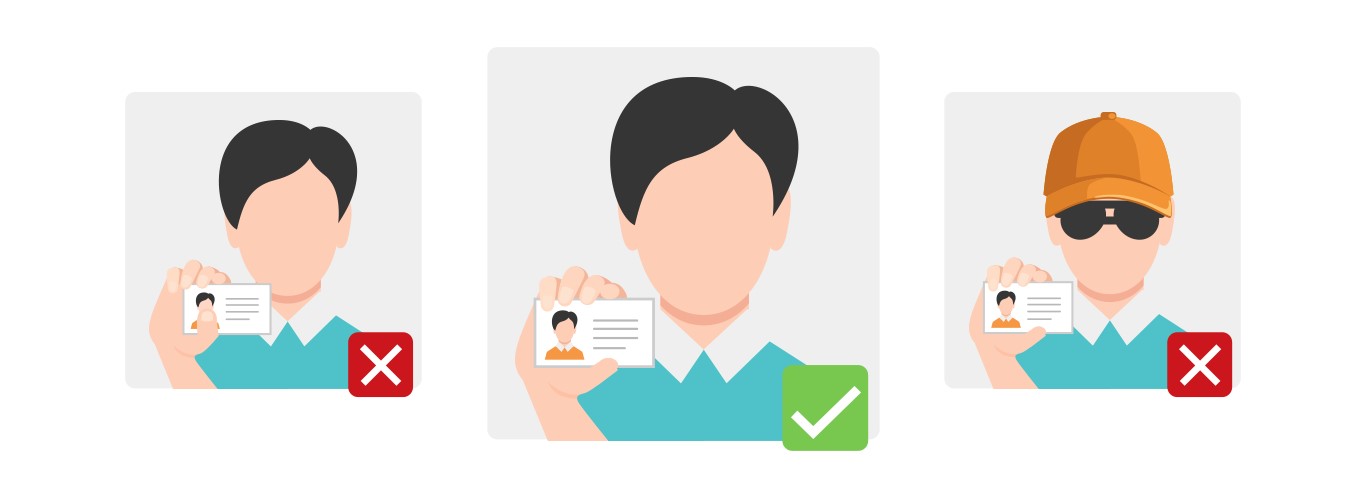

Чем отличаются AML и KYC?

Практика «Знай своего клиента», или KYC, – это обязательство финансовых учреждений и сервис-провайдеров в рамках исполнения AML. Процедура KYC требует, чтобы пользователь предоставил личные данные, подтверждающие его личность, и накладывает на пользователя ответственность за все совершаемые финансовые транзакции. KYC – проактивная часть AML, которая входит в процедуру комплексной проверки благонадежности клиента. Это отличает ее от других механизмов AML, направленных на расследование подозрительного поведения.

Что такое отмывание денег?

Отмывание денег заключается в том, что преступники узаконивают денежные средства, полученные незаконным путем (торговля наркотиками, терроризм, мошенничество), используя для этого инвестиции или финансовые активы. Законы и правила борьбы с отмыванием денег в каждой стране разные, однако унификация этих мер является целью многих юрисдикций и FATF.

Отмывание денег проходит в три этапа:

- Размещение: ввод «грязных» денег в финансовую систему, например, в бизнес, основанный на использовании наличных.

- Наслоение: перемещение незаконных средств с целью затруднить их отслеживание. Использование криптовалюты и есть один из способов скрыть происхождение «грязных» денег.

- Интеграция: использование легальных инвестиций и других финансовых каналов для повторного введения «грязных» денег в экономику.

Как отмывают деньги?

Сделать это можно разными способами. Традиционный метод – создание поддельных чеков за услуги в магазинах, ресторанах и т. д. В этом случае частное лицо или организация использует другие компании в качестве прикрытия для отмывания денег. Преступники создают поддельные квитанции и расплачиваются за них «грязными» физическими деньгами, превращая их в законный доход. Затем этот приток смешивается с подлинными транзакциями, чтобы их было трудно отличить.

Однако на сегодняшний день нелегальные средства обычно представляют собой цифровые, а не физические деньги. Соответственно, и методы отмывания денег модернизируются. Возможностей спрятать и отмыть «грязные» деньги стало еще больше, чем раньше. Например, стало возможным напрямую переводить деньги без участия банка. Для этих целей активно используются такие платежные сервисы, как Paypal или Venmo.

Технологии анонимности, такие как VPN и криптовалюты, только усугубляют эту проблему. Иногда доказать вину конкретного человека в отмывании денег может быть невозможно. Главный метод борьбы с такой деятельностью – последовательное отслеживание. Следуя «бумажному следу» блокчейна к бирже, есть вероятность привязать отмытые средства к счету криптобиржи или банковскому счету другого человека. Однако покупка криптовалюты за наличные или через P2P-сервисы затрудняет отслеживание входа или выхода грязных денег из финансовой системы.

Еще одним методом отмывания денег является использование сайтов с азартными играми. Преступники кладут деньги, которые они хотят отмыть, на счет онлайн-казино. Затем они приступают к размещению ставок, чтобы учетная запись выглядела законной. После этого они выводят свои средства и в конечном итоге получают чистые деньги. Обычно для этого используется несколько учетных записей, чтобы не вызывать подозрений. Учетная запись с большой суммой средств может вызвать подозрение во время AML-проверки.

Как работают меры по борьбе с отмыванием денег?

Основная деятельность регулятора или биржи криптовалют проходит в три этапа:

-

Выявление подозрительных действий, например крупные притоки или оттоки средств автоматически отмечаются. Другой пример – непоследовательное поведение, скажем, увеличение количества выводов средств с малоактивного счета.

-

Во время или после расследования приостанавливается возможность пользователя вносить или снимать средства. Применяется это с целью исключить возможную деятельность по отмыванию денег. Затем составляется отчет о подозрительной деятельности (SAR).

-

Если выявляются доказательства незаконной деятельности, их передают в соответствующие органы. В случае обнаружения украденных средств их по возможности возвращают законным владельцам.

Криптовалютные биржи обычно используют проактивный подход к борьбе с отмыванием денег. Из-за огромного давления на криптоиндустрию и требований к соблюдению нормативных положений, биржи, такие как Binance, должны проявлять повышенную бдительность и осторожность. Мониторинг транзакций и усиленная комплексная проверка – два ключевых инструмента в борьбе с отмыванием денег.

Что такое FATF?

FATF – международная организация, основанная G7 для борьбы с финансированием терроризма и отмыванием денег. Из-за набора стандартов, которых должны придерживаться страны во всем мире, преступникам становится все труднее находить подходящую юрисдикцию.

Сотрудничество между правительствами также улучшает обмен информацией и отслеживание лиц, занимающихся отмыванием денег. Уже более 200 стран взяли на себя обязательство следовать стандартам FATF. FATF следит за деятельностью всех участников, чтобы контролировать соблюдение правил.

Зачем нужен AML в криптовалюте?

Из-за анонимного характера криптовалюты преступники используют ее для отмывания незаконных средств и уклонения от уплаты налогов. Регулирование криптовалюты улучшает ее собственную репутацию и обеспечивает уплату налогов. Развитие AML приносит пользу добросовестным пользователям криптовалюты, хотя для этого и требуется много усилий и времени.

По данным Reuters, в 2020 году преступники отмыли с помощью криптовалюты около 1,3 миллиарда долларов США. Криптовалюта удобна для отмывания денег по нескольким причинам:

-

Сделки необратимы. После того как вы отправили средства через блокчейн, они не могут быть возвращены, если только новый владелец не отправит их обратно. Полиция и регулирующие органы не смогут извлечь средства за вас.

-

Криптовалюта обеспечивает анонимность. Некоторые монеты, например Monero, отдают приоритет конфиденциальности транзакций. Существуют также «тумблерные» сервисы, которые пропускают криптовалюту через разные кошельки, чтобы затруднить ее отслеживание.

-

Регулирование и налогообложение криптовалюты все еще не определенны. Несмотря на глобальные усилия налоговых органов по всему миру, эффективной системы налогооблажения криптовалюты до сих пор нет, чем и пользуются преступники.

Примеры отмывания криптовалюты

Власти добиваются определенных успехов в отслеживании и поимке преступников, которые отмывают средства через криптовалюту. В июле 2021 года полиция Великобритании изъяла криптовалюту на сумму около 250 миллионов долларов США, которую использовали для отмывания денег. Это изъятие криптовалюты стало крупнейшим в истории Великобритании, побив предыдущий рекорд в 158 миллионов долларов, установленный всего за несколько недель до этого события.

В том же месяце бразильские власти изъяли 33 миллиона долларов в ходе сложной операции по поимке злоумышленников. Два физических лица и 17 компаний были вовлечены в покупку криптовалюты для сокрытия незаконно полученных средств. Преступная организация целенаправленно занималась созданием компаний для преступной деятельности. Криптовалютные биржи также сознательно сотрудничали с преступными организациями и не соблюдали надлежащие процедуры AML.

Как Binance поддерживает AML?

Binance активно использует различные меры AML для борьбы с отмыванием денег, включая расширение возможностей обнаружения и аналитики AML. Все эти усилия объединяются в рамках программы соответствия AML. Binance также тесно сотрудничает с международными агентствами, помогая привлекать к ответственности крупные киберпреступные организации.

Например, Binance содействовала в предоставлении доказательств, что привело к аресту нескольких создателей программы-вымогателя Cl0p. Binance отмечала подозрительные транзакции и передавала данные в соответствующие органы для дальнейшего расследования. В сотрудничестве с международными агентствами власти занимаются выявлением лиц, отмывающих деньги, полученные в результате атак программ-вымогателей, в том числе атаки Petya.

Резюме

Хотя AML-процедуры замедляют процесс торговли криптовалютами, они выполняют важную функцию по обеспечению безопасности нас всех. К сожалению, правительства и организации не могут полностью решить проблему отмывания денег, но реализация нормативных требований определенно помогает. Технологии для обнаружении возможного отмывания денег совершенствуются, и криптобиржи начинают серьезно относиться к своей роли в борьбе с преступностью.